Moody’s to Factor Pensions in Ratings

Published on January 27, 2011

Policy Director

SHARE

The New York Times reports today that Moody’s, the credit rating company, will change its methodology to calculate state indebtedness to include unfunded pension liabilities. Moody’s expects the change will lead to better disclosure of the states’ overall liabilities.

The more immediate effect, however, is a significant increase in state debt burdens.

As shown on the chart below, adding the unfunded pension liability to the states’ tax supported bonded debt results in higher debt burdens both as a percentage of state Gross Domestic Product (GDP) and in per capita terms.

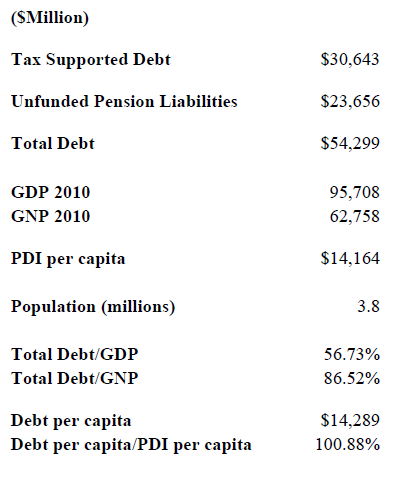

If we replicate the analysis for Puerto Rico, we find that the island’s debt burden is literally off the chart. As shown on the table below, we estimate Puerto Rico’s tax supported debt (consisting of general obligation bonds, Commonwealth guaranteed debt, appropriation debt, and sales tax debt) to be around $30.6 billion. To that amount we add unfunded pension liabilities (central government and teacher’s retirement system) of $23.7 billion. Therefore, total debt equals approximately $54.3 billion.

If we calculate Puerto Rico’s debt burden using the same benchmarks as Moody’s, we find that the ratio of debt to GDP in Puerto Rico is 56.7%, compared to 16.2% for Hawaii, which is the highest among the states. If we use Gross National Product (GNP), a more accurate measure of real economic activity in the island, the ratio jumps to 86.5%.

In per capita terms the picture is equally dismal. We estimate debt per capita in Puerto Rico to be approximately $14,289, while in Connecticut, which has the highest per capita indebtedness in the United States, it is $9,366. Furthermore, and perhaps more worrisome, the amount of debt per capita in Puerto Rico roughly equals 100% of the island’s per capita disposable income in 2010.

Puerto Rico’s combined tax supported debt and unfunded pension obligation is higher than Florida’s ($38.4 billion); New York’s ($50.8 billion); or Texas’ ($28 billion).

In our opinion, any objective analysis of the data leads only to one conclusion: no matter how you slice and dice it, Puerto Rico is essentially insolvent.