Puerto Rico’s Retirement Problem

Published on August 9, 2011

Policy Director

SHARE

Yesterday, Moody’s Investors Service issued a press release announcing it was downgrading the Commonwealth’s of Puerto Rico A3 rating to Baa1. Its decision was partly based on the weak funding of the government’s pension plans and the “significant strain that future pension requirements will likely exert on the Commonwealth’s financial position.”

The government of Puerto Rico currently runs five different retirement systems: (1) the Employees’ Retirement System (“ERS”), which covers most employees of the central government, the public corporations, and the municipalities; (2) the Teachers’ Retirement System (“TRS”), which covers public school teachers; (3) the Judiciary Retirement System (“JRS”), which covers judges; (4) the University of Puerto Rico Employees’ Retirement System; and (5) the Puerto Rico Electric Power Authority Employees’ Retirement System.

Each one of these retirement systems is running an actuarial deficit. This means they do not have enough assets to invest today in order to meet its future obligations.However, the Moody’s report focuses on the problems of the ERS, the TRS, and the JRS because funding for these three systems depends in large measure on the general fund.

As of June 30, 2010, the ERS had an unfunded actuarial liability of $17.834 billion; the TRS had an unfunded actuarial liability of $7.058 billion; and the JRS had an unfunded actuarial liability of $283 million. Therefore, the aggregate unfunded liability for these three systems amounted to $25.175 billion, which is equivalent to 39.8% of Puerto Rico’s GNP in 2010.

The warning from Moody’s is based on two analytical conclusions. First, the sum of (1) the aggregate unfunded actuarial liabilities of the three systems that depend on the general fund ($25.175 billion) and (2) Puerto Rico’s net tax supported public debt ($42 billion) is approximately $67 billion, an amount that is seven times the annual general fund budget and greater that the total indebtedness for states such as Texas, Florida, and New York, which are much larger than Puerto Rico. The analysts at Moody’s conclude, reasonably in our opinion, that this combined burden will exert significant budgetary pressure for many years to come.

Second, the magnitude of the annual actuarially required contribution (“ARC”) necessary to start amortizing the accumulated unfunded liability is enormous. If the government of Puerto Rico began to make the annual ARC for these systems, its ability to comply with other obligations would be severely impaired.

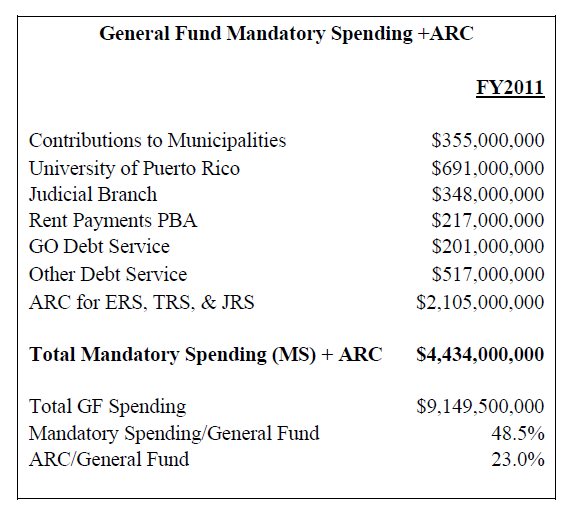

For fiscal year 2011, the ARC was $2.105 billion, an amount equivalent to 23% of that year’s general fund. Furthermore, as shown on the table above, if we were to add the ARC and the annual mandatory expenditures for FY2011, the combined amount would total $4.434 billion, or 48.5% of the general fund budget. Please note that such amount does not include other “discretionary” general fund expenditures on public education, healthcare, and public safety.

For fiscal year 2011, the ARC was $2.105 billion, an amount equivalent to 23% of that year’s general fund. Furthermore, as shown on the table above, if we were to add the ARC and the annual mandatory expenditures for FY2011, the combined amount would total $4.434 billion, or 48.5% of the general fund budget. Please note that such amount does not include other “discretionary” general fund expenditures on public education, healthcare, and public safety.In sum, the public pension problem raises extremely complicated financial, political, legal, and moral issues. Puerto Rico currently owes approximately 40% of its GNP to 8% of its population. Wealth transfers of this magnitude do not occur without political consequences. In our view, solving this problem will require retirees, current employees, and taxpayers in general to make and honor significant concessions.