Puerto Rico’s Budget Deficit: an Independent Assessment

Published on April 4, 2012

Policy Director

SHARE

Recently there has been a public debate regarding the amount of Puerto Rico’s fiscal deficit for Fiscal Year 2012. Before moving on to provide our analysis of the Commonwealth’s deficit, we believe it is appropriate to differentiate among and between three different definitions of the term “deficit”, which, unfortunately, oftentimes are erroneously used interchangeably in the public debate. In order to clarify our analysis we pause briefly to explain each one of these definitions:

Budget Deficit – Is defined as the excess of spending over income for a government, a corporation, or an individual during a particular period of time. For purposes of this calculation the recurrence or non-recurrence of income and spending is not material. Similarly, the timing of the cash receipts or disbursements associated with a particular income or expense stream is irrelevant for purposes of this calculation. The important thing is to correctly and timely recognize income and expenses during the appropriate fiscal year.

Cash Deficit – Is defined as the excess of actual expenditure payments over actual collected revenues during a particular period of time. This cash deficit is by definition equal to the government’s borrowing requirement (from domestic or foreign sources). For purposes of calculating the cash deficit the relevant criterion is when the cash was actually disbursed; the recurrence or non-recurrence of the expenditure and the timing of its accrual or authorization are irrelevant.

Structural Deficit – According to Dr. Ramón Cao, perhaps Puerto Rico’s pre-eminent fiscal economist, the term “structural deficit” has two definitions in the formal economic literature, none of which coincides with the local usage of the term. First, according to Nobel Prize-winning economist Joseph Stiglitz, a structural deficit is that which occurs even when the economy is operating at full employment. The term is thus used to differentiate between cyclical budget deficits, which are the product of normal fluctuations in the economic cycle, and chronic deficits that persist even when the economy is operating at full throttle.

The second definition was coined during the 1980s and was used to describe the economic situation of several Latin American countries. In that case, the adjective “structural” referred to the difficulty of Latin American governments to comply with their external debt service obligations due to the large amount of those debts, the high interest rates then prevailing, and the large deficits generated by state-owned enterprises.

The accepted operating definition of the term in Puerto Rico appears to be adopted from the practice of the credit rating agencies, which define structural deficit as the excess of recurring expenditures over recurring revenues. Defined in this way, the term appears to have some analytical value as it may reveal the existence of a core deficiency in government finances by stripping away all one-time or special items, both from the income and expenditure sides. However, we recognize that there are no hard and fast, black letter rules for determining what constitutes recurring revenues or recurring expenses. It thus may become necessary, at some points in the analysis, to make subjective analytical judgments as to what items should or should not be included in calculating the structural deficit.

For purposes of this analysis we adopt the definition of structural deficit used by the rating agencies. Under that definition we estimate the Commonwealth’s deficit for fiscal year 2012 to be at least $1.449 billion. Our analysis is based on the government’s recent disclosure to its bondholders. In the Preliminary Official Statement for its recent offering of $1,500,000,000 of Commonwealth of Puerto Rico Public Improvement Refunding Bonds, Series 2012 A (General Obligation Bonds), the government of Puerto Rico makes the following disclosure:

“The deficit for fiscal year 2012 is projected to be approximately $610 million, excluding approximately $685.2 million of principal and interest payments on Commonwealth general obligation bonds that were refinanced through GDB financings (the “GDB Lines of Credit”), which financings are expected to be repaid from the proceeds of the Bonds and the Series B Bonds, and $154 million of interest payments on Commonwealth guaranteed Public Building Authority Bonds that were refinanced through GDB financings, which financings are expected to be repaid from the proceeds of the issuance of Public Building Authority Bonds. In addition, the Office of Management and Budget (“OMB”) has indicated that the sectors of health and public safety carry the risk of budget overruns for fiscal year 2012 as they are undergoing operational changes that were not considered during the preparation of the 2012 budget.”

In our view, debt service is a recurring expenditure. Therefore, the difference between general fund recurring revenues and recurring spending for fiscal year 2012 is at least $1.449 billion ($610 million + $685.2 million + $154 million) plus any budget overruns in the public health and safety sectors.

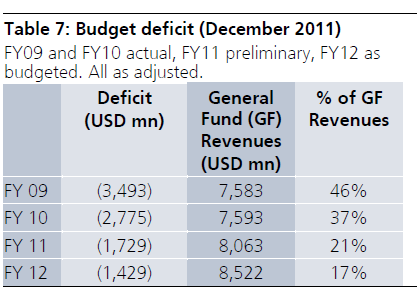

The municipal bond analysts at UBS Wealth Management Research based in New York seem to agree. In their most recent analysis of the Commonwealth’s finances (dated January 11, 2012) they estimate the Commonwealth’s structural deficit at $1.429 billion. (See table below)

Source: UBS Wealth Management Research, Municipal Report Commonwealth of Puerto Rico (11 January 2012)

According to UBS’s analysts, “as UBS WMR defines a structural budget deficit as the excess of recurring expenditures over recurring revenues and views debt service as a recurring expenditure, we feel that the representation shown in Table 7 –Budget deficit (December 2011) is more appropriate from an analytical perspective.”

In sum, it appears to us that given (1) the government’s own disclosures and (2) the financial analysts’ definition and use of the term “structural deficit”, it is difficult for the administration in Puerto Rico to claim that the deficit for fiscal year 2012 is only $610 million. Intellectual honesty demands that the people in charge of our public finances be consistent, they cannot use one budget deficit figure for bondholders and another one in Puerto Rico.