Economic Complexity: Using Data to Identify Puerto Rico’s Opportunities

Published on November 14, 2025 / Leer en español

Introduction

2026 will mark a decade since the Financial Oversight and Management Board (FOMB) was tasked with managing Puerto Rico’s fiscal affairs. Back in 2015, the consensus in Washington was that Puerto Rico needed a comprehensive restructuring mechanism paired with strong fiscal oversight. Through the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA), it was able to renegotiate the largest municipal bankruptcy in U.S. history, reducing the debt burden by over $30 billion. While this represents significant progress, the jury is still out on whether the level of debt relief achieved is sufficient for long-term fiscal and economic sustainability. Further, other critical challenges remain, including unresolved issues like the debt of the Electric Power Authority.

Beyond that, the question before us now is not only how to restore fiscal balance, but how to reignite economic growth. How do we move from stabilization to transformation? How do we move beyond survival and towards prosperity? How do we unlock Puerto Rico’s full potential?

At the Center for a New Economy (CNE), we have long argued that the answers lie in the evidence before us. We build upon what we know. We grow where opportunity lies. What Puerto Rico needs is a modern industrial policy: a forward-looking strategy grounded in data that channels local capabilities, forges stronger links between global and local firms, and turns today’s challenges into a generational opportunity for long-term growth.

In this policy brief, we propose Economic Complexity as an analytical tool to do just that. This framework can inform Puerto Rico’s future growth areas by characterizing the knowledge embedded in our economy and illuminating areas of potential growth. This knowledge would form the foundation for industrial policy and give policymakers an empirical basis for decision-making.

A development strategy for Puerto Rico grounded in economic complexity would not start from scratch; it builds upon existing strengths to develop new activities in commerce, manufacturing, and services. Our approach is predicated on cross-sector collaboration to share information and work toward a common vision of prosperity. The time is ripe for growth; let’s work together to build a more dynamic and prosperous future.

The Basics of Economic Complexity

Economic Complexity analysis is a conceptual framework used to assess a region’s productive capacities and the similarities between goods in the productive capacities required to make them. By studying the goods produced in a region and how those compare across the globe, economic complexity analysis can reveal the underlying knowledge embedded in an economy.

At the heart of this analysis are two core concepts: country capacity, which represents the knowledge, institutions, and infrastructure in a region; and product relatedness, which captures how similar or complementary different products are in terms of the inputs, knowledge, and capacities they require to be produced. Understanding these concepts enables policymakers to:

- Set clear, objective goals and track progress over time.

- Strategically invest limited resources where they will have the greatest impact.

- Identify feasible and high impact opportunities for diversification.

Economic Complexity Theory gives us a framework through which to understand development by looking at the composition and sophistication of what a region produces rather than relying solely on traditional economic measures. While indicators like gross domestic product (GDP), foreign direct investment (FDI), and trade balances capture the size and flow of economic activity, on their own they reveal little about the knowledge and capabilities embedded in an economy. By examining the Economic Complexity of their jurisdictions, policymakers can gain insights into the underlying knowledge that drives production.

Economic Complexity Theory emerged from research at Harvard University and MIT in the late 2000s. Economists Ricardo Hausmann, César Hidalgo, and their colleagues developed this framework by applying network science and complexity theory to economic development (Hausmann & Hidalgo, 2009). Their research showed that a region’s prosperity depends not just on how much it produces, but on what it produces. Reconciling a fundamental gap in classical economics, this approach has since been adopted by numerous governments and international organizations, including Mexico’s Secretariat of the Economy[1], the European Commission[2], the World Bank[3], and the OECD[4], as tools for designing more effective development strategies.

Economic Complexity Theory is founded on three basic principles:

First, a region’s productive capacity is defined by its knowledge, in simpler terms, places produce what they know how to make. In this context, productive capacity refers to the collection of goods and services an economy could produce if it optimally employed its accumulated capabilities, skills, and institutional capacity.

Second, economic development is a learning process. Since knowledge is productive capacity, expanding the base of knowledge in an economy is how it grows.

Third, learning is path-dependent, in other words, what we already know informs what we can learn (Hidalgo, 2021; Balland et al., 2022). Just as it’s easier (harder) to learn Spanish (Mandarin) if you already know Italian, it would be easier (harder) for an economy to diversify into making liquor[5] (rubber gloves[6]) if it already produces wine[7].

1) Knowledge as Productive Capacity

The first principle, knowledge as productive capacity, states that economic production requires specific know-how distributed across society. This knowledge exists in three distinct forms: embodied in people as expertise and skills, embedded in products as design and functionality, and encoded in institutions as processes and organizational capabilities (Blackler, 1995). When we say a region “knows how to make” something, we mean it possesses this distributed network of capabilities and resources at its disposal to use in the production of goods and services (Hidalgo, 2023). No single person holds all the knowledge required to produce complex goods like pharmaceuticals. Instead, it requires skilled workers who understand chemical processes; organizations with robust quality control protocols and experts to monitor them; institutions with regulatory expertise; and specialized equipment manufactured by experts in entirely different fields.

The understanding of knowledge as productive capacity highlights the foundational role of learning in economic growth. Joseph Stiglitz argues that “what truly separates developed from less-developed countries is not just a gap in resources or output but a gap in knowledge,” (Stiglitz & Greenwald, 2014) suggesting that an economy’s growth largely depends on how it closes these knowledge gaps. Since an economy’s productive capacity depends on its collective knowledge, economic development is fundamentally a learning process that builds this knowledge over time.

2) Economic Development is a Learning Process

The second principle, economic development is a learning process, establishes that growth occurs as an economy expands its knowledge base over time. Development isn’t simply about accumulating physical capital or resources, but rather about enhancing the capabilities that allow an economy to produce increasingly sophisticated goods and services (Balland et al., 2022). By viewing development as a learning process, we can better understand why effective development strategies should prioritize knowledge acquisition and capability building rather than focusing solely on capital accumulation, job creation, or market access.

What makes this insight so powerful is that it explains why seemingly similar countries with comparable resources achieve vastly different economic outcomes. The difference lies in how they mobilize distributed knowledge across people, products, and institutions. Consider Taiwan’s electronics industry. They started with simple assembly operations in the 1960s, and over time, workers and managers gradually mastered increasingly complex production techniques, eventually enabling the country to become a global leader in semiconductors. Taiwan’s development wasn’t simply about adding more factories or workers, but about continuously expanding what these workers and firms knew and fostering an environment that institutionalized that knowledge (Chang & Shih, 2005).

Rather than viewing poor countries as simply lacking resources, we understand they lack specific productive knowledge that must be systematically accumulated, coordinated, and mobilized (Hausmann et al., 2024). Policy implications extend beyond debating levels of protectionism or liberalization to focus on two fundamental questions:

How do societies best acquire, retain, and build upon productive knowledge?

How can education systems, industrial policies, and institutional designs accelerate learning processes?

The answers depend critically on each economy’s starting point, because new knowledge builds upon existing knowledge (Hausmann & Hidalgo, 2009).

3) Learning is path dependent

The third principle, learning is path dependent, explains why economic development follows specific trajectories rather than random paths. Economies tend to diversify into activities related to their existing productive structure rather than jumping to entirely new areas (Pinheiro et al., 2018). The underlying mechanism is straightforward: new capabilities are built most effectively upon existing ones, or in other terms, the cost of diversifying into related products is lower than developing unrelated capacities from scratch (Alshamsi et al., 2018). Path dependency explains why oil-rich countries rarely become software powerhouses and why attempts to create silicon valleys from scratch often fail (Hausmann & Hidalgo, 2009; Hidalgo, 2021).

This path-dependent view adds nuance to the idea of “leapfrogging” strategies, where developing nations catch up through implementing new advanced technologies skipping ‘inferior’/less-efficient ones, often promoted in development literature. Many traditional approaches suggest developing economies can simply adopt the latest technologies by opening markets and attracting foreign investment. However, Economic Complexity Theory suggests that successful diversification typically occurs through incremental steps along paths that share common capabilities (Alshamsi et al., 2018; Hidalgo, 2023). This concept of relatedness provides a practical metric for identifying strategic opportunities by measuring the similarity between different productive activities.

These three core principles, knowledge as productive capacity, learning as development, and path-dependent learning, form the theoretical foundation of Economic Complexity Theory. Together, they explain why economies develop along specific trajectories and why some are more successful than others at generating sustainable growth. But how can we measure these abstract concepts and, more importantly, make them practical and useful to policymakers, industry leaders, and entrepreneurs?

How is Economic Complexity Measured?

Different products require different types of knowledge, and this knowledge is reflected in the kinds of products countries are able to produce. These differences can be inferred by analyzing these production patterns across countries, giving us a view of both the complexity of economies and the sophistication of products.

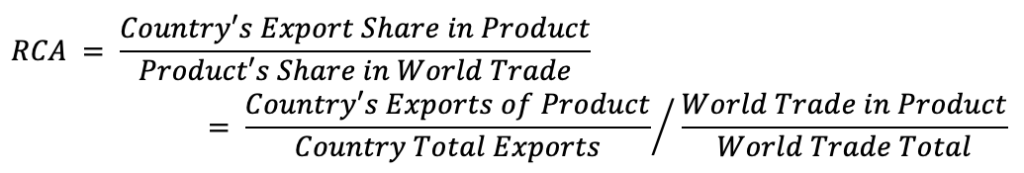

The starting point for Economic Complexity measurements is a binary matrix, a grid of yes/no (1/0) responses, showing which countries have demonstrated ability to competitively produce specific products. This matrix is constructed using export data and a measure called Revealed Comparative Advantage (RCA):

An RCA greater than 1 indicates that a country likely has a comparative advantage in producing that product, and the corresponding cell in the matrix is marked 1; otherwise, it is 0 (Mealy et. al., 2019). From this matrix, two fundamental measures are calculated:

- Diversity: The number of products a country produces with comparative advantage

- Ubiquity: The number of countries that make a product with comparative advantage

While diversity provides some insight into a country’s capabilities, it doesn’t distinguish between complex and simple products. Similarly, ubiquity gives some indication of a product’s complexity but doesn’t account for the sophistication of the countries producing it. To address this, Economic Complexity indices use an iterative algorithm called the Method of Reflections that refines these measures by repeatedly adjusting Product and Country complexities by their counterpart’s average until they converge to a stable value (Hausmann & Hidalgo, 2009).

Economic Complexity analysis relies on four primary metrics that help quantify an economy’s productive knowledge:

Economic Complexity Index (ECI), which measures the knowledge intensity of an economy by analyzing the diversity and ubiquity of its exports. A high ECI indicates that an economy produces sophisticated products that few other countries make.

Product Complexity Index (PCI) measures the knowledge implied in the production of a specific product. Products with high PCI values need rare capabilities found in few countries and are typically higher value than those with lower PCI.

Relatedness (Proximity) measures similarity between products based on how frequently they are co-exported by the same countries. Values range from 0 to 1, with higher values indicating products require more similar capabilities.

Revealed Comparative Advantage (RCA) indicates whether a country exports more of a product (as a percentage of total exports) than the global average. Products with RCA > 1 represent areas where a country has demonstrated an ability to produce competitively in global markets (Mealy et. al., 2019).

The Product Space – Understanding the Spatial Analogy at the Heart of Economic Complexity

Using the Economic Complexity Index, Product Complexity Index, Relatedness, and RCA metrics described above, complexity researchers have created detailed network representations of goods. These visualizations transform abstract economic data into more digestible spatial maps that help policymakers understand their economies and what they make. Fundamentally, this spatial analogy uses concepts of physical space like distance and position to represent the relationships between products. In philosophy, mathematics and data science, spatial analogies help visualize or contextualize complex relationships that would otherwise be difficult to comprehend. For example, we use a spatial analogy when we say two colors, like pink and purple, are ‘close’ to each other, or purple is ‘between’ red and blue.

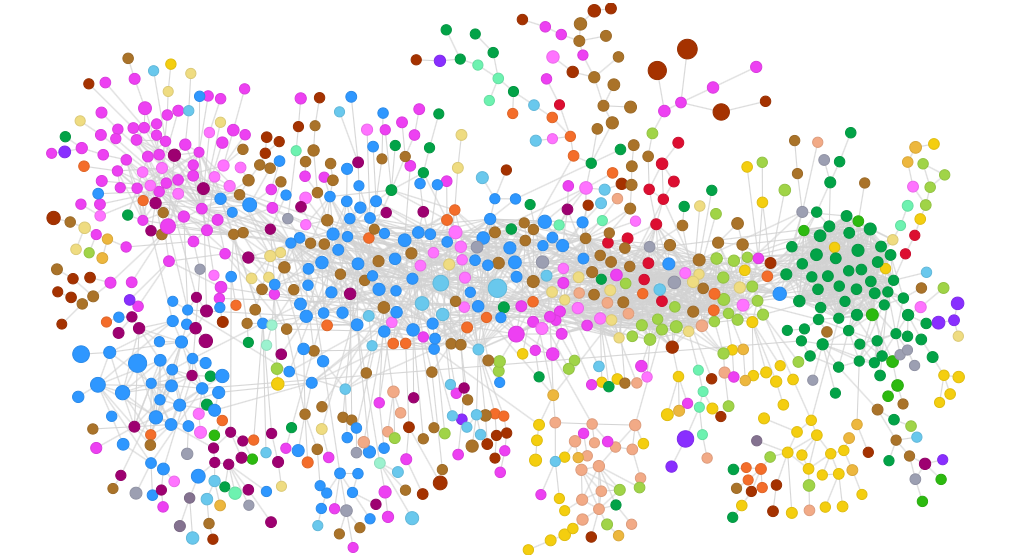

Figure 1: Global Product Space – 2023

Source: OEC Product Space Image, 2025

Source: OEC Product Space Image, 2025

Applying this logic to products, we can represent similarities in production requirements as a network called the Product Space. This network connects products based on how frequently countries export both items with comparative advantage (RCA > 1). When visualized, the Product Space reveals a structure of dense and sparse areas. The center contains tightly connected clusters of sophisticated products like machinery, electronics, and chemicals. The periphery holds more isolated products such as raw agricultural goods and mineral resources. Certain products share many capabilities with others (appearing densely connected) while some require unique capabilities and remain distant from other products (Simoes & Hidalgo, 2011).

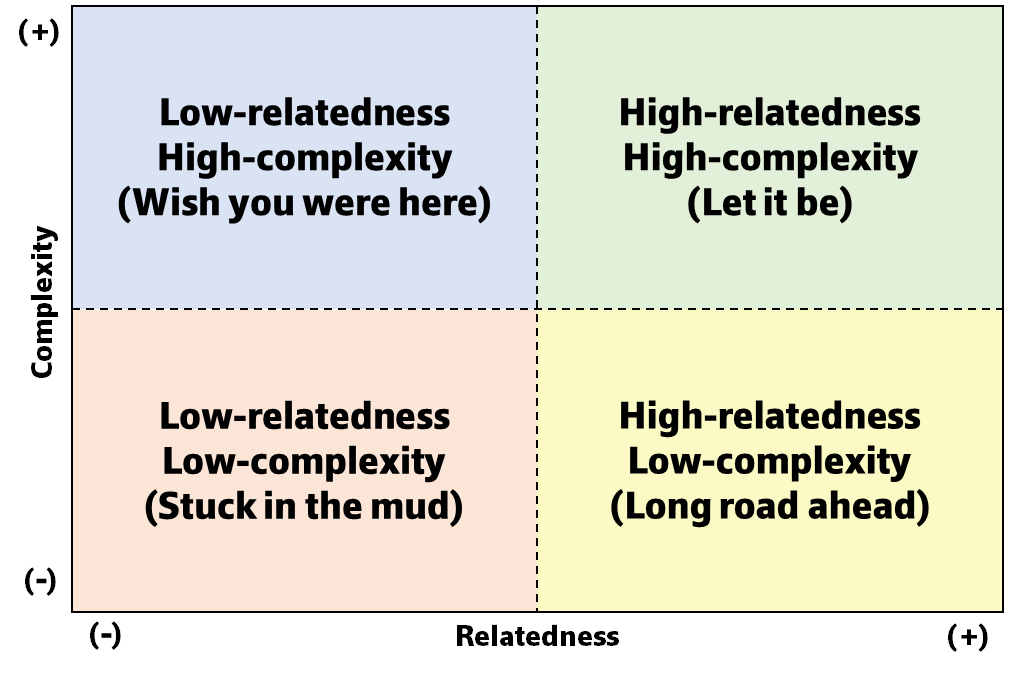

Complementing the Product Space is the Diversification Frontier, which maps products along two critical dimensions: their complexity (vertical axis) and their relatedness to a country’s existing capabilities (horizontal axis). The resulting chart can be divided into four quadrants, each with distinct strategic implications and a fun nickname from Hidalgo (2023):

- High Complexity, High Relatedness (top-right quadrant): Contains products that are both valuable (complex) and accessible given existing capabilities. Called the “Let it be” quadrant, these represent ideal opportunities where diversification is both feasible and desirable.

- High Complexity, Low Relatedness (top-left quadrant): Contains attractive products in terms of value that would be difficult to produce given current capabilities. Called the “Wish you were here” quadrant, these represent stretch goals and opportunities for unrelated diversification.

- Low Complexity, Low Relatedness (bottom-left quadrant): Contains products that are neither particularly valuable nor easily accessible. Called the “Stuck in the mud” quadrant, these typically offer little strategic value.

- Low Complexity, High Relatedness (bottom-right quadrant): Contains products with lower complexity value but are nonetheless accessible. Called the “Long road ahead” quadrant, these might represent easier diversification options but with limited value.

Figure 2: Diversification Frontier Quadrants

Source: Hidalgo, 2023

Source: Hidalgo, 2023

The Product Space and Diversification Frontier provide complementary views of an economy and the capacities therein. The Product Space shows the overall landscape of products and an economy’s position within it. At the same time, the Diversification Frontier describes the specific country/region’s production and offers a strategic framework for identifying specific diversification targets by balancing feasibility with desirability. These tools help move economic complexity theory from abstract mathematics into practical policy guidance, enabling policymakers to identify strategic pathways that leverage existing capabilities while building toward more complex, higher-value activities.

Puerto Rico’s Economy through the Complexity Lens

When viewed through the lens of Economic Complexity, Puerto Rico’s economy shows surprising strengths. In 2022, Puerto Rico ranked 10th among states and territories in the U.S. in terms of its economic complexity.[8] Its established capabilities are in several highly sophisticated industries, particularly pharmaceutical manufacturing, provide strong potential for diversification into other high-complexity sectors. Yet, this potential can only be unlocked through better alignment between public and private sector efforts and a shared vision for the future.

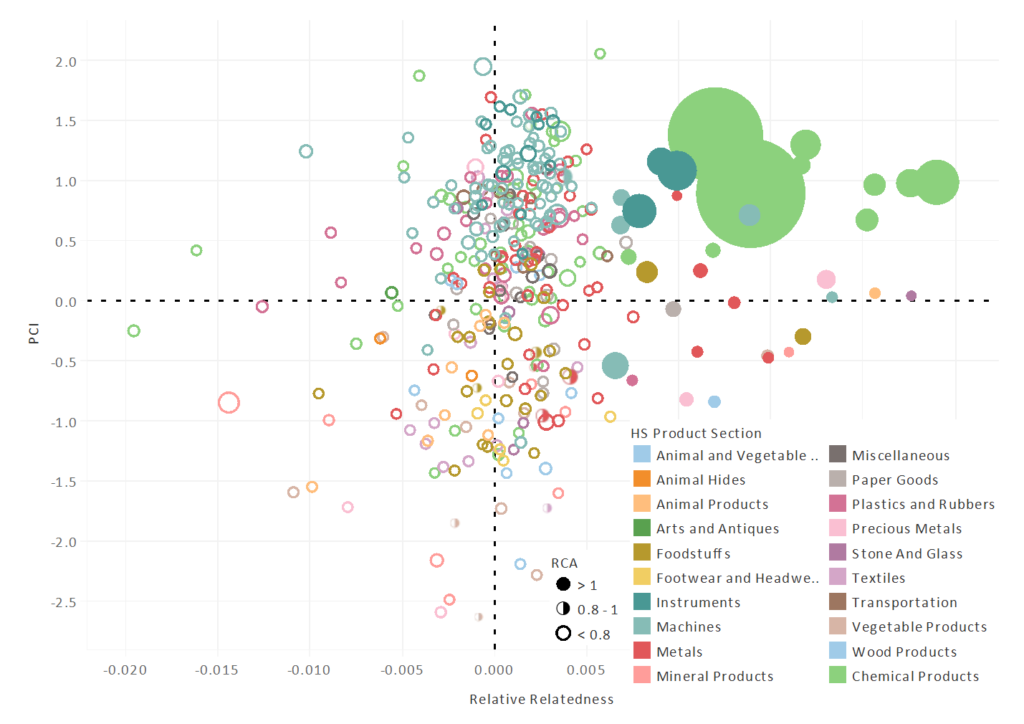

Figure 3 shows Puerto Rico’s Diversification Frontier in 2023. As described in the previous section, the diversification frontier maps Puerto Rico’s export products according to their complexity (vertical axis) and relatedness to current capabilities (horizontal axis) with the size of points representing 2023 exports of the product and colors showing their HS Section. We use the ECI for Puerto Rico and average relatedness to set the boundaries between high and low complexity/relatedness.

Figure 3: Puerto Rico Diversification Frontier – 2022

Source: OEC Trade Data API and Author’s Calculation

Puerto Rico’s Diversification Frontier reveals a notable concentration of products in the high complexity region. Within the high-complexity/high-relatedness quadrant, Puerto Rico shows strengths in pharmaceutical and chemical products including packaged medicaments, vaccines, blood products, antisera, toxins, and cultures, and hormones. These high-value products form the core of Puerto Rico’s export profile, with chemical products making up roughly 83% of exports, and just the three product categories mentioned above accounting for over 75% of total exports in 2023.

Looking at the high-complexity/low-relatedness, we find sophisticated products that would typically be challenging to develop given Puerto Rico’s current export basket. In most economies at similar development levels, this quadrant would be sparsely populated. Puerto Rico’s larger-than-typical presence here suggests unique capabilities that enable potential “strategic jumps” into complex new sectors despite lower relatedness. While these products represent greater development challenges than those in the high-complexity/high-relatedness quadrant, they offer valuable opportunities that could reduce Puerto Rico’s concentration in pharmaceuticals and chemicals. Identifying and supporting firms in these sectors is critical to achieving a more sustainable development.

By looking at trends in global trade, we also find several products that show significant growth potential, with other protein & polypeptide hormones growing 70.8% in 2023, electric motor vehicles 57%, and polypeptide hormones 38%. This indicates both expanding global demand and potential for Puerto Rico to position itself in sophisticated and expanding markets by producing those goods or intermediate goods that are components of these.

However, capitalizing on these opportunities requires the kind of sustained, coordinated effort that has been lacking. Even successful clusters like the aerospace hub in Aguadilla, which houses major companies like Pratt & Whitney, Honeywell, and Lockheed Martin, have struggled to reach their full potential due to inconsistent policy support and fragmented private sector coordination.

What This Means for Business Leaders:

- Your specialized knowledge may be more valuable than you think

- Opportunities exist beyond pharma in related high-tech sectors

- Collaboration between local firms and the government could unlock new markets

With regards to its strengths, Puerto Rico demonstrates global leadership in specific pharmaceutical niches, commanding dominant market shares in products like insulin (20.7%), and adrenal cortical hormones (14.9%). The island’s positioning in the high complexity/high relatedness quadrant reflects deep, established capabilities in sophisticated pharmaceuticals and chemicals manufacturing. Even more promising, Puerto Rico’s unusual abundance of products in the high complexity/low relatedness quadrant suggests hidden capabilities that could enable some quick wins.

However, these strengths coexist with structural vulnerabilities. Puerto Rico’s export concentration in pharmaceuticals is extremely high. This creates acute sector-specific risk where pharmaceutical industry shocks could significantly impact the broader economy. Hurricane Maria demonstrated this when it disrupted Baxter International’s IV fluid production facilities in Puerto Rico, forcing the FDA to authorize emergency imports from multiple countries to address critical shortages of IV fluids that affected the U.S. healthcare system. The concentration extends beyond products to knowledge; a loss of pharmaceutical expertise would leave few viable alternatives for the island’s economy. Scale limitations in diversified production compound this challenge; while Puerto Rico produces sophisticated non-pharmaceutical goods, most generate minimal export revenues, limiting their potential as economic alternatives. Only ten products demonstrate significant comparative advantage (RCA > 1) with substantial export volumes, suggesting limited breadth in competitive capabilities. Furthermore, some key specializations show declining performance, with insulin exports falling 58.1% and adrenal cortical hormones declining 5.1%, potentially signaling eroding competitiveness in these core areas.

Puerto Rico’s complexity profile thus presents both significant opportunity and pressing urgency for economic planning. It underscores the need for evidence-based decision-making and cross-sector coordination that Economic Complexity analysis can help build. The island possesses sophisticated capabilities that are hard to find elsewhere, yet these are concentrated in ways that could create systemic risk. The challenge lies in leveraging existing capacities and unusual potential for high-value unrelated diversification to build resilience against over-dependence on a narrow set of sectors. Our analysis suggests Puerto Rico is uniquely positioned for growth, but it will require deliberate and sustained policy intervention. Economic Complexity analysis can provide the objective, data-driven framework needed to guide this collective effort.

Policy Recommendations

The following recommendations focus on establishing Economic Complexity Analysis as a formal component of Puerto Rico’s economic policymaking framework. Rather than proposing specific sectoral investments or long-term development strategies, these recommendations aim to introduce economic complexity tools and metrics into existing government institutions, creating the analytical foundation for more informed future policy decisions. This approach recognizes that sustainable economic transformation requires first building institutional capacity to measure, monitor, and understand the island’s productive capabilities. By integrating these tools, policymakers will acquire more sophisticated tools to track economic progress, identify strategic opportunities, and make development decisions grounded in empirical analysis rather than influence, expediency or outdated development orthodoxies.

Create, Monitor, and Publish Complexity Metrics for PR

The Puerto Rico Planning Board (JP) and Department of Economic Development and Commerce (DDEC) must collaborate to establish annual or quarterly reporting of Economic Complexity metrics. Systematic tracking would provide objective benchmarks for evaluating whether Puerto Rico’s economy is successfully achieving its development goals and acquiring new and more sophisticated capacities. These statistics and analyses should also be formally integrated in the annual economic reports to the governor and legislative assembly. Collecting and preparing the necessary data, performing all the analyses and effectively presenting them will require a modest initial investment, but these costs pale in comparison to the economic losses from continued policy incoherence and missed diversification opportunities that have characterized Puerto Rico’s development approach for decades.

Train Development Agencies on Economic Complexity Analysis

Key staff at Puerto Rico’s economic development agencies need technical training to collect, prepare, and analyze the data required for complexity measurements. This capacity building should focus on 1) technical skills to deliver reporting, and 2) analytical skills to interpret and integrate this information into economic policy. Publishing complexity metrics for Puerto Rico alone is insufficient for transforming the way economic policy is made on the island. Staff at development agencies like JP and DDEC or promotion agencies like InvestPR must be able to understand these concepts and use them to craft policy. With personnel at multiple levels trained in these concepts, these agencies can maintain consistent analytical capabilities regardless of political changes, ensuring that institutional knowledge about Puerto Rico’s productive capabilities and strategic opportunities is preserved and enhanced over time.

Private Sector Engagement

Successful implementation also requires buy-in from Puerto Rico’s business community. The government should organize regular forums where complexity analysis findings are shared with industry leaders, gathering their feedback on identified opportunities and constraints. These sessions would serve dual purposes: validating the analysis against private sector experience and building confidence in complexity metrics as objective tools rather than political instruments. Clear communication about how these tools work, emphasizing their basis in global trade patterns rather than subjective assessments, will be crucial for overcoming skepticism and encouraging private investment aligned with complexity-informed goals.

Align Incentives with Complexity Related Outcomes

Future tax incentives, subsidies and development initiatives should incorporate complexity criteria into their targeting, eligibility requirements and benefit structures. Rather than offering blanket incentives to any export activity, new programs could provide enhanced benefits for activities that increase economic complexity, either by adding new high-complexity products to Puerto Rico’s export basket or strengthening capabilities in strategic sectors identified through complexity analysis. This approach would channel public resources toward diversification efforts most likely to generate sustainable economic growth.

Limitations and Future Work

While economic complexity measures can provide more tools for policymakers and researchers to understand our economy, Puerto Rico’s economic statistics are known to be distorted by income shifting, transfer pricing and other distortions primarily stemming from tax accounting strategies which see multinational firms overrepresenting incomes originating from the island. In the past CNE has shown how these distortions impact national accounts and output figures.[9] These same distortions are present, and in cases like pharmaceutical products amplified, in Puerto Rico’s export data.

We are working on applying previously used methods to adjust exports to address these distortions and further refine our estimates of economic complexity in Puerto Rico. Additionally, we would like to expand our work in this area by studying the development impact potential of industries and applying more intricate analyses that are based on economic complexity measures.

Conclusion

Economic Complexity Analysis offers a powerful lens through which to understand Puerto Rico’s economy and a practical framework to transform how Puerto Rico approaches economic development. As the island moves beyond forward into a post-PROMESA future, the question becomes how to channel our capacities into sustained prosperity. By measuring the knowledge embedded in production, tracking the relatedness between different economic activities, and identifying feasible pathways for diversification, these tools can replace the ad-hoc, influence-driven development strategies that have repeatedly failed to generate sustainable growth.

Puerto Rico’s economic complexity reveals both immediate opportunities and long-term potential. The unusual abundance of high-complexity products suggests that opportunities for diversification beyond pharmaceuticals are abundant. Products like printed circuit boards, industrial printers, and specialized chemicals represent more than export opportunities; they signal the presence of sophisticated knowledge that could be the cornerstones of new industrial clusters. This requires Puerto Rico to build the modern industrial policy needed to plant the seeds for tomorrow’s economic growth.

By establishing complexity metrics as a standard component of economic reporting, training government personnel in these methods, and engaging the private sector in discussions, Puerto Rico can build the institutional capacity for evidence-based policymaking. These steps require no massive fiscal outlays or radical policy shifts, only the time to learn these tools and a commitment to ground economic decisions in objective analysis.

The urgency of this transformation cannot be overstated. Each year of continued policy incoherence creates more missed opportunities and deepening vulnerability. But the complexity framework offers hope: Puerto Rico possesses more sophisticated productive capabilities than most economies at similar levels of development. The challenge lies not in building these capabilities from scratch but in deploying them strategically to create a more resilient, diversified, and sustainable economy.

The tools exist, the capabilities are present, and the opportunities are identifiable. What remains is the institutional will to transform Puerto Rico’s approach to economic development from one driven primarily by clientelism, political partisanship, federal transfers, and influence peddling to one guided by empirical evidence and strategic vision. This transformation is the first step in moving Puerto Rico from survival to prosperity, from managing decline to unlocking growth.

References

Aktug, M., Podat, S., & Basoglu, A. (2025, February). Fiscal Policy as a Driver of Economic Complexity: Evidence from Selected OECD Countries. Journal of the Knowledge Economy. doi:10.1007/s13132-024-02551-2

Alshamsi, A., Pinheiro, F., & Hidalgo, C. (2018, April 6). Optimal diversification strategies in the networks of related products and of related research areas. Nature Communications, 9. doi:10.1038/s41467-018-03740-9

Balland, P.-A., Broekel, T., Diodato, D., Giuliani, E., Hausmann, R., & David Rigby, N. O. (2022, April). The new paradigm of economic complexity. Research Policy, 51, 104450. doi:10.1016/j.respol.2021.104450

Blackler, F. (1995). Knowledge, Knowledge Work, and Organizations: An Overview and Interpretation. In The Strategic Management of Intellectual Capital and Organizational Knowledge (Vol. 16, pp. 47-64). Oxford University Press, New York, NY. doi:10.1093/oso/9780195138665.003.0003

Hausmann, R., & Hidalgo, C. A. (2009, June 30). The building blocks of economic complexity. Proceedings of the National Academy of Sciences, 106, 10570-10575. doi:10.1073/pnas.0900943106

Hausmann, R., Yildirim, M. A., Chacua, C., Hartog, M., & Matha, S. G. (2024). Innovation Policies Under Economic Complexity. SSRN Electronic Journal. doi:10.2139/ssrn.4814938

Hidalgo, C. A. (2021, January). Economic complexity theory and applications. Nature Reviews Physics, 3, 92–113. doi:10.1038/s42254-020-00275-1

Hidalgo, C. A. (2023, November). The policy implications of economic complexity. Research Policy, 52, 104863. doi:10.1016/j.respol.2023.104863

Mealy, P., Farmer, J. D., & Teytelboym, A. (2019). Interpreting Economic Complexity. Science Advances, 5. doi:10.1126/sciadv.aau1705

Observatory of Economic Complexity (2024). HS6 Product Data. HS6 Product Data. Observatory of Economic Complexity. Data retrieved through OEC API. Retrieved Mar 15, 2025, from https://api.oec.world/

Observatory of Economic Complexity (2024). Puerto Rico Exports Data. Puerto Rico Exports Data. Observatory of Economic Complexity. Data retrieved through OEC API. Retrieved Mar 15, 2025, from https://api.oec.world/

Observatory of Economic Complexity (2024). Puerto Rico Product Map Visualization. Puerto Rico Product Map Visualization. Observatory of Economic Complexity.

Observatory of Economic Complexity (2024). U.S. National and State Data. US National and State Data. Observatory of Economic Complexity. Data retrieved through OEC API. Retrieved Mar 15, 2025, from https://api.oec.world/

Observatory of Economic Complexity (2024). World Trade Data. World Trade Data. Observatory of Economic Complexity. Data retrieved through OEC API. Retrieved Mar 15, 2025, from https://api.oec.world/

Pinheiro, F. L., Alshamsi, A., Hartmann, D., Boschma, R., & Hidalgo, C. A. (2018). Shooting High or Low: Do Countries Benefit from Entering Unrelated Activities? Retrieved from http://econ.geo.uu.nl/peeg/peeg1807.pdf

Rutar, T. (2023, September). What is neoliberalism really? A global analysis of its real-world consequences for development, inequality, and democracy. Social Science Information, 62, 295–322. doi:10.1177/05390184231202950

Simoes, A. J., & Hidalgo, C. A. (2011). The Economic Complexity Observatory: An Analytical Tool for Understanding the Dynamics of Economic Development.

Stiglitz, J., & Greenwald, B. (2014, June 24). Creating a Learning Society. Columbia University Press. doi:10.7312/columbia/9780231152143.003.0013

Teixeira, D. M., Lara, H., & Filho, F. (2023). Public Policy Insights for a New Developmental Strategy From the Relations Between Sustainability and Economic Complexity. Development Macroeconomics Bulletin, 3, 39-46.

U.S. Food and Drug Administration. (2017, November 14). FDA works to help relieve the IV fluid shortages in wake of Hurricane Maria. FDA Drug Safety and Availability.

U.S. Food and Drug Administration. (2017, October 24). Examining HHS Public Health Preparedness and Response: 2017 Hurricane Season. Congressional Testimony.

Endnotes

[1] Economic Complexity Explorer | Data México. https://www.economia.gob.mx/datamexico/en/profile/economic_complexity/1

[2] Handbook of Economic Complexity for Policy | European Commission. https://publications.jrc.ec.europa.eu/repository/handle/JRC138666

[3] Thinking about Development Differently: Complexity and Network-based Approaches for Policy | World Bank. https://www.worldbank.org/en/events/2025/05/05/thinking-about-development-differently-complexity-and-network-based-approaches-for-policy

[4] New Approaches to Economic Challenges | OECD. https://www.oecd.org/naec/newapproachestoeconomicchallenges-complexityoftheeconomy.htm

[5] HS4 22.08 – Spirits, liqueurs and other spirituous beverages. PCI = -0.41

[6] HS4 40.15 – Apparel and clothing accessories made of rubber. PCI = -0.41

[7] HS4 22.04 – Wine of fresh grapes, including fortified wines. PCI = -0.82

[8] Ranking of U.S. states and territories by 2022 ECI calculated at the HS4 product level using HS Rev 22.

[9] See chapter 2 of Collins, Bosworth & Soto-Class (2006) for more details.