The recent electrical outage in Puerto Rico has again brought to the fore the inordinate delays in modernizing the system, the lack of coordination between public and private entities involved in the task, and the urgent need to reconstruct the electrical grid in the right direction once and for all. To the electrical system’s lack of reliability and the frustrating slowness of the reconstruction process, it is now necessary to add an additional challenge: the instability in the global natural gas markets caused by Russia’s invasion of Ukraine and the uncertainty that now surrounds this energy source.

The planning guidelines driving Puerto Rico’s electric transition anticipate no less than two decades of natural gas in the island’s energy mix; it can thus be expected that the electric bill will continue to be affected by its price swings. It is important to highlight that the price of fossil fuels has already caused the price of electricity in the island to surge from 17¢ Kw/h a 30¢ Kw/h in the past two years. In this Apuntes desde Madrid I will take a look at what has happened in Europe regarding natural gas in order to reflect on the implications of the new global scenario in the future of Puerto Rico’s electrical system.

At least two more decades tied to natural gas

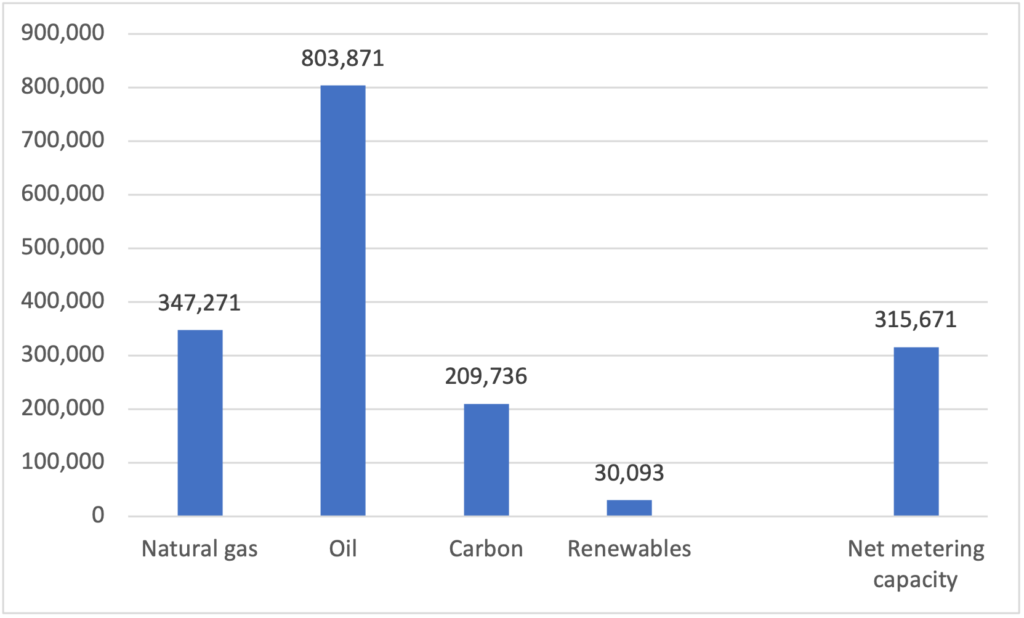

In January 2022 Puerto Rico produced most of its electricity using fossil fuels (57.8% oil, 25% natural gas), according to the U.S. Energy Information Administration (USEIA). Only 2.2% came from renewable sources produced by large-scale suppliers under contract with PREPA, even though PR Law 17-2019 establishes a renewable energy generation goal of 40% for 2025 (60% for 2040 and 100% for 2050). It is interesting to note that the capacity of consumers to produce electricity (reflected in net metering statistics) increased from 202,992 MW (20,855 consumers) in 2020 to 315,671 MW (42,199 consumers) in January 2022. This would make distributed generation the third source of electricity in the island.

ELECTRICITY GENERATION (MW) / NET METERING CAPACITY (MW)

JANUARY 2022

Source U.S. Energy Information Administration, EIA-923 and EIA-861

Source U.S. Energy Information Administration, EIA-923 and EIA-861

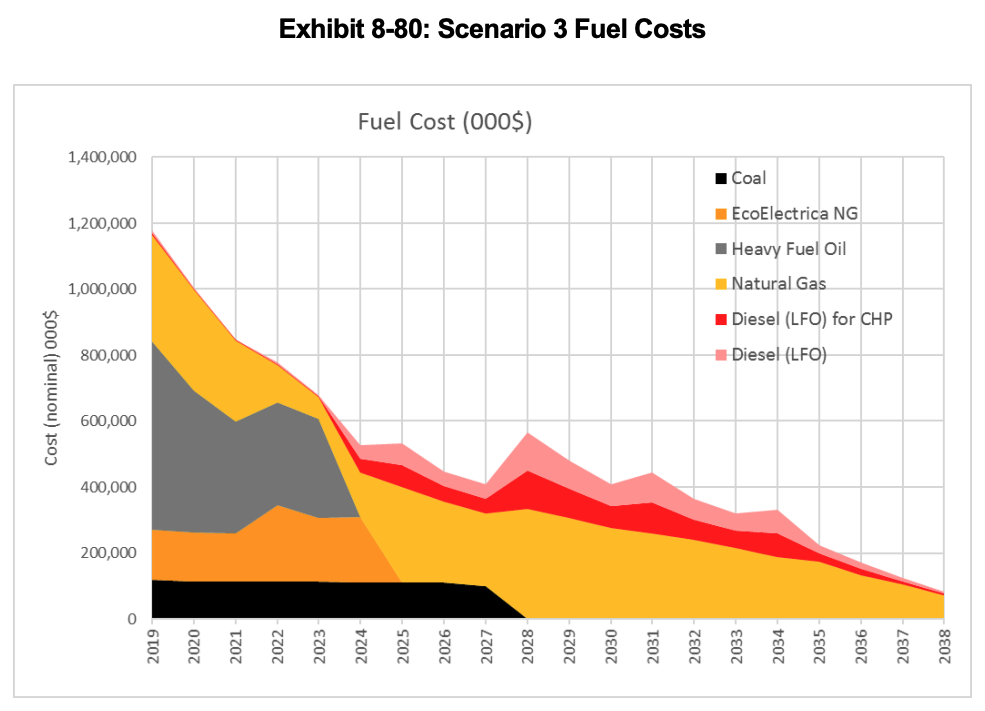

The future evolution of Puerto Rico’s electrical grid – contained in the Integrated Resource Plan (IRP) that PREPA submitted to the Puerto Rico Energy Bureau (PREB) in June 2019 and the Resolution that the PREB emitted in August 2020 – envisage natural gas as an important part of the island’s electrical infrastructure in the foreseeable future. Oil units will be retired as renewables are integrated into the system during the present decade (several of them do not comply with federal environmental standards) and the system’s transition will be anchored in natural gas. The selected planning scenario (Scenario 3 of the IRP) anticipates a significant penetration of renewable energy by 2038 (90% of installed capacity and 72% of generation) while continuing to rely on natural gas at least until 2040, according to a recent conversation with the PREB. The Bureau says that the transition will be anchored on existing gas facilities, although a new 300MW one could be built if the integration of renewables calendar fails.

This means that natural gas will be an important part of the electric bill in the foreseeable future (the yellow strip in the IRP graph below): consumers in the island will continue to be exposed to the fuel’s volatility in the global markets.

EXPECTED FOSSIL FUEL COSTS

Source: Puerto Rico Integrated Resource Plan 2018-2019

Source: Puerto Rico Integrated Resource Plan 2018-2019

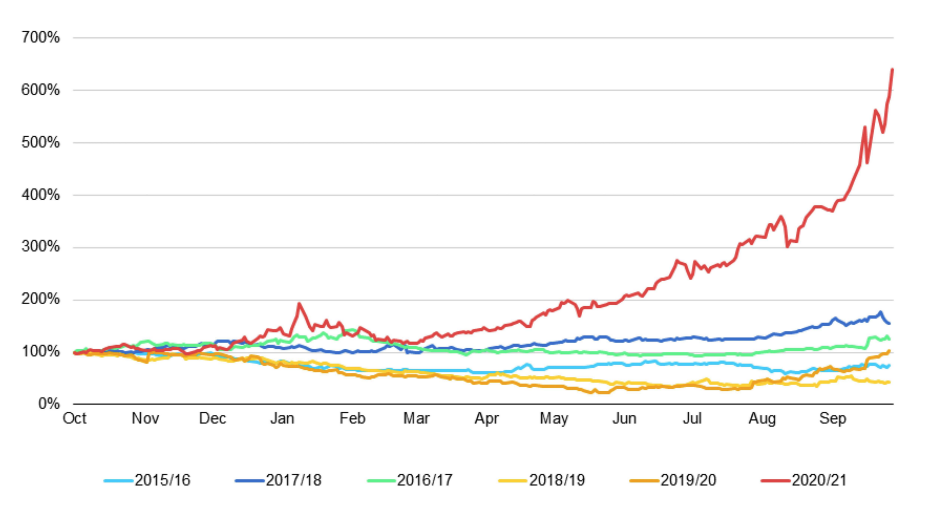

Europe and the “shock” of prices for natural gas

The global spike in the prices of natural gas has been dramatic: in Europe, the juncture has been compared to the 1970s oil crisis (in Puerto Rico we have the remains of the former CORCO refinery as a reminder of the juncture). The signals of the gas crisis started well before Russia’s invasion of Ukraine, at the beginning of 2021, with increased demand due to the rapid post-pandemic economic recovery and a particularly harsh 2020/2021 winter. Geopolitical factors also came into play: during the last quarter of 2021, Russia, the European Union’s principal supplier, reduced by 25% its gas exports to Europe as a way of pressuring Germany to certify the controversial Nord Stream 2 underwater pipeline (the German government had halted approval for security and non-compliance reasons).

EVOLUTION OF THE PRICE OF NATURAL GAS IN EUROPE (DUTCH TTF)

Source: International Energy Agency, Gas Market Report Q4-2021

Source: International Energy Agency, Gas Market Report Q4-2021

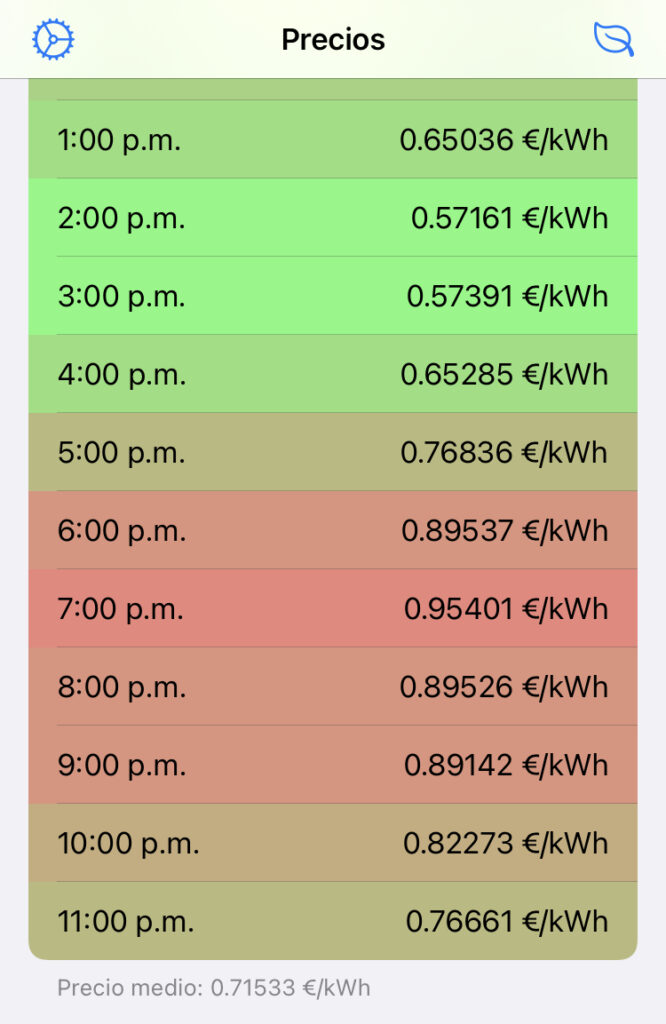

The marked increase in the price of natural gas provoked in turn a dramatic increase in the price of electricity: in Germany and Spain, for example, prices for the last quarter of 2021 were three and four times those of 2019 and 2020. The European Union (EU) has a marginalist structure that ties the price of electricity to the costliest source of energy; until now, it served as an incentive for investment in renewables, but it has now provoked an upward spiral in the price of electricity. The upward trend was aggravated by the invasion of Ukraine: in Spain, for example, on March 8 (two weeks after the invasion) residential consumers in the regulated market (those that do not have fixed-rate contracts and pay a daily market price) paid 95 ¢ of euro per kWh during the 7 PM tranche (about $1.03 kWh, more than three times the cost in Puerto Rico).

PRICE OF ELECTRICITY FOR RESIDENTIAL CONSUMERS

WITH NO FIXED RATE CONTRACT, MARCH 8 2022

Source: PrecioLuz March 8, 2022

Source: PrecioLuz March 8, 2022

In Spain, the dramatic increase in the price of electricity provoked production stoppages in electro-intensive industries (steel mills, chemical plants), as well as enormous public pressure. Social tensions have run high, and the fear of destabilization over the price of energy moved the Spanish government to approve a “crash programme” that included decreases in energy taxes (from 21 to 10%) in September of 2021 and, recently, credits and direct assistance to vulnerable businesses and consumers. The fiscal cost of the programme is € 24,000 million (about $ 25,300 million), a significant gap for the Spanish treasury (the spectre of the gilet jaunes, the French “yellow vests” has been all-too present in Spanish decision-making). Both the International Energy Agency (IEA) and rating agency Fitch anticipate that the prices for natural and liquified gas will continue high for the remainder of 2022; managing the cost of electricity will continue to require significant political maneuvering.

Economic imperatives have intermingled with geopolitical ones aimed at reducing Europe’s dependency on Russian gas. Germany, for example, is considering the possibility of postponing the retirement of its carbon and nuclear plants and has started to build two liquified natural gas (LNG) terminals in order to receive supplies from alternative suppliers. The European Commission (EC) has launched an initiative to ensure gas supplies for the coming 2022 winter and to reduce demand for Russian gas to 1/3 of present demand by the end of the year (events seem to be overtaking the programme, as Russia has unilaterally stopped gas supplies to Poland and Bulgaria). The European Union (EU) has also started to diversify gas suppliers (the United States and Algeria figure prominently in the plan), increase its natural gas storage capacity, and implant block-purchase mechanisms similar to the one used for COVID-vaccine purchases.

Some think tanks such as the French Jacques De Lors understand that these short-term measures are not enough: the issue is not about finding new gas suppliers but about transitioning out from this energy source. The institute recommends accelerating the green transition: fast-forwarding the deployment of renewable sources; renovating buildings in order to reduce thermal needs (in Europe the need is to provide heat in winter; in Puerto Rico, the imperative is to cool interior environments); substituting grey with green hydrogen (hydrogen produced from green sources instead of gas); and excluding natural gas from sustainable finance taxonomies in order to minimize its attractiveness for investors.

Gonzalo Escribano, analyst at Spanish think tank Real Instituto Elcano understands that this new scenario opens the door for Spain to become a protagonist in Europe’s energy transition, particularly in the development and production of new technologies: green hydrogen (produced from renewable sources), marine eolic capacity (which harnesses wind in high seas), bio-combustibles (which is produced from organic residues or natural resources) and concentrated solar energy (which produces electricity from solar light using mirrors or lenses).

The transition to renewables: an expert’s opinion

Diego Rodríguez Rodríguez, professor at Universidad Complutense in Madrid and research associate at Spanish think tank FEDEA, understands that, even though in the short run the urgency to reduce dependency on Russia will slow the elimination of fossil fuels in Europe, the “shock” will actually accelerate the transition to renewable energy both in the medium and in the long-term. “We are in the process of abandoning natural gas”, Rodriguez recently told CNE, “there will be no more deployment of gas networks, except for hydrogen”. The EU has recently launched RePowerEU, an initiative that will halve the consumption of natural gas by 2030 and that will accelerate the transition to renewable sources of energy. According to this new norm, all new gas infrastructure must eventually be converted to hydrogen.

Diego Rodríguez Rodríguez, Universidad Complutense and FEDEA

Diego Rodríguez Rodríguez, Universidad Complutense and FEDEA

Rodríguez understands that the biggest challenges to achieving the transition will be administrative and technical since the funding will be readily available through the NextGen EU program (by contrast, in Puerto Rico, federal funding is geared towards reconstructing the grid, not towards new generation). First, it will be necessary to break the bureaucratic bottlenecks in environmental assessments, which should be completed in five months instead of two years. Second, it will be necessary to deploy a robust electrical grid to integrate and transport new green generation. As in Puerto Rico, the Spanish grid is operated by a private company, Red Eléctrica, but planning is made by public entities. Spain has recently approved a roadmap to renovate the Electrical Transport Grid which will entail a € 7,000 million investment (about $ 7,600 million) capable to integrate a new contingent of 37MW of renewable energy throughout the country. By 2026, 67% of electric generation should come from renewables, both land and marine-based (a timeline that is a decade and a half shorter than Puerto Rico’s).

Rodríguez highlights the similarities between Puerto Rico and the Canary Islands archipelago: as islands, both have isolated electrical systems. For both, transitioning the electrical systems towards renewables poses a challenge. Most of the electricity generated in the Canary archipelago is fossil-fuel-based (mainly petroleum) – 91% in Lanzarote, 57% in Tenerife. Several decades back, the Canary Islands discussed converting its electric infrastructure to gas, but the endeavor was abandoned for environmental and cost reasons (a local councilperson said last year that renewables had rendered gas obsolete). Rodriguez says that the archipelago seems to have missed the boat on gas: it will not convert existing petroleum-based plants and will instead use these existing thermal units as “back up” in its transition to renewables (in contrast to Puerto Rico, the islands do not register violations to sulfur dioxide air quality norms since 2011). By 2030 the islands must have reduced fossil-based electricity to 50%.

Renewable-based electricity is being integrated into the grid at an increasing pace, but it is still a small share of the archipelago’s mix, below the Spanish median, (17%, well above Puerto Rico). The islands face the environmental challenge of deploying solar panels and wind towers in landmasses of limited territorial extension (El Hierro, for example, is about half of Culebra). For Rodríguez, new technologies like marine eolic floating platforms (which allow deploying wind structures in deep waters) are the archipelago’s big hope and should be an important part of its energy transition: the first Spanish platform was tested and deployed in the archipelago’s waters. Spain is planning to deploy fifteen floating eolic parks within the next decade and has earmarked € 200 million (about $ 217 million) for research and development of new marine-based new technologies. Both Scotland and Holland are also betting heavily on marine eolic technologies.

Floating eolic platform

Floating eolic platform

And Puerto Rico?

Should Puerto Rico continue depending on a natural gas infrastructure for several decades, as is contemplated in the current planning? It will all depend, according to the PREB, on the celerity with which renewables are integrated into the system. The Bureau recently named an independent coordinator to oversee the process, after determining that PREPA “fails to comply with important directives and milestones” and that it “is not capable of executing the renewables Procurement Plan”. The integration of 5,157.82 MW of renewable and storage resources is foreseen between December 2023 and May 2026; the first units to be retired will be oil-fired ones, several of which are in non-compliance with federal environmental standards. Moreover, would it be possible to incorporate locally-based governance, production, and R + D in new technologies? Without a doubt, the reconstruction of the electric infrastructure opens the door for such an aspiration, but it will be necessary to leave behind outmoded paradigms, address coordination failures between actors, and bestow the process with a true sense of urgency.