Published on March 19, 2020 / Leer en español

Five Things You Should Know Today

1) The world faces the coronavirus

According to the most recent data collected by Johns Hopkins University, the coronavirus has been detected in 159 countries or territories and 221,416 cases have been confirmed worldwide.

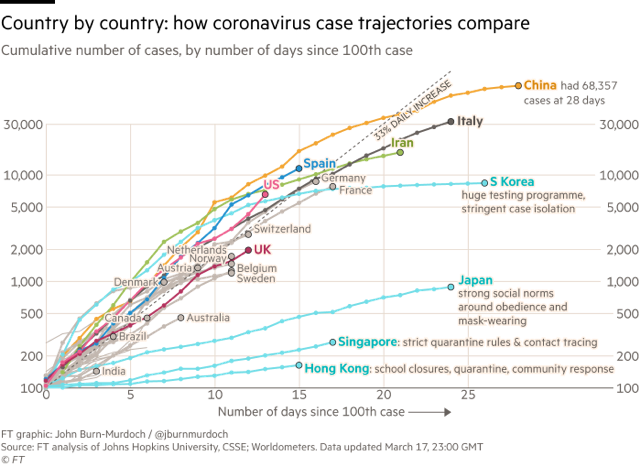

The chart below, developed by the Financial Times, shows infection curves for various countries. Unfortunately, many jurisdictions still have an exponential infection rate despite imposing strict social distancing measures.

Sources: Johns Hopkins, Financial Times (paywall)

2) Social distancing measures could last more than fifteen days

Experts from London’s Imperial College, as well as the Surgeon General of the United States, have warned that it may be necessary to extend social distancing measures beyond two weeks. Epidemiologist Neil Ferguson believes that these measures will need to be extended, at least intermittently, until the rate of infection is significantly reduced or a vaccine is developed, which can take anywhere from 12 to 18 months.

3) Puerto Rico: There are still not enough testing kits

In Puerto Rico, the main problem is the lack of testing kits to confirm the rate of contagion among the population. The local government has implemented strong measures of social distancing, including a curfew between 9:00 pm and 5:00 am until March 30, 2020. However, the inability to test everyone who needs it prevents public health authorities from developing an effective response. If we do not perform enough tests, it will be impossible to run the epidemiological models that would help us project the future development of the epidemic in Puerto Rico, which in turn serves as the basis for decisions about where to allocate resources and how long to extend the quarantine. In other words, without that basic information we are essentially flying blind.

Beyond performing the necessary number of tests, the government of Puerto Rico still has to (1) implement measures to protect the doctors, nurses, and medical technologists who are on the front lines responding to this crisis; (2) coordinate diagnosis and treatment protocols with hospitals across the island; and (3) ensure access to health services for all those who need it, either through “field hospitals” or other measures to avoid the possible collapse of the country’s medical facilities.

4) The financial impact is huge

The economies of more than 150 countries have been affected by the pandemic. On the supply side, we have seen factories, stores and businesses of all kinds close down. On the demand side, many people have dramatically cut spending on travel, conventions, restaurants, and art shows. This was to be expected, especially given the imposition of social distancing measures. In fact, the reduction of economic activity in the short term is, in a way, an indicator of the success of these public health policies.

But the combination of a reduction in production and a contraction in consumer spending has generated an economic slowdown not seen before. According to the most recent estimate by Goldman Sachs, economic growth in the United States could decrease to 0% during the first quarter of this year and contract at an annualized rate of 5% during the second quarter. Those projections would entail a monumental increase in unemployment, bankruptcies and poverty in an economy that until recently was operating essentially at full employment.

The economic impact will depend largely on the duration and severity of the pandemic, two variables that cannot be predicted with certainty at this time. However, the United States Federal Reserve has already implemented aggressive measures to keep credit flowing and provide liquidity to the markets: it has reduced short-term interest rates to zero and is preparing (1) to buy at least $ 700,000 million in United States Treasury bonds and mortgage-backed securities and to intervene in the commercial paper market that large multinationals depend on for their financing.

These actions are necessary but insufficient. They mostly help medium-sized companies, which are dependent on commercial banks for financing, and large financial institutions that use significant amounts of cash to carry out their day-to-day operations. But the benefits for both small businesses and large multinationals are marginal. For example, Delta announced that it will be reducing its active aircraft fleet by 40%. A reduction of 1 or 1.5% to the rate at which they borrow does little to solve this problem if people are unable or unwilling to travel on planes.

For individuals and families, the impact of unemployment or the damage caused by the bankruptcy of a small family business could have a more lasting impact than the threat of the coronavirus. To limit the long-term economic effects of the pandemic, it will be necessary for governments to take greater and creative measures than those traditionally taken during a “normal” recession. We can put all the money in the world into the economy, but if governments prohibit or limit social interaction, traditional policies will not have much impact. You have to think outside the usual matrix of stimulus policies.

Source: Wall Street Journal (paywall)

5) Congress to the rescue?

The United States Congress has passed two emergency bills to lessen the impact of the pandemic on public health and the economy. The first allocates $8 billion to finance the cost of tests and other prevention and protection measures. The second includes an increase in unemployment insurance payments, provides for paid sick leave, and increases the federal government’s contribution to Medicaid expenses, among other measures.

The Treasury Department has also announced that President Trump’s administration will be introducing additional legislation that could inject more than $1 trillion into the economy, including direct payments to citizens. This resembles the unorthodox policies that Milton Friedman called a “helicopter money drop,” a term that was later popularized by Ben Bernanke. To be clear, the United States government is not going to drop bags of money from a helicopter; the term refers to unconventional macroeconomic stimulus measures. But the mere fact that such measures are being seriously considered by a Republican administration is a powerful indicator of the magnitude of this crisis.

Source: Washington Post

This is the end of today’s briefing.

Stay safe and well informed!