PREPA’s Chiaroscuro

Published on June 9, 2019 / Leer en español

The Royal Spanish Academy dictionary has four definitions for the word chiaroscuro (claroscuro). Two of these are particularly relevant to describe the reality of the Puerto Rico Electric Power Authority (PREPA), in general terms and the Restructuring Support Agreement (RSA) with a group of bondholders, in specific. According to the dictionary, chiaroscuro can refer to: (1) “the distribution of light and shade in a picture”; or (2) “a set of contradictory traits in a person, situation or thing.”

For decades PREPA has operated in the gradations of light and shade; between the truth and lies; between legal lobbying and illegal scams. The recently negotiated RSA is an excellent example: it is an agreement negotiated on behalf of the people of Puerto Rico in dark rooms by local and international consultants, some with dubious reputations, and backed by the illegitimate agents of a bureaucratic-authoritarian regime that itself inhabits the vast political chiaroscuro that exists between a democracy and totalitarianism.

The RSA proposes an exchange of existing PREPA Bonds for two types of New Bonds. Tranche A Bonds will be exchanged at a ratio of 67.5% of the principal amount of outstanding bonds subject to the exchange, plus other payments. While Tranche B Bonds will be exchanged at a ratio of 10% of the principal amount of the outstanding bonds subject to the exchange. This implies a reduction in the nominal principal, or face value, of the existing bonds of 22.5%. However, it’s not possible to determine, from the documents that have been made public, if that debt relief reduces PREPA’s debt burden to a sustainable level.

The Tranche A Bonds will have a stated maturity of 40 years, subject to early redemption under certain circumstances. They will bear interest at an annual rate of 5.25% to be paid in cash, on a tax-exempt basis. The Tranche B Bonds will have a stated maturity of 47 years. The interest on Tranche B Bonds will be paid in kind, that is, in the form of additional Tranche B Bonds, and will accrete at an annual rate of 7.00% (if tax exempt) or of 8.75% (if taxable).

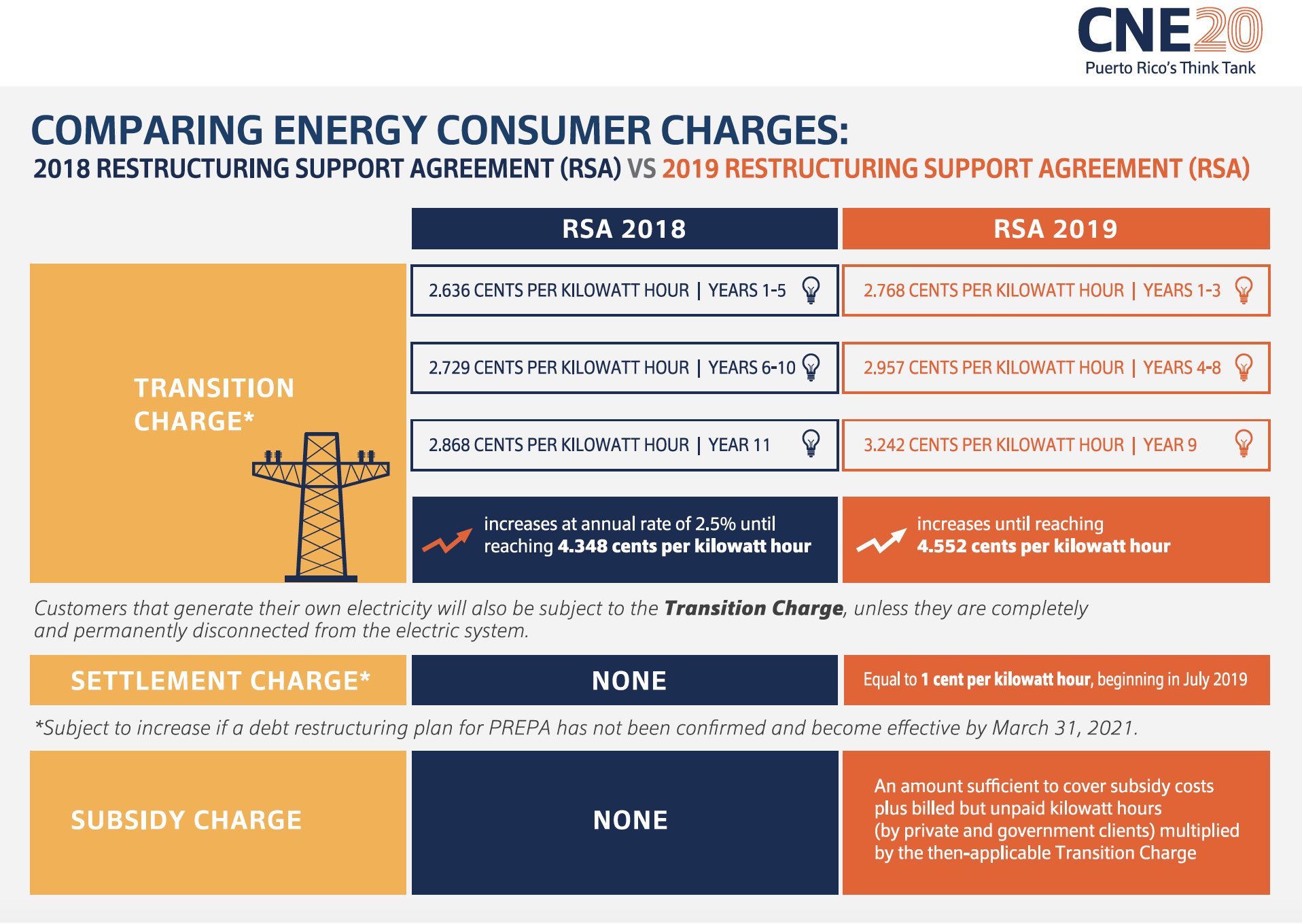

The repayment of the new bonds would be secured by a lien on the future cash flow generated by PREPA through the imposition of a transition charge. This is a special charge that will be added to the amount billed to PREPA’s customers and used exclusively to pay the new bonds. The transition charge is designed to increase gradually, starting at 2.768 c/kWh during fiscal year 2021 up to a maximum of 4.552 c/kWh during fiscal year 2044 and until the new bonds mature.

It’s important to point out that these terms and conditions are basically the same as those negotiated in the July 2018 RSA that was eventually discarded. After an additional ten months of costly negotiations, Puerto Rico ends up with the same reduction in the PREPA debt and a higher transition charge than the one proposed in 2018. What has changed since then? Why was that agreement a “bad” one and this one “good”? Only those that walk quietly in the shadows surrounding PREPA know the answer.

Customers that generate their own electricity will also be subject to the transition charge, unless they are completely and permanently disconnected from the electric system. The transition charge, as currently proposed, would essentially constitute a regressive tax on all customers. It will also discourage the installation of behind the meter generation systems. This would be inconsistent with Puerto Rico’s Energy Policy law, the preliminary Integrated Resources Plan and PREPA’s fiscal plan, which all promote, at least in theory, a transition to distributed generation based on renewable sources of energy.

The RSA also mandates the imposition of a subsidy charge on all customers, except those expressly excepted by legislation. This charge seeks to recover from all of PREPA’s clients: (1) costs incurred by PREPA or any successor for subsidies granted to various customer classes; (2) certain billed and uncollected amounts from private clients; and (3) billed and uncollected amounts from government clients.

In addition, the RSA includes a settlement charge that will be included in customer bills commencing on July 1, 2019, equal to 1 c/kWh. Commencing on August 30, 2019, PREPA will pay participating bondholders an amount equal to the number of kilowatt hours billed by PREPA during the previous month, multiplied by 92%, and then multiplied by the settlement charge.

In conclusion, the RSA is emblematic of the “set of contradictions” that constitutes Puerto Rico’s energy policy. Its terms and conditions are overly generous to creditors; it is full of hidden charges; it discourages the transition to distributed renewable generation; it is uncertain whether it provides the debt relief necessary to maintain PREPA as a going concern, while avoiding another restructuring in the short to medium term; and will in all likelihood result in a significant rate increase for Puerto Rican ratepayers for decades to come.

Put simply, the proposed agreement is not a good transaction for Puerto Rico. For all the foregoing reasons the proposed RSA should be rejected and we respectfully recommend the parties go back to the negotiation table.