The Outlook for 2010

Published on December 31, 2009

Policy Director

SHARE

In 2009, according to The Economist magazine, world output shrank by more than 1 percent, the first time since 1945 that it has declined on a year-over-year basis. At the same time, years of excessive lending and irrational asset pricing finally caught up with the world’s financial system. Governments across the world responded to the dual economic and financial crises with massive public spending programs, historic liquidity increases, and unprecedented interventions by central banks. These policy initiatives appear to have worked and by the end of the year all the world’s big economies had stopped shrinking.

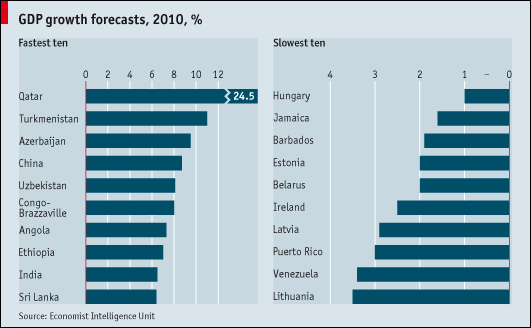

That is good news, but hold the celebration: the consensus forecasts of global growth for 2010 are a sluggish 1 to 2 percent for most advanced economies. Thus, after a year of economic collapse, multiple bank bailouts, stimulus spending, and large-scale monetary easing, it appears that 2010 will be a year of reassessment, sorting through the wreckage, burying the dead, and regrouping the walking wounded.

A weak, jobless recovery appears to be the best case scenario for many countries. In the United States, for example, the consensus forecast is for growth to be around 2.5 per cent in 2010, with the unemployment rate stubbornly hovering around 9 or 10 per cent. There are good reasons for these diminished expectations. Most of the growth in the U.S. during 2010 will be driven by the restocking of depleted inventories and stimulus spending. This should keep the U.S. economy going for a couple of quarters, but neither of these factors, however, can sustain growth past 2010 without a self-sustaining cycle of private spending and income.

Unfortunately, it is highly unlikely that private consumption spending will grow vigorously in 2010 because American household balance sheets are weighed down by debt. Household wealth is down some $12 trillion relative to 2006, a decrease of 19 per cent due mostly to the collapse in house and stock prices. This means that people in the U.S. are more likely to spend less, save more, and pay down debt. Indeed, some analysts expect consumer spending to grow more slowly than income for the first time in twenty-odd years. Weak consumer demand means that business firms will not be hiring in large numbers in 2010. Relatively high unemployment will hold back wage gains. Low wage growth, in turn, further depresses consumer demand and the cycle reinforces itself.

Weakness in the financial sector is the other factor limiting growth in the U.S. Credit flows to businesses are “glacial” in the words of a recent Financial Times editorial. In the U.S. bank loans to business and consumers are actually falling, as are loans packaged into asset-back securities, this despite unprecedented measures—such as public guarantees of bank debt, equity infusions, and the outright purchase of assets—introduced to address the financial crisis. This reluctance to lend is due in part to a shortage of willing borrowers; in part to the weigh of toxic assets still festering in banks’ balance sheets; in part to rising delinquency and foreclosure rates among non-subprime borrowers, as well as falling commercial property values; and in part due to the expectation that new stringent capital requirements are on the way. All these factors encourage bankers to lend less and hoard their capital.

In addition, at some point during 2010 we are likely to see pressure mounting for the U.S. to reduce its massive budget deficit, currently in excess of 10 per cent of GDP, and for the Federal Reserve to begin reducing its bloated balance sheet, currently well over twice its pre-crisis size. The failure to implement a credible budget plan or any uncertainty generated by the withdrawal of monetary support could adversely impact investors’ assessments of sovereign risk and push up sharply bond yields in the U.S.

If the outlook for the U.S. is somewhat unclear, in Puerto Rico it is pretty much cloudy. We can expect economic activity to be stagnant or declining during the first half of 2010 as the government finishes the implementation of its fiscal austerity program. Unemployment should also keep rising during this period. According to the Economist Intelligence Unit, Puerto Rico should be the third slowest (out of 180 countries tracked by the EIU) growing economy in 2010.

Growth could turn positive towards the second half of the year, if the government winds down its budget-cutting measures by June, and if it is effective in spending the remainder of the ARRA funds allocated to Puerto Rico. However, there are several downside risks to this scenario.

- First, any significant increases in oil prices or in short-term interest rates could stifle the recovery.

- Second, financial institutions in Puerto Rico are under great strain. Three of the eight publicly traded local banks are operating under cease and desist orders issued by the FDIC. According to some analysts this means the FDIC could be active in Puerto Rico next year. Any intervention by the FDIC in Puerto Rico could further depress consumer confidence.

- Third, some labor leaders are calling for a general strike early next year to protest government layoffs, the implementation of public-private partnerships, and efforts to turn back the clock on labor legislation. It is impossible at this time to determine whether this effort will be successful but uncertainty associated with widespread labor and social unrest could adversely affect investment and economic activity.

In sum, in 2010 we can expect a weak, jobless recovery for the U.S. and a sluggish, anemic economy in Puerto Rico. In both places uncertainty will weigh on the economy and 2010 will be a year of hard work, difficult decisions, and little, if any, improvement in economic conditions.

This column was originally published in the Puerto Rico Daily Sun on December 31, 2009.