The (in)justice of COFINA

Published on March 3, 2010

Imagine it is the year 2035 and all international trade and travel has halted to a dead stop due to the sudden appearance of a highly contagious disease hitherto unknown to humanity. The good news is that Chinese Pharmaceutical Company, which is majority-owned by the Chinese government, has developed a highly effective vaccine against this disease. The bad news is that it will cost the government of Puerto Rico $2 billion to acquire sufficient doses to protect its population.

As usual, Puerto Rican government officials are scrambling to find the money. A financial analyst at the Government Development Bank notices that pursuant to the terms of a transaction executed in 2010, Puerto Rico has to set aside $1.3 billion of the sale taxes collected in 2035 to repay bonds issued by the Puerto Rico Sales Tax Financing Corporation, known in Spanish as COFINA. The analyst writes a memo to his boss suggesting that Puerto Rico should default on its COFINA obligation and use the money to buy vaccines from the Chinese government. You are the president of the GDB, what would you recommend to the Governor? Would you recommend default, thereby damaging Puerto Rico’s credit, or would you recommend honoring the obligation to bondholders, thereby depriving thousands of Puerto Ricans of their chance to live through the epidemic?

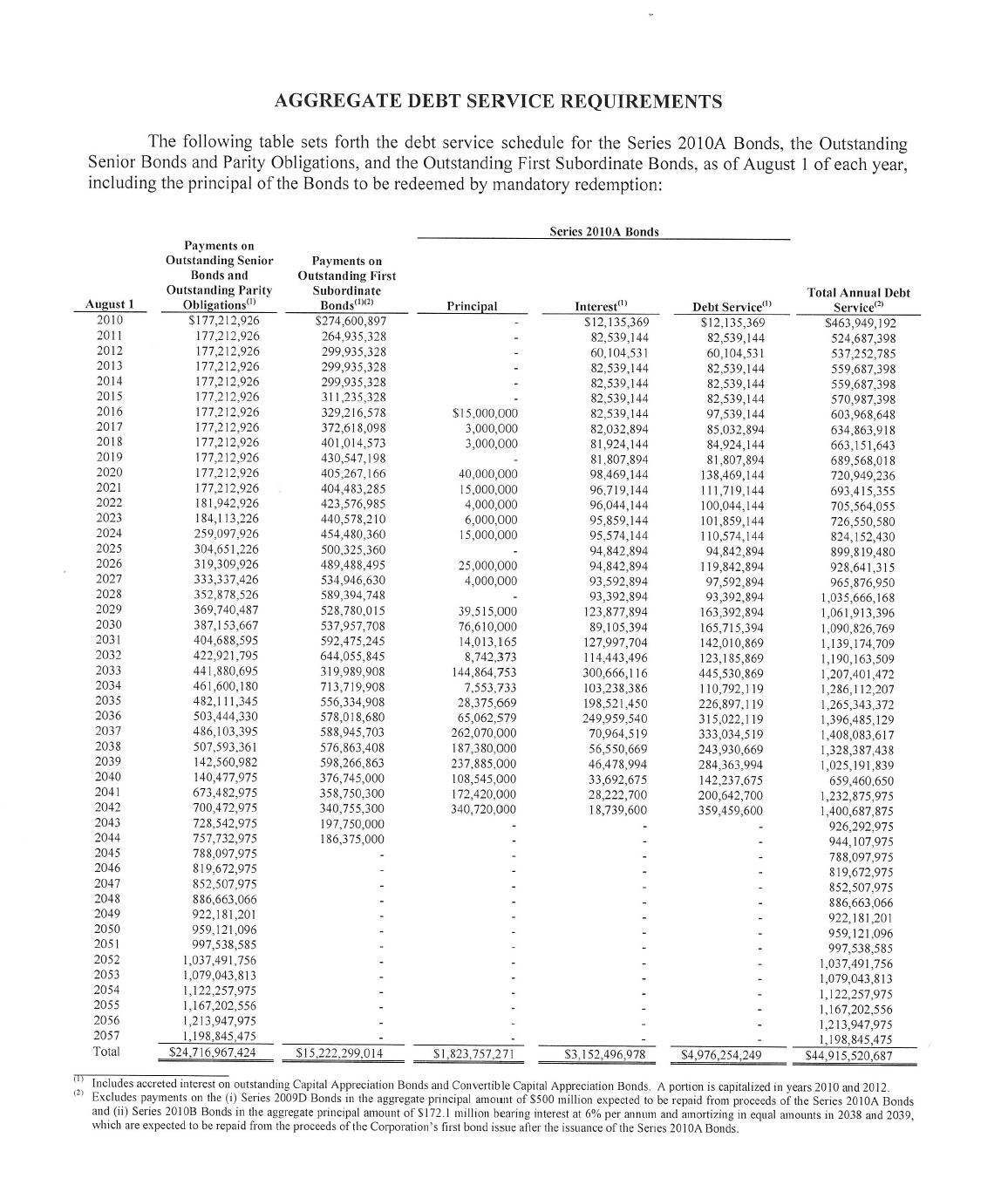

The above scenario obviously is a hypothetical, except for the part about COFINA and its debt. COFINA, which was created in 2006, has issued approximately $12.2 billion in bonds. Of that amount, $4.7 billion were issued by the prior administration and $7.5 billion by the current one. Total debt service on those bonds amounts to $44.92 billion, to be paid between 2010 and 2057. The table below sets forth the COFINA debt service requirements for the next 47 years.

Source: COFINA Offering Statement, January 28, 2010, p. 35.

COFINA receives half of the Commonwealth sales tax (2.75% out of a total sales tax of 5.5%), which it sets aside, up to a certain amount, to pay principal and interest on its bonds. This pledged amount is set to increase by 4% every year, from $550 million in 2009 to $1.85 billion in 2041.

The proceeds from the bond offering, that is, the $12.2 billion that has been issued, can be used by COFINA to pay old government debt and current operational expenses. No long-term assets, no hospitals, no roads, no bridges, no schools, will be financed with this debt. Yet, we are sticking the $44 billion bill on future generations, which will derive no benefit from this indebtedness. By amassing this huge debt, we are passing the cost of our fiscal profligacy to our children and grandchildren. Some people would call this immoral and unjust. So, let’s analyze the COFINA transaction through the lens of several theories of justice.

For Aristotle, a just society gives each person his or her due and he developed a complex system to figure out just what people are due and why. But the bottom line for him was to “do the right thing, to the right person, to the right extent, at the right time, with the right motive, and in the right way.” Under this theory, it cannot be argued that it is morally right to impose this massive burden on future generations. Underlying this conclusion is a basic belief about moral desert: the unborn cannot be said to deserve this burden because they have not committed any moral wrong. If anything, Aristotle’s theory would seem to support imposing a special tax on those government officials that incurred all those obligations without a repayment source, for they are the ones who morally deserve to bear this burden.

For utilitarians, such as Jeremy Bentham, justice means maximizing utility or welfare, the greatest happiness for the greatest number. By utility he means whatever produces pleasure or happiness, and whatever prevents pain or suffering. Even if we could argue that the COFINA transaction maximizes utility for those of us living in 2010, there is no way we can know today how it will affect the utility of future generations stuck with this massive repayment obligation. For all we know, as we demonstrated in the hypothetical above, making those payments could subject future generations to intense pain and suffering, so the overall level of utility associated with this transaction could be negative.

For libertarians, such as Robert Nozick, justice means maximizing freedom and individual liberty. For people such as Nozick the COFINA deal infringes the liberty of future generations in two ways. First, taxing future generations violates their liberty to do with their money whatever they please. Second, even if you accept taxation as a necessary evil, the COFINA transaction limits the uses that future government officials can give to future sale tax receipts because they are pledged to pay COFINA bondholders.

For John Rawls a just society is, among other things, one in which social and economic inequalities are arranged for the benefit of those least well off. It must be noted that Rawls’s theory is not meant to assess the fairness of this or that financial transaction; it is concerned with the way society is structured and how it allocates certain basic goods such as income, power, opportunities, and wealth. For Rawls, the important question would be whether COFINA arose as part of a system that, taken as a whole, works for the benefit of those least well off. Even the most optimistic person would be hard pressed to argue that Puerto Rican society is currently structured for the benefit of the least well off. In fact, the case can be made that our society is structured to benefit mostly the wealthy and the well connected.

In the end, the inescapable conclusion is that the COFINA transaction is profoundly unjust. To be fair to the current administration, it is true that it inherited all that debt without a repayment source. That fact, however, does not excuse its unjust actions. Indeed, this is a situation where government officials have to choose between two courses of action both of which it would be wrong for them to undertake. Be that as it may, the payments on COFINA’s bonds are the wages of Sisyphus to be borne by future generations in atonement for the delusions of grandeur and other excesses committed by our dissolute politicians during decades of financial profligacy and mismanagement.

This column was originally published in the Puerto Rico Daily Sun on March 3, 2010.