CNE Analyzes the New PREPA Restructuring Support Agreement: It is Worse Than You Think

Published on May 23, 2019

On May 3, 2019, the Puerto Rico Electric Power Authority (“PREPA”), the Puerto Rico Fiscal Agency and Financial Advisory Authority (“AAFAF”), and the Financial Oversight and Management Board for Puerto Rico (the “FOMB”), executed a “Definitive Restructuring Support Agreement” (the “RSA”), with the members of the Ad Hoc Group of PREPA Bondholders (the “Ad Hoc Group”), and Assured Guaranty Corp. and Assured Guaranty Municipal Corp. (collectively, “Assured”), for the restructuring of a portion of certain bonds issued by PREPA. Last week, CNE Public Policy Director and energy policy expert Sergio M. Marxuach published an analysis of the new RSA and its implications for Puerto Rico.

In his analysis, Marxuach reaches the following conclusions about the agreement:

- Its terms and conditions are overly generous to creditors;

- it discourages the transition to distributed renewable generation;

- it is uncertain whether the deal provides the debt relief necessary to keep PREPA functioning while avoiding another restructuring in the short to medium term; and

- it will in all likelihood result in a significant rate increase for Puerto Rican ratepayers for decades to come.

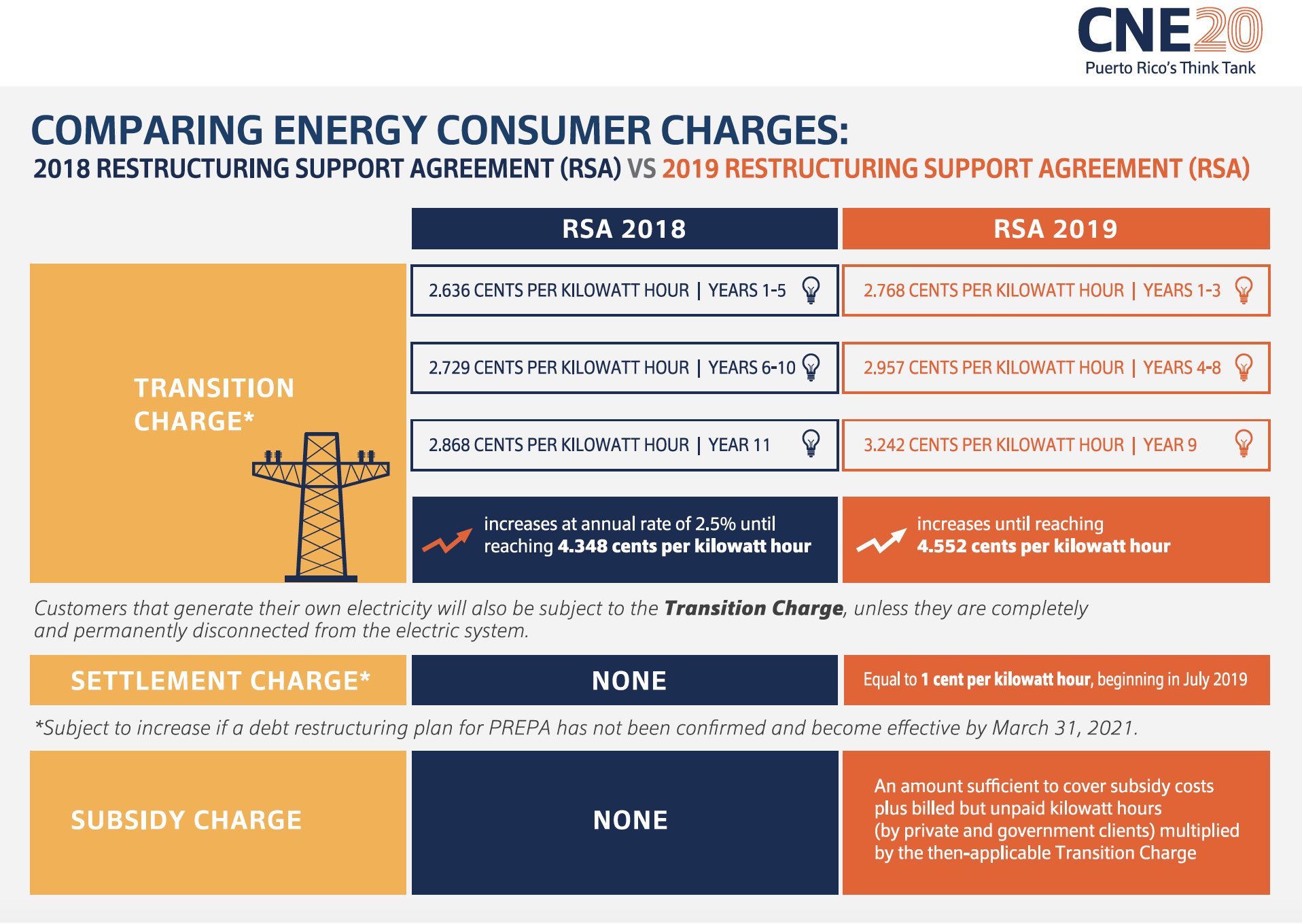

Additionally, the new RSA established even greater charges for ratepayers than last year’s proposed restructuring agreement. “After ten months of additional negotiations, we’ve ended up with the same reduction in principal and paying a greater Transition Charge than we would have paid under the July 2018 RSA,” said Marxuach, who added: “…if Puerto Rico continues to be too generous with its creditors, the likelihood of experiencing another debt crisis in the short to medium term increases significantly.”

In the linked report and executive summaries, we summarize some of the principal terms and conditions of the RSA and provide some analysis of its potential effects on Puerto Rico’s electricity market.