Introduction

Decades of corruption, mismanagement, politically influenced business decisions, and postponing critical maintenance and required capital expenditures resulted in the bankruptcy of the Puerto Rico Electric Power Authority (“PREPA”) in the summer of 2017. The hurricanes of September 2017 and the earthquakes of 2020 further weakened PREPA’s already fragile infrastructure.

Now in 2023, the reconstruction and transformation of Puerto Rico’s electric power system is entering a critical stage, as several important processes—PREPA’s operational and financial restructuring; the commencement of large-scale projects to rebuild the grid; and the elaboration of a new Integrated Resource Plan—converge at a key point in time.

However, existing policy disagreements regarding the extent of the use of natural gas during the transition to 100% renewable generation and the ongoing debate about the advantages and limitations of installing distributed generation capacity (mostly rooftop solar systems with batteries) instead of utility-scale projects have generated delays in the rollout of new renewable generation capacity and pose a serious risk to Puerto Rico’s ability to meet its renewable energy objectives.

Operational Restructuring

The restructuring of PREPA’s operations is at a fairly advanced stage after the execution of two agreements to outsource the operation and management of PREPA’s (1) transmission and distribution (“T&D”) grid and (2) legacy generation assets (“LGA”).

LUMA, a Canadian/American consortium, has been in charge of energy dispatch operations and maintaining the stability of the T&D system since July 2021. The transfer to LUMA of the T&D assets was bumpy and the company faced severe problems during its first year of operations. Recently, however, the T&D system has appeared to gain some stability although rolling blackouts and unplanned outage rates are still significantly above average when compared with similar utilities in the mainland.

Equally important is that LUMA is the main entity in charge of working with FEMA on the redesign and rebuilding of the T&D system. This process has taken longer than expected in part due to special procedures imposed by FEMA (Section 428 of the Stafford Act), in part due to LUMA’s learning curve with respect to Puerto Rico’s energy system, and partly also due to the multiplicity of plans/proposals to rebuild the grid. According to PREPA’s most recent Fiscal Plan, “since the start of Fiscal Year 2023, LUMA has submitted a total of 341 SOWs [scopes of work] to FEMA for T&D projects representing an estimated $7.1 billion in reconstruction activities.” (PREPA Fiscal Plan, p. 98) It is not clear from the Fiscal Plan how many of these SOWs have been approved or in what stage of the work process are they in (planning, design, in progress, or finalized).

Early this year the government of Puerto Rico selected Genera PR, a subsidiary of New Fortress Energy (a natural gas company), to manage and operate PREPA’s aging fleet of LGAs. As part of the agreement, Genera is required to make some short-term capital expenditures (funded by FEMA) to stabilize the system, generate savings from renegotiating fuel contracts, and eventually commence decommissioning the LGAs.

Although the government has high hopes for generating savings from increasing system efficiencies and the renegotiation of fuel contracts, the real savings will come from decommissioning PREPA’s aging fleet of fossil fuel generation. It is unlikely, though, that those savings will be realized in the short-term because (1) fossil fuel generation can be decommissioned only when there is enough new renewable capacity to replace it and that process has taken longer than expected; and (2) Genera, as a subsidiary of a natural gas company, may have an incentive to prolong the life of the existing generation fleet (under the pretense that there is insufficient renewable generation available) and purchase the required natural gas from its parent company.

Financial Restructuring

PREPA has been in negotiations with its creditors since July 2017. However, six years of tough on-and-off negotiations have not yet yielded a court-certified plan of adjustment of PREPA’s liabilities. PREPA currently owes about $9 billion in outstanding bonds, has an unfunded pension liability of $3.8 billion, owes an additional $700 million to fuel line lenders, and several million more to other unsecured creditors.

According to the PREPA Fiscal Plan, “without restructuring its debt and other liabilities, PREPA would need to repay approximately $2.62 billion of scheduled legacy debt obligations over four years from FY2024 to FY2027 in addition to the roughly $4.83 billion of unpaid past and currently due amounts through the end of FY2023. Bringing PREPA’s unrestructured debt obligations to funded status in the near term would require rate increases of approximately 6 to 7 ¢/kWh in real dollars in the FY24- 27 period. In the longer term, without any restructuring, PREPA’s estimated annual debt service obligation is approximately $1 billion per year based on amortization of all long-term financial liabilities at a 5.25% interest rate over 20 years.” (PREPA Fiscal Plan, p. 140) Under that scenario, the average residential customer who consumes 425 kWh per month would see its bill increase by approximately 26%. Clearly, that is an unsustainable scenario given Puerto Rico’s stagnant economy and high poverty rates.

The legal process continues pursuant to the procedures established by Title III of the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”). In June 2023, the judge presiding over the proceedings determined that bondholders had only a partial lien on PREPA’s revenues and that there were significant risks associated with other remedies they may seek (for example, the appointment of a receiver). Therefore, she estimated the value of their claim at $2.38 billion.

On August 25, 2023, the Financial Oversight and Management Board for Puerto Rico (“FOMB”) announced that it had “filed the third amended Plan of Adjustment to reduce more than $10 billion of total asserted claims by various creditors against the Puerto Rico Electric Power Authority (PREPA) by almost 80%, to the equivalent of $2.5 billion, excluding pension liabilities.” (FOMB Press Release, August 25, 2023) According to the FOMB, the face value of bondholder debt would be reduced from $8.4 billion to approximately $2.4 billion. Bondholders who support the plan would recover (in the form of new bonds) 12.5% of their original asserted claim, while bondholders who do not agree to the proposed plan would recover 3.5% of their asserted claim. General unsecured creditors would recover, presumably in cash, approximately 13.5% of their initial claims. Negotiations continue with representatives of PREPA’s pensioners and other retirement plan beneficiaries.

The FOMB estimates the settlement with bondholders and other creditors (excluding the pensioners) would result in a 5% increase in monthly electricity bills, on average. That estimate will certainly increase, depending on the pension settlement. As of this writing a relatively large group of bondholders has announced their opposition to the proposed plan and we can expect them to eventually file an appeal with the U.S. Court of Appeals for the First Circuit. In the meantime, the Tittle III judge has announced March 2024 as the deadline for certifying PREPA’s plan of adjustment.

New Integrated Resource Plan

Act 57 of 2014 requires PREPA, now LUMA as its agent, to prepare an Integrated Resource Plan (“IRP”) for a 20-year planning period and to update it every three years. The law defines an IRP as “a resource plan that shall consider all reasonable resources, including both energy supply (e.g. utility-scale generation) and energy demand (e.g. energy efficiency, demand response, and distributed generation), to satisfy the current and projected future needs of Puerto Rico’s energy system and its customers at the lowest reasonable cost.” (PREPA Fiscal Plan, p. 26) In April 2022, the Puerto Rico Energy Bureau (the “PREB”) extended the deadline for the next IRP filing, resolving that LUMA shall file the next IRP by no later than March 1, 2024.

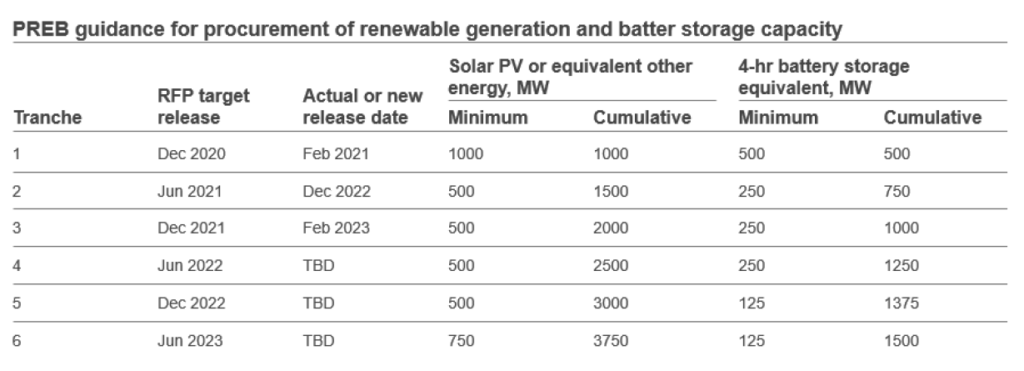

The IRP is a key document since, pursuant to Puerto Rico law, it sets forth the timetable and sequence for achieving the objective of 100% renewable generation by 2050. Unfortunately, the intermediate objectives set in the IRP currently in effect (approved in 2020) have not been met. As can be seen in the chart below, the procurement process for large-scale renewable generation is approximately two years behind schedule:

Source: PREPA Fiscal Plan 2023-24, p. 85.

According to the Fiscal Plan, “PREPA has renegotiated or completed the procurement of 844.8 MW of new renewable generation capacity. However, as of the close of the second quarter of 2023, none of these projects have reached financial close or commenced construction, resulting in significant delays as compared to PREB-established procurement and development timelines.” (PREPA Fiscal Plan, p. 26) Furthermore, “on April 26, 2023 PREB issued an order requiring a sweeping investigation into the Tranche 1 renewable energy and battery storage procurement process due to persistent delays. The PREB order states that the delays in the Tranche 1 procurement process “could affect” renewable energy regulatory goals in the short-, medium- and long-term.” (PREPA Fiscal Plan, p. 54)

Given the delays that occurred during the Tranche 1 process, the PREB decided to appoint an “independent coordinator”, Acción Group, LLC, to carry out the Tranche 2 and Tranche 3 RFPs. It is not clear to us who manages and operates Acción Group as of this writing. In addition, RFPs for tranches 4 through 6 have been postponed indefinitely.

With respect to rooftop solar installations, LUMA claims to have connected over 50,000 customers, representing 300 MW of generation capacity, since it took over the operation of the T&D system in 2021. (PREPA Fiscal Plan, p. 19) The U.S. Department of Energy (“DOE”) estimates that, as of June 2023, there were 85,661 rooftop solar interconnections in Puerto Rico. While these statistics show some progress in the interconnection of rooftop solar systems, they also highlight the slow rate of the transition, as PREPA has more than 1,000,000 clients.

Reconstruction of the T&D System

According to the Fiscal Plan, “as of June 2, 2023, PREPA has been awarded over $15 billion of federal funding in total. Approximately $12 billion of FEMA funding is obligated for permanent work and has received approval for projects amounting to approximately $2.3 billion. The remaining obligated federal fundings include approximately $2.4 billion FEMA funding for emergency work, approximately $600 million FEMA funding for management costs, and approximately $2.3 million CDBG funding.” (PREPA Fiscal Plan, p. 87) Thus, in terms of funding for the rebuilding of the grid, only 19% has been “approved” to be spent.

In terms of the number of permanent work projects to rebuild the grid, a recent DOE presentation states that as of July 2023, there were 220 grid improvement projects in FEMA’s “pipeline”; 134 grid improvement projects had been “approved” by FEMA; and 60 grid improvements had “broken ground”. The DOE presentation did not set forth the total number of grid improvement projects that comprise the rebuilding of the entire grid.

Regardless of the metric we use, the conclusion appears to be that the grid reconstruction process has proceeded at a relatively slow pace. Several factors explain this situation. First, it is not clear, at least to outside observers, which grid modernization plan is the one that should be implemented: there is a plan designed by PREPA, there is the current IRP, there is LUMA’s system remediation plan, and there is the grid modernization plan being developed by the DOE as of this writing. It is not clear to us how each of these plans relates to the other nor which has precedence in the case of conflicts among and between them.

Second, both PREPA and FEMA have agreed to build out significant new generation capacity based on natural gas at the old Palo Seco plant site. This investment of approximately $900 million has been questioned by environmentalists as unnecessary and perhaps even unlawful given Puerto Rico’s legal requirement to transition to 100% renewable generation by 2050. Proponents, on the other hand, argue that this new fossil fuel generation is necessary to stabilize the system and to provide a “bridge” to full renewable generation on the island. It is important to address this policy issue as soon as possible to avoid further delays.

Finally, there is a strong disagreement among and between proponents of renewable generation regarding the issue of distributed generation versus centralized utility-scale solar farms. Proponents of rooftop solar systems argue there are sufficient roofs in Puerto Rico to install enough capacity so as to render unnecessary the buildout of large utility-scale solar farms in Puerto Rico.

Proponents of large-scale solar facilities argue that a system based solely on rooftops would be unstable given Puerto Rico’s energy demand, takes too long to bring up to scale, and does not take into account the needs of (1) people who live in multifamily units, (2) commercial clients, and (3) industrial and manufacturing operations. The DOE, in an interim report, concluded that Puerto Rico needs both kinds of systems.

This debate is more than a mere policy disagreement because the policy decision will influence the design of the new grid. If the government of Puerto Rico decides to rely mostly on distributed rooftop solar systems, the grid has to be designed in one way; while if it decides to rely mostly on centralized utility-scale solar generation, the grid has to be designed in another way. It appears the DOE has concluded that the new grid can be designed to accommodate both distributed rooftop solar generation, which is good for hard-to-reach, isolated “last-mile” communities, and large-scale utility generation, which can provide stable base loads to the system. Unfortunately, the DOE final report on grid design will not be ready until December of this year. So, it appears unlikely this policy disagreement will be solved before then.