Published on April 17, 2020 / Leer en español

Five things you should know today

1) “Only the people save the people”

Analysis by Deepak Lamba Nieves, PhD, Research Director at CNE

As funds dedicated to provide support for small and medium enterprises dry up in the United States, questions loom over how much more assistance will be needed and if new provisions will reach areas currently underserved. Unfortunately, the needs of the truly disadvantaged, those who live on the margins and in places where the government has historically been absent, continue to be overlooked in many of these debates.

Nevertheless, communities and NGOs across the globe have stepped up and found ways to serve the most vulnerable. Reports from Brazil showcase how organizations have carried out food distribution drives and effective communication campaigns in the favelas of Rio de Janeiro. Residents have also activated crisis task forces that focus on taking care of the people while pressuring state authorities to provide basic services, like access to water and basic health care. In Argentina, grassroots organizations have activated local cooperative enterprises to produce masks, food delivery and programs to prevent gender violence, amongst other primary services.

Puerto Rico has also seen new coalitions spring up, like the “Red Comunitaria de Respuesta” in the town of Guánica, which was pummeled by a string of earthquakes at the start of 2020. The group is providing medical screening services, via telephone and community communication campaigns, and has also partnered with doctors to administer COVID-19 tests.

Contrary to popular belief, many of the world’s poor are not waiting for a state handout or just throwing their hands up as the coronavirus threatens their lives. As one of Rio’s favela residents explains: “[we, from the favelas] decided to organize ourselves, as we have always done, and began making decisions in response to the situation. We aren’t going to sit around and do nothing. We have never done that.”

2) Economic Impact Payments

Analysis by Rosanna Torres, Director of CNE’s Office in Washington, DC

Economic Impact Payments have started to make their way into the hands of U.S. citizens. In a country where unemployment is rising exponentially, with 22 million new unemployment claims in just four weeks, these cash payments are a much-needed palliative for the economic pain. Individuals are eligible to receive direct payments of up to $1,200 per person (up to $2,400 for joint filers) and an additional $500 per child. Designed as a means-tested program, the assistance applies only to those with an adjusted gross income up to $75,000 (and $150,000 if married) and payments are gradually phased out.

In order to accelerate payments, the federal government used information from the 2018 and 2019 federal tax returns to emit electronic payments directly to individuals. That process, however, does not cover the entire eligible population in the U.S. After considerable pressure from policy groups, the IRS announced a third-party website for people not required to file tax returns. This week, the IRS also announced that recipients of Supplemental Security Income (SSI) will automatically receive payments.

But, there’s a caveat: Most of this doesn’t apply to Puerto Rico. First, Puerto Rico does not participate in the SSI program. But more importantly, most residents don’t file federal income tax returns. Those U.S. possessions that do not mirror the U.S. tax code, such as Puerto Rico, must submit a plan, to be approved by the Secretary of the U.S. Treasury, detailing how it plans to administer the funds from the third stimulus package. The local treasury, Hacienda, has already submitted its plan to the U.S. Treasury and is awaiting a response before distributing the funds. The draft plan has not been publicly released and there is no deadline in the law limiting the back and forth between San Juan and D.C.

As soon as the plan is approved, Hacienda will begin disbursements with a $400 million cash advance authorized by the Financial Oversight and Management Board. The secretary of Hacienda, Francisco Parés Alicea, estimates that people that have filed tax returns in 2018 and 2019 will start to automatically receive their benefits as early as the end of April.

For those who don’t file tax returns in Puerto Rico, Hacienda will enable a new electronic tool for applications through its SURI system, emulating the U.S. model. It’s worth noting this has caused confusion for residents in Puerto Rico that have accessed the federal counterpart under the impression both systems interface with each other. In a press release, Hacienda warned individuals to refrain from using the federal website and cautioned against seeking duplicate benefits.

More information:

3) Funding for the Paycheck Protection Program is depleted

Funding has run out for the Payroll Protection Program, which is intended to provide low-cost loans to small businesses. The loans can be converted to a grant if businesses meet certain requirements, such as maintaining its payroll. Both Republicans and Democrats want to allocate additional funding but disagree about the details. The Republicans want to appropriate an additional $250 billion for the program and to address other pressing needs in a different bill. Democrats for their part have no quarrel with the additional funding, but would like a specific funding stream set aside for minority-owned businesses, in addition to including additional funds for hospitals, state and local governments, and increased benefits under SNAP. As of the close of this edition, representatives of both parties were negotiating with the Secretary of the Treasury, but apparently were still holding fast to their positions.

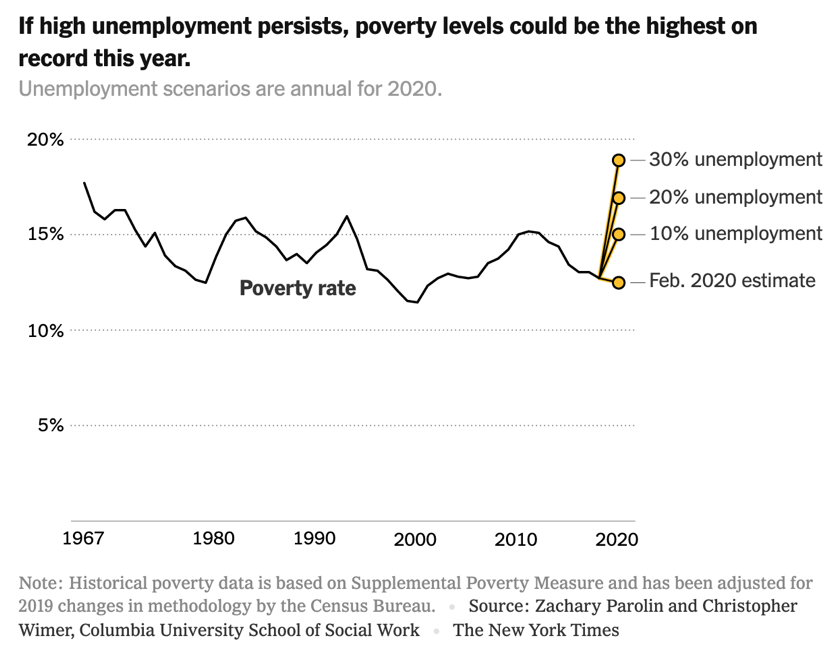

4) Poverty in the United States could reach highest level in 50 years

Researchers from the Center on Poverty and Social Policy at Columbia University have published a Policy Brief setting forth their forecast of poverty rates under different economic scenarios that may develop in the near future. Among their key findings, the authors highlight the following:

- “If unemployment rates rise to 30 percent, we project that the annual poverty rate in the United States will increase from 12.4 percent to 18.9 percent, the highest recorded poverty rate since at least 1967.

- Even if employment rates recover after the summer, we project that the annual poverty rate will reach levels comparable to the Great Recession.

- We project that pre-tax/transfer poverty rates will reach a record high if the annual unemployment rate surpasses 10 percent.

- Working-age adults and children will face particularly large increases in poverty.

- Absent a quick recovery in employment rates, substantial income transfers are likely needed to prevent a record-high poverty rate in the United States.”

These findings underscore the need for large social safety net spending for the duration of the pandemic and perhaps for quite some time thereafter. As our friend Robert Greenstein, president of the Center on Budget and Policy Priorities, said to the New York Times “the Cares Act would lower poverty in the short run, but the Columbia model pointed to the long-term peril if the crisis endured. ‘We need to make sure the key provisions don’t expire as long as unemployment stays elevated’.”

5) Trump administration issues voluntary guidelines for reopening

Even as the U.S. registered the highest number of deaths in a single day due the SARS-CoV-2 virus, President Trump unveiled a new set of voluntary guidelines to help states lift social distancing restrictions and shelter-in-place orders. The guidelines set forth a three-stage process for lifting restrictions, predicated on states first satisfying certain “gating criteria”, related to symptoms, cases, and hospitals. According to the summary obtained by CNN, these criteria are:

- Symptoms: Downward trajectory of influenza-like illnesses (ILI) reported within a 14-day period AND downward trajectory of covid-like syndromic cases reported within a 14-day period;

- Cases: Downward trajectory of documented cases within a 14-day period OR downward trajectory of positive tests as a percent of total tests within a 14-day period (flat or increasing volume of tests); and

- Hospitals: Treat all patients without crisis care AND robust testing program in place for at-risk healthcare workers, including emerging antibody testing.

States also should meet certain core preparedness requirements regarding (1) testing and contact tracing; (2) hospital capacity; and (3) have in place plans to protect certain critical workers and personnel. The guidelines also include recommendations for individuals and employers to follow as the social distancing restrictions are phased out over time. It is not clear what will happen with states or territories that do not satisfy the guidelines but decide to lift restrictions in any event. It is also not clear how binding these recommendations are on businesses and enterprises, especially if some choose to disregard them.

Quote of the Day

“That best portion of a good man’s life,

His little, nameless, unremembered, acts

Of kindness and of love.”—William Wordsworth

Note from the editor

In the end, it will be up to governors and local officials to decide when and how to start lifting social distancing restrictions. The federal guidelines are “not mandatory”, so it is not clear what will happen to states that choose to disregard them, while others choose to comply with them. This could lead to rolling waves of viral outbreaks across the fifty states for the foreseeable future. In addition, this is a nightmare scenario for businesses with operations in multiple states, some of which may follow the federal guidelines, others that may follow their own guidelines, and still others that follow no guidelines.

States will also need a lot more detail, especially regarding the “core preparedness” requirements and how to comply with them. Furthermore, will there be federal assistance for states that want to comply with the guidelines but do not have the financial or public health resources to implement them? Will employers that fail to provide adequate protection for their employees be subject to administrative and/or civil liability? In sum, the guidelines almost raise as many questions as they answer. One thing is clear though. Puerto Rico is not even remotely ready to reopen right now. Not even under the watered-down Trump guidelines.

Weekend Reading Recommendations

Here are some reading recommendations from the CNE team:

- Plague time: Simon Schama on what history tells us – Financial Times

- Grieving with Brahms – The New Yorker

- André Aciman: Who Will We Be This Time Next Year? – LitHub

- Lesson From Singapore: Why We May Need to Think Bigger – New York Times

- By invitation: Mark Carney on how the economy must yield to human values – The Economist

- Can History’s Biggest Stimulus Stave Off a Coronavirus Depression? – Foreign Affairs

- Radical Wordsworth: The Poet Who Changed the World — mind over mountains – Financial Times

- We Need an Atlantic Charter for the Post-coronavirus Era – The Atlantic

This is the end of today’s briefing.

Stay safe and well informed!