Published on May 6, 2020 / Leer en español

Five things you should know today

1) Could the pandemic permanently decrease potential GDP?

One way to measure the impact of a demand shock is by calculating what economists call the output gap. In general terms, the output gap measures the difference between actual output (GDP) and the potential output (potential GDP) that could be produced had whatever demand shock that affected the economy not occurred. As usual, there is no general agreement among economists about using this indicator: those who lean left like it because it can be used to justify additional government spending to prop up demand; while those who lean right don’t like it because they prefer other mechanisms (austerity and unemployment) to adjust for shocks.

A recent article in the Financial Times (FT) raises the interesting question of whether the lockdowns and social restrictions imposed in response to the pandemic could lower potential output permanently. The argument is that if countries go through cycles of lockdowns, gradual re-openings, and additional rounds of restrictions in response to sporadic COVID-19 outbreaks, then their capacity to produce goods and services could be heavily impacted—permanently lowering potential GDP. According to the FT, “If demand for the spare capacity sitting on the sidelines never comes back, which it may never do (especially when it comes to airline and leisure assets), those assets will have to be written down. That equates to a huge economic opportunity loss.”

Some may argue that losses in one sector (for example travel) could be made up by higher demand in other sectors (for example at-home delivery services). That is possible in theory, but in practical terms it will take time for the economy to adjust and even that adjustment may not be enough to make up for all the lost potential output. Something to think about as policymakers ponder the road ahead for the Puerto Rican economy.

2) Goodbye to the blue skies?

The travel, leisure, and entertainment sector has been one of the hardest hit by the current economic crisis. Demand for travel specifically declined rapidly as the SARS-CoV-2 virus spread around the world. Suddenly all non-essential travel seems like a risk to life and limb. And it is likely to stay that way for a while. Some industry analysts believe it could take up to five years for air travel to recover “taking into account that the airline industry took three years to recover post-9/11, and two years to return to pre-2008 revenues after the recession.”

In general, people are reconsidering the necessity of air travel now that Zoom has allowed white-collar professionals to keep working perfectly well from home without setting a foot in a germ-infested airport. As for tourism, some destinations may become popular again but it is also unlikely that demand will return to pre-COVID-19 days, as ticket prices increase, flight availability decreases, and fear of crowded places permanently affects our behavior.

Of course, people will keep traveling for life events such as weddings, commencement ceremonies, funerals, etc. But according to Vox, “it’s not an overstatement to say things will look very different for years to come — virtual meeting technology is already making corporations question the need for business travel; borders are being more starkly defined; retirees looking forward to traveling the world will likely tread more cautiously; and even young, intrepid backpackers raring to set out as soon as possible might keep hitting walls in the form of travel restrictions until vaccines are widely available.”

3) Unraveling the mysteries of COVID-19

Most of us consider COVID-19 to be a respiratory disease. However, every day doctors in the frontlines report that COVID-19 can affect other organs and systems as well. As reported recently in The New Yorker, COVID-19 “can push kidneys into failure, send the body’s immune system into catastrophic overdrive, and cause blood clots that impede circulation to the lungs, heart, or brain. It’s a disease of remarkable complexity, which even the most experienced doctors are struggling to understand.”

This is no common cold, no seasonal flu. Physicians who have attended dozens of COVID-19 patients sound like doctors who work in intensive care units, who “tend to talk not about symptoms or diseases—chest pain, diabetes—but about organ systems, which can malfunction and interact in complex ways.”

The hard truth is that doctors don’t have a clear idea of the clinical progression of the disease. For all our technology and trillions of dollars spent on healthcare, right now “we are back in the seventeenth century, the age of ground-zero empiricism, and observing as if our lives depended on it. One patient at a time, we have to work our way into the present.”

Until then, physicians should be keenly aware of how little they know about this disease when treating patients, and policymakers should be extremely cautious when making what in the end are life-and-death decisions.

4) Do not underestimate the lethality of COVID-19

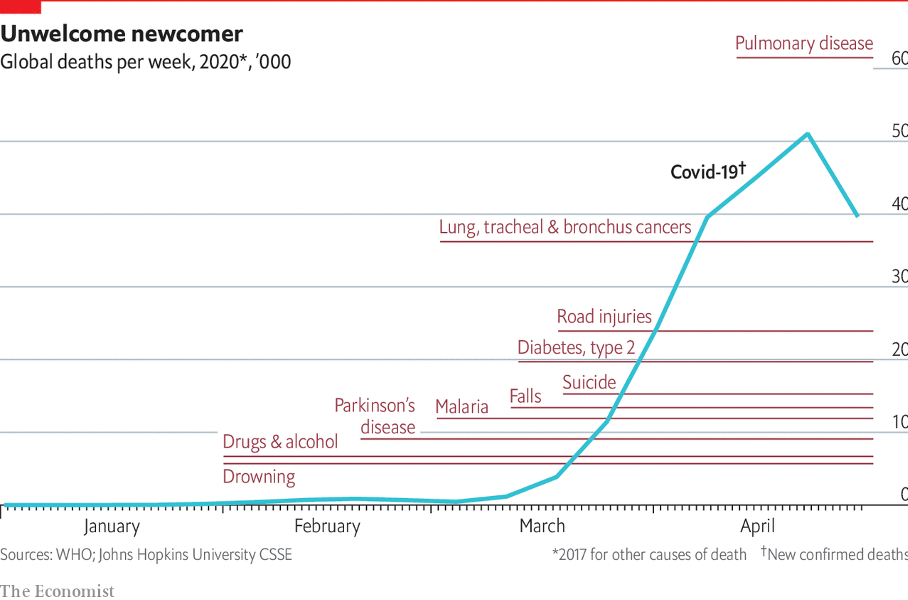

A recent analysis published by The Economist shows that COVID-19 has become one of the leading causes of death around the globe in just four months. As shown in the chart below, “even if it were to end tomorrow, COVID-19 would still be among the leading causes of death in 2020 so far. At more than 235,000 lives lost according to official records, the disease currently ranks above breast cancer, malaria and Parkinson’s disease.” And this is in all probability an underestimate, as many people may have died undiagnosed or outside a hospital.

The good news is that the weekly death toll appears to be declining, at least in the developed countries. But many people are already worried about the impact of the disease as it spreads across the Global South during the next few months.

5) Congressional Budget Office issues update to its economic forecast

The Congressional Budget Office (CBO) issued its projections of output, employment, and interest rates and preliminary estimates of federal deficits for 2020 and 2021. According to the CBO, “in the second quarter of 2020, the economy will experience a sharp contraction, and CBO’s current economic projections include the following:

- Inflation-adjusted gross domestic product (real GDP) is expected to decline by about 12 percent during the second quarter, equivalent to a decline at an annual rate of 40 percent for that quarter.

- The unemployment rate is expected to average close to 14 percent during the second quarter.

- Interest rates on 3-month Treasury bills and 10-year Treasury notes are expected to average 0.1 percent and 0.6 percent, respectively, during that quarter.

For fiscal year 2020, the CBO’s early look at the fiscal outlook shows the following:

- The federal budget deficit is projected to be $3.7 trillion.

- Federal debt held by the public is projected to be 101 percent of GDP by the end of the fiscal year.”

This forecast should not be surprising, given the economic impact of the shelter-in-place restrictions imposed across the nation. What is interesting is that the CBO “projections also include the possibility of a reemergence of the pandemic. To account for that possibility, social distancing is projected to continue, although to a lesser degree, through the first half of next year. In particular, the degree of social distancing is projected to diminish by roughly 75 percent, on average, during the second half of this year relative to the degree in the second quarter and then to further diminish in the first half of next year.”

Quote of the Day

“If we want things to stay as they are, things will have to change.”

—Giuseppe di Lampedusa

Note from the editor

How do you assess and manage risks when you have “no idea about what could happen” as the CEO of Royal Dutch Shell recently put it? Or when “no amount of information about the past can accurately guide us in our deliberations on the future” as Simon Wolfson, chief executive of Next, a UK retailer, stated a few days ago. This is no idle academic musing. Corporate executives, elected government officials, bureaucrats, intelligence analysts, military leaders, NGO chiefs, all need at some point to make risk assessments, develop potential scenarios, and plan accordingly. Remember, the objective of these exercises is not to predict the future, but to identify and prepare for outcomes that seem reasonably plausible.

The difference this time is that we are not dealing with “spreadsheet-based threats”. The first question right now for many risk managers is “Is it safe?”, a question many of them have not confronted before. That one is followed by “Can we survive?” as a business, industrial sector, etc. Beyond these difficult existential short-term issues, however, lie other complex questions that are almost impossible to answer right now: Will the borders open up as they used to be? Will companies shift their supply chains? Will people get on airplanes again, or go shopping as they used to?

Perhaps the difference in these pandemic times, is that risk managers have to incorporate “each individual’s personal sense of threat” into their assessments: “Does it make sense to leave the house? Go to the park? Report to the office for work?” And that, it turns out, is a lot more difficult than, say, preparing scenarios about the price of oil or the rise and fall of the price of gold.

This is the end of today’s briefing.

Stay safe and well informed!