Published on May 14, 2020 / Leer en español

Five things you should know today

1) Puerto Rico in the HEROES Act

Analysis by Rosanna Torres, Director of CNE’s office in Washington, D.C.

Ever since the CARES bill was signed into law, work on a second large stimulus package got underway to further offset the economic impact of the COVID-19 pandemic. Speaker Pelosi recently unveiled a $3 trillion package that serves as the Democratic marker for negotiations with Republicans. According to House Majority Leader Steny Hoyer, the House expects to vote on the bill as early as Friday. Meanwhile, Senate Majority Leader Mitch McConnell is not expected to move his caucus priorities until next month.

As drafted, the House bill includes a substantial amount of aid for Puerto Rico. Below are some of the relevant policies for the island:

- EITC expansion – Puerto Rico does not participate in the federal earned income tax credit (EITC) program. In lieu of that important policy tool, in 2018, Puerto Rico enacted its own tax credit locally. On its own, the Puerto Rico EITC is small relative to what similar working-poor households receive in jurisdictions that are eligible for the federal EITC. The HEROES Act includes a provision that amplifies the Puerto Rico tax credit, at a three to one ratio, by providing an estimated additional $612 million annually, subject to adjustment for cost of living increases. This funding expansion follows CNE’s proposal for strengthening Puerto Rico’s EITC program.

- Coronavirus State Fiscal Relief Fund – Of the $540 billion allocated for fiscal relief, $20 billion is set aside for Puerto Rico and the other U.S. territories. Of that amount, $10 billion will be divided equally among the five territories and the other $10 billion will be allocated in proportion to the size of the territories’ population.

- Homeowner Assistance Fund – The homeowner assistance fund includes $75 billion to provide direct assistance for housing-related costs. Puerto Rico is considered a state, whereas the other four territories have a set-aside of $200 million. The amount allocated for each “small” state will not be less than $250 million.

We will keep reading and analyzing the 1,800-page bill and will provide additional updates in the future.

2) Incomplete rent payments increase by 93% during the pandemic

With large portions of the economy shut down and millions of workers either on furlough or unemployed, the total number of incomplete rent payments increased 93% between March and May, according to Housing Wire, a specialized publication. The nationwide trend is that “about 22% of landlords said they did not receive rent in full in March, while 33% did not receive rent in full in April and 42% did not receive rent in full in May.”

This trend highlights the need for a federal government program to assist low-and-middle-income renters, who so far have not received any assistance, despite being one of the groups most affected by the pandemic. A recently unveiled bill by the House Democrats would provide $100 billion in assistance for low-income renters, but the approval of that bill is by no means secure and, in any event, would probably not occur until mid-June.

3) Brookings report finds that increased unemployment insurance covers about half of lost wages in April

In late March, Congress made several changes to the Unemployment Insurance (UI) program:

- it expanded eligibility to workers who were not previously covered (Pandemic Unemployment Assistance or PUA);

- increased UI benefits by $600 per week (Pandemic Unemployment Compensation or PUC); and

- extended the maximum duration of benefits by 13 weeks.

Three scholars affiliated with the Brookings Institution, Ryan Nunn, Jana Parsons, and Jay Shambaugh, have published an analysis of the effectiveness of these changes so far.

They find that for the month of March, the increase in UI payments offset less than 15 percent of the drop in wage and salary personal income over the same period. While for the month of April, UI benefits offset roughly half of lost wages and salaries. So the program, while beneficial, still falls short in significant ways. In addition, many states have not been able to process the upsurge in applications, leaving many unemployed people and families without access to key benefits.

Nunn, Parsons, and Shambaugh find that “for workers, families, and the economy as a whole, unemployment insurance has been a critical component of the economic policy response to the crisis. However, the UI system has been able to do this in large part because of legislated expansions that are all set to expire over the next few months.” Therefore, they recommend the program’s deadlines be adjusted so the benefit increases end when the economy recovers instead of according to some arbitrary date set by Congress.

4) Senate Republicans start working on their own wish list

Senate Republicans are quietly working on their own package of policy proposals for a new coronavirus relief bill. According to The Hill, the Senate Republican proposal will likely include liability protection for employers from employee lawsuits related to COVID-19 infections in the workplace; a revision of the newly increased unemployment insurance benefits, which they claim provide a disincentive for workers to return to their jobs; and perhaps some assistance for states facing fiscal difficulties but with strings attached. Apparently, the White House proposal to reduce payroll taxes has not been well-received in the Senate.

In the end, this is a tactical move by the Senate Majority in response to the $3 trillion bill unveiled by House Democrats on Tuesday. We remind our readers that it’s highly unlikely either piece of legislation will be approved, but the Republican text, when it is released, will highlight the tradeoffs they are willing to make with the Democrats. We will keep you informed as negotiations progress in Washington, D.C.

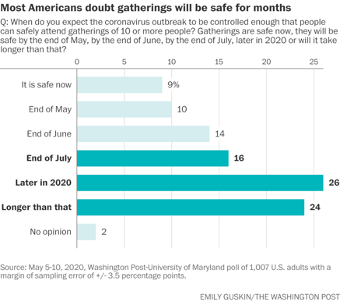

5) Washington Post poll: 50% of Americans believe it will not be safe to attend large gatherings until late 2020 or 2021

A new Washington Post\University of Maryland poll found that half of Americans “think it will not be safe for gatherings of 10 or more until midsummer, including nearly one-quarter who say it will not be safe until 2021 or later”. While “just about 1 in 5 say they believe such gatherings are safe now or will be by the end of this month.”

Furthermore, “despite the visibility of angry protests over coronavirus closures, most Americans remain cautious about reopening their state economy. A 58 percent majority say current restrictions on restaurants, stores, and other businesses in their state are appropriate, with 20 percent saying they are not restrictive enough and 21 percent saying they are too restrictive.”

These results are consistent with other polls made by other institutions, all of which found clear majorities in support of social distancing, wearing protective masks, avoiding large crowds, and slowly lifting restrictions on bars, restaurants, and other businesses. These polls show that people are aware and understand the risks. No matter what states may legislate, people just will not go to bars, barbershops, or baseball games if they don’t feel safe.

Quote of the Day

“To doubt everything or to believe everything are two equally convenient solutions: both dispense with the necessity of reflection.”

—Henri Poincaré

Note from the editor

It has become common these days to hear stories about how ostensibly difficult it is to encourage workers to return to their old jobs given the recent temporary increase in Unemployment Insurance (UI) benefits. Those stories sound plausible, perhaps even convincing. The only problem is they happen to be false.

A recent paper published by Annelies Goger, Tracy Haddon Loh, and Nicole Bateman, affiliated with the Brookings Institution, puts to rest several myths regarding what they call “unemployment insurance on steroids”. First, workers cannot just quit their jobs and claim UI, they have to be involuntarily unemployed. Second, workers who continue to collect UI benefits after their employer has asked them to return to work can be prosecuted for fraud. Third, workers usually lose their healthcare insurance coverage when they are unemployed, a definite disincentive to “willingly” stay unemployed during a pandemic. Finally, the increase in benefits is temporary—the additional money is scheduled to run out in June.

In addition, as the authors point out, full wage replacement, or something close to it, is a valid policy goal in a pandemic, when the primary goal is to save lives by imposing shelter-in-place restrictions and lockdowns. From a macroeconomic perspective, we should remember that UI beneficiaries use that extra money to purchase groceries and food, make rent and mortgage payments, acquire consumer goods and make health care payments, among other purchases of goods and services. This spending partially offsets the negative economic impact of the lockdown and decreases the need for even more government spending in the short-term. Therefore, those who oppose increased UI payments are being penny wise and pound foolish.

As the economy reopens, most workers will return to their old jobs, if they still exist. The real problem, though, will be (1) protecting those workers who cannot return to a safe workplace and (2) creating new jobs for those workers whose employers went out of business permanently. That’s where we should be focusing our attention, not on anecdotal tales of unemployed workers living on Champagne wages.

This is the end of today’s briefing.

Stay safe and well informed!