Back in February of this year, the Financial Oversight and Management Board for Puerto Rico (“FOMB”) reached an agreement with holders of $10.6 billion of Puerto Rico’s General Obligation Bonds (“GOs”) and filed a proposed Plan of Adjustment (“POA”) with the Title III court. That initial proposal sought to adjust approximately $35 billion in creditor claims against the government of Puerto Rico and included not just the GOs, but also bonds issued by the Public Building Authority (“PBA”), the Employees Retirement System (“ERS”), certain bonds payable from tax streams that were subject to the “clawback” provisions of the Puerto Rico Constitution, and other claims made by unsecured creditors.

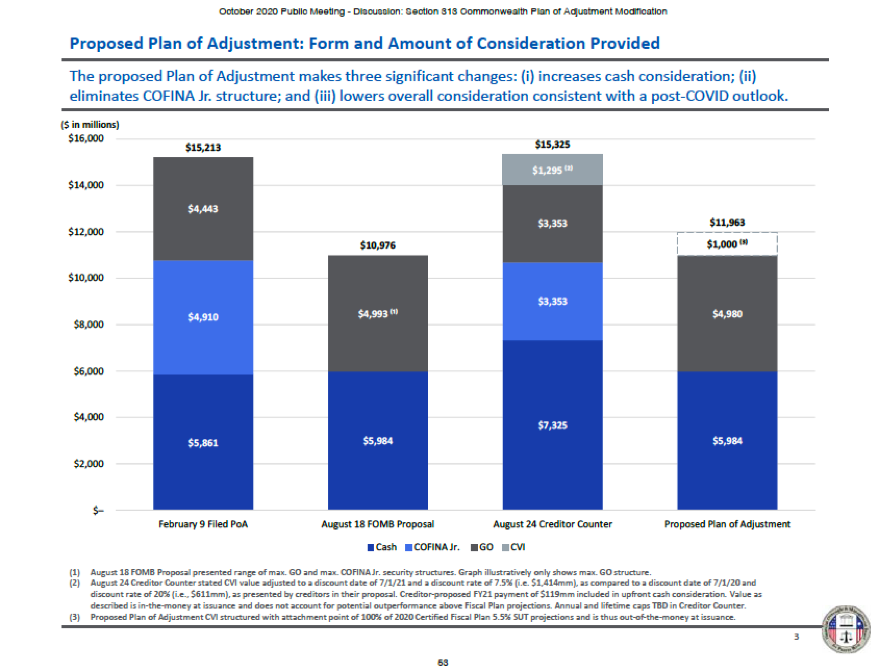

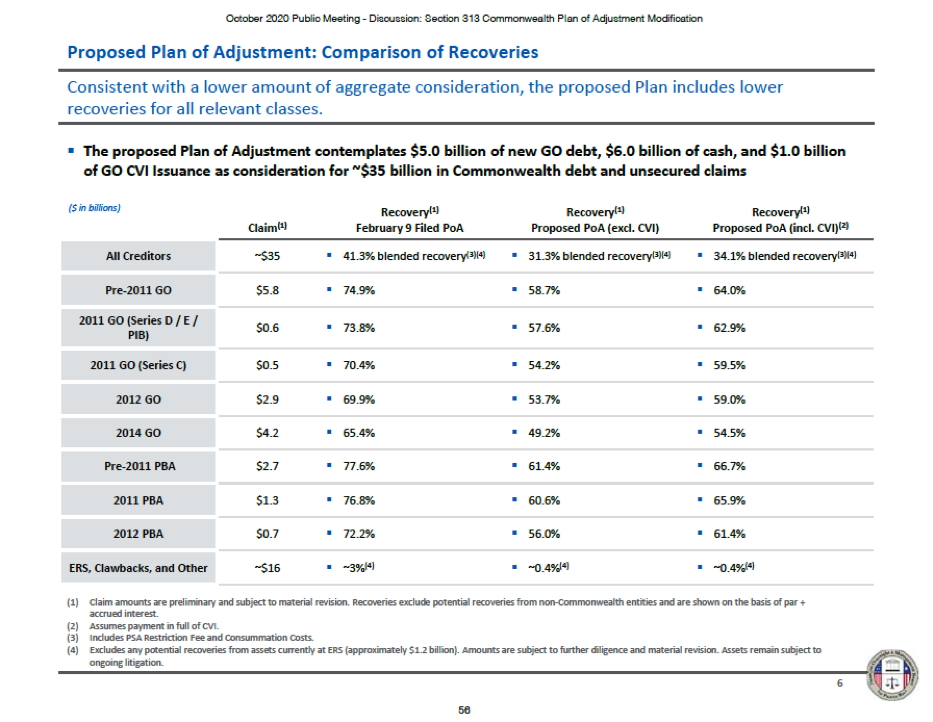

The initial plan implied a 41.3% blended recovery for creditors, reducing outstanding liabilities from $35 billion to about $15 billion. Total consideration offered consisted of three elements (1) approximately $6 billion in cash; (2) almost $5 billion in new COFINA Jr. bonds; and (3) $4 billion of new GOs. Note, however, that recovery by creditor class varied significantly, from close to 78% for some holders of PBA bonds to 3% for unsecured creditors.

The economic impact of the COVID-19 pandemic forced the FOMB to revise its proposal on August 18. As shown in the chart below, the August FOMB proposal reduced total creditor recovery from $15.2 billion to about $10.9 billion. This new offer consisted of (1) approximately $6 billion in cash; and (2) $4.9 billion in new GO bonds. The COFINA Jr. element was eliminated.

The creditors countered with a proposal to recover $15.3 billion, but changed the composition of the consideration they were willing to receive. Its counteroffer consisted of (1) $7 billion in cash; (2) $3.3 billion of COFINA Jr. bonds; (3) $3.3 billion of new GO bonds; and (4) approximately $1.3 billion in the form of a contingent value instrument (“CVI”), payable only if Puerto Rico SUT revenues outperformed its annual target set forth in the Fiscal Plan.

Source: FOMB, Public Meeting Presentation, October 30, 2020

Finally, last month the FOMB revised its offer to about $11.9 billion, consisting of (1) $6 billion in cash; (2) $4.9 billion in new GO bonds; and (3) $1 billion in the form of a CVI. The contingent instrument consists of an additional $1 billion in GOs bonds payable solely from any excess revenues (“outperformance”) generated by the 5.5% SUT relative to the May 2020 Fiscal Plan baseline. According to the plan, the outperformance amount is split 60% for the Commonwealth/40% for creditors and is subject to an annual cap of $50 million. Unused amounts do not carry forward and the face value of the CVI amortizes by $50 million per year, regardless of whether an actual cash payment is made. The term of the CVI is 20 years. Under the revised plan the blended recovery rate for all creditors fluctuates between 31.3% (excluding the CVI payments) and 34.1% (including all CVI payments). See the chart below for a breakdown by creditor class.

Source: FOMB, Public Meeting Presentation, October 30, 2020

The introduction of a CVI is a novel and welcome development as it provides an alternative to mitigate the high level of uncertainty. It is very difficult to make reliable medium and long-term economic and financial projections in the best of times. However, the current Covid-19 pandemic; the amount of economic “scarring” (in the words of the International Monetary Fund) that may persist after the pandemic is under control; the ambiguity surrounding the disbursement of federal disaster relief funds; and the potential inability of the government of Puerto Rico to perform much-needed governance reforms, makes it close to impossible. There are too many moving pieces and the level of uncertainty is unprecedented.

In the absence of reliable economic and financial projections, it is unfeasible for Puerto Rico to submit in good faith a Plan of Adjustment that will be binding on the island’s government for thirty years. Yet, it is required under PROMESA for Puerto Rico to submit a viable Plan of Adjustment in order to successfully exit the Title III process and Judge Taylor Swain has given the parties until February 10, 2021 to agree to the basic terms of a POA. The CVI helps the parties to get around this conundrum and mitigate some of the uncertainty surrounding the Fiscal Plan, by providing investors with an equity-like exposure to Puerto Rico, should its economy overperform, while protecting the government and residents of Puerto Rico in the event government revenues come in below expectations.

Our main quibble with the proposed POA is that according to the FOMB’s own analysis the Commonwealth’s cash balance as of June 30, 2021, after payment of the POA obligations, is estimated to be slightly below the required minimum working capital level of $2.5 billion (which includes Commonwealth working capital needs, FEMA advances, and initial liquidity of the PREPA T&D project). Indeed, under the current proposal, liquidity tightens significantly by 2026 and by 2030 the initial cash balance is negative at the beginning of that fiscal year.

Perhaps one way to address this issue would be to increase the CVI component, while reducing the consideration paid in the form of new GO bonds. The precise amount would be subject to negotiation, of course, but the idea is to allow the Commonwealth to submit a viable POA; successfully exit the Title III proceedings, and reduce the probability of a liquidity crunch by the end of the decade. In the end, it is a win/win proposition, as investors partake of any potential economic upside scenario; Puerto Rico is left with a sustainable debt burden, and; both parties mitigate the risk of a new default in the short-term.