Published on March 23, 2020 / Leer en español

Flying Blind

1) We need to run more tests – now

The government of Puerto Rico announced that it will begin to run more tests to detect COVID-19 infections. This is necessary, as mentioned in a recent column, to run epidemiological models that should be guiding decision making. But, as this COVID Act Now model demonstrates, we may already be too late. If there are still people who think we are exaggerating, please read this ProPublica article (h/t: Deepak Lamba Nieves) that clearly explains that we are dealing with a virus that spreads and affects humans in ways we do not fully understand. And without tests, we are flying blind.

2) The economic impact could be catastrophic

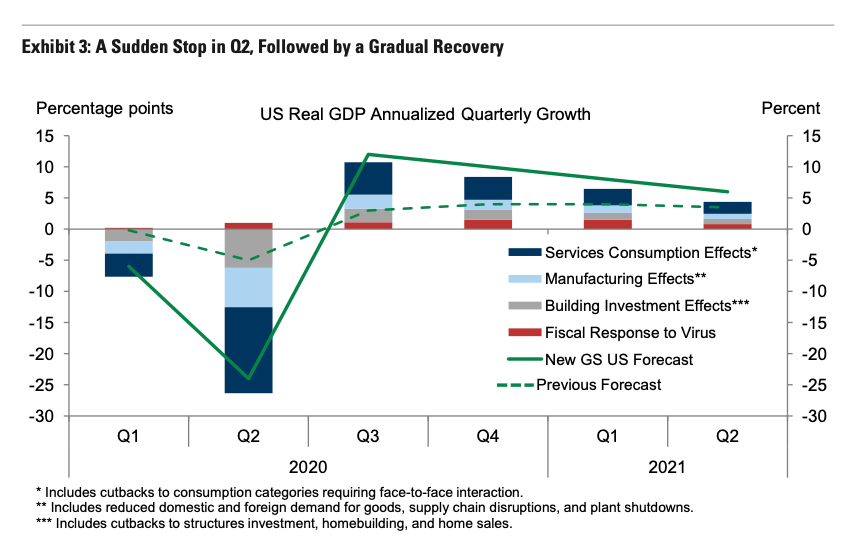

The Goldman Sachs (GS) economic research team updated its projections for the United States on March 20. As can be seen in the graph below, GS estimates that the economic contraction during the first quarter of this year will be 6% (annualized rate), increasing to 24% during the second quarter. Goldman’s economists then project positive growth of 12% and 10% for the third and fourth quarters, respectively.

This type of contraction, if it were to become a reality, has not been seen in the United States economy since before World War II. However, it is important to note that this projection was made at a time of great uncertainty about (1) the duration of the pandemic; (2) its severity; and (3) the total magnitude of the fiscal and monetary stimulus that the federal government will implement.

3) United States Senate: The debate over the economic stimulus package continues

At the close of this edition, Democrats and Republicans in the United States Senate had not yet reached an agreement on the third fiscal stimulus package. According to various press reports, the total amount of the package could reach $2 trillion, equivalent to 10% of the United States GDP—an enormous amount of money. One of the main points of contention, The Hill reports, is a proposal to lend up to $500 billion to different companies, such as airlines, that are facing liquidity problems. On the other hand, the federal government may be making direct payments to families and individuals to help them with their financial obligations and spending up to $100 billion on protective equipment for healthcare providers. All this spending is necessary for a simple reason, as Neil Irwin of the New York Times reminds us, “One person’s expense is another person’s income. That simple sentence explains how the $87 trillion global economy works.” However, we must not forget the distributional impact of all this spending. Politicians have to decide how to split the fiscal stimulus between helping people and rescuing companies. It would be good to review the lessons learned from past recessions (h/t: Raúl Santiago Bartolomei).

4) Government of Puerto Rico works on a local stimulus package

The government of Puerto Rico is also designing an economic stimulus plan for the island. It’s a good first step, based on what has been reported so far, but the plan needs additional fine-tuning. Some proposals, like eliminating the inventory tax, make a lot of sense. Others can be improved. For example, increasing the amount of funds dedicated to marketing the island as a tourist destination does not seem like a good investment at this time. Many people just don’t want to travel, period. Furthermore, this measure presents ethical problems that apparently have not been analyzed. Do we really want to spend money to encourage people to board a plane and travel to Puerto Rico when many countries are demanding that their citizens not leave their homes? What are the public health consequences of such a message? In our opinion, it would be more effective to distribute that money as cash grants to hotels and restaurants so that they do not have to lay off employees.

Read more: Four Theories for Why People Are Still Out Partying – The Atlantic

5) The price of oil and the Puerto Rico Electric Power Authority

According to data from the Financial Times the price of a barrel of West Texas Intermediate crude oil has dropped more than 60% in the last twelve months.

That is the reference market for Puerto Rico and serves as a proxy (although imperfect) for the cost of electricity on the island. Based on this trend, we should be seeing a substantial reduction, in excess of 40%, on our electricity bill. We will be paying attention.

Quote of the Day

“In times of destruction, I create. For every act of fear and darkness, I create with a deeper level of intention to match it.”

–Maya Angelou

From the editor’s desk

There are two things that have caught my attention in the past few days. First, the number of people who have expressed surprise at the “dark side of globalization,” as if this were a recent phenomenon. However, as Fintan O’Toole reminds us in The Irish Times (h/t: Mike Soto Class), our ancestors knew very well that “colonizers, armies, and merchants” have been the three great spreaders of pestilence throughout history, for millennia. And second, the ease with which many people assume that we will soon return to “normal.” Do we really think it will be that easy? Furthermore, is it desirable to return to that so-called normality? (h/t: Raúl Santiago Bartolomei).

This is the end of today’s briefing.

Stay safe and well informed!