Published on February 18, 2021 / Leer en español

Dear Readers:

For decades now, residents of Puerto Rico have been excluded from the federal earned income tax credit (“EITC”) program, notwithstanding its proven efficacy in increasing participation in the formal economy and reducing poverty. That is why since 2003 we have collaborated with entities such as the Center on Budget and Policy Priorities (“CBPP”), the Urban Institute, and Espacios Abiertos to advocate for both extending the application of the federal EITC to Puerto Rico and developing a local EITC program, similar to the one already in effect in twenty-nine states.

As many of us who toil in the often harsh terrain of the social policy vineyard know, it takes a long time for a policy initiative to mature from an idea, to a proposal, to technical legislative language and, finally, to its implementation. Last week, years of hard advocacy work by CNE paid off when the Ways and Means Committee of the U.S. House of Representatives included language in a bill to match Puerto Rico’s spending on an EITC on a 3 to 1 basis, a formula developed jointly by CNE and CBPP. Given that the annual cost of Puerto Rico’s EITC is approximately $200 million, the federal matching funds would make available an additional $600 million to fund the credit in the island.

This is great news for Puerto Rico. The EITC, by providing a significant wage supplement to low-income workers, promotes labor force participation, reduces systemic poverty, and decreases reliance on social welfare programs. The consensus among social scientists is that it is the most effective anti-poverty program currently in the effect in the U.S. If enacted and implemented as currently designed, the federal funding match will significantly complement and enhance the local EITC program, benefit thousands of low-income workers in the island, and hopefully jumpstart a deep structural change of Puerto Rico’s labor market.

The EITC, though, is not a magical solution to all our socioeconomic problems. Some people, for instance, may not be able to work, due to family obligations or physical or mental disabilities, and other programs are required to address their needs. Also, the EITC is complicated and can be difficult to administer, so Hacienda should start preparing a plan for its implementation as soon as possible. Finally, the EITC must be supplemented with other policies that increase labor demand for it to be optimally effective.

Nonetheless, and regardless of its complexity and cost, the effectiveness of the EITC has been consistently confirmed by numerous studies over the last 40 years. In end, the EITC is a prime example of how sophisticated social science research and analysis can be applied to develop evidence-based public policies, which end up having positive and significant effects on the life of hundreds of thousands of people. That is why we dedicate this entire Special Edition of the Weekly Review to the EITC.

—Sergio M. Marxuach, Editor-in-Chief

Insights + Analysis from CNE

By Sergio M. Marxuach, Policy Director, and Rosanna Torres, Director – Washington, D.C. Office

The Earned Income Tax Credit (“EITC”), enacted by Congress in 1975, is a tax credit available to working families in the United States whose incomes range from well below the federal poverty threshold to roughly double the poverty line.

The federal EITC helps low-income working families in two ways. First, since it is a credit, it reduces the federal tax liability of the taxpayer on a dollar for dollar basis. That is, each dollar of EITC reduces the taxpayer’s tax burden by a dollar. Second, unlike most federal tax credits, the taxpayer can claim as a refund any amount left over once its tax liability has been reduced to zero, a feature known as the “refundable” portion of the credit. This refundable portion of the EITC effectively works as a wage subsidy or supplement for low-income working families, which encourages participation in the formal workforce and reduces poverty.

Extending the Federal EITC to Puerto Rico

The most recent $1.9 trillion COVID-19-related stimulus plan proposed by the Biden-Harris Administration includes meaningful tax credits for Puerto Rico, including a federal supplement to expand Puerto Rico’s local EITC for fiscal years 2021-2025 – a proposal developed jointly by CNE and CBPP. Click the button below to learn more about the potential impact of this supplement for the residents of Puerto Rico.

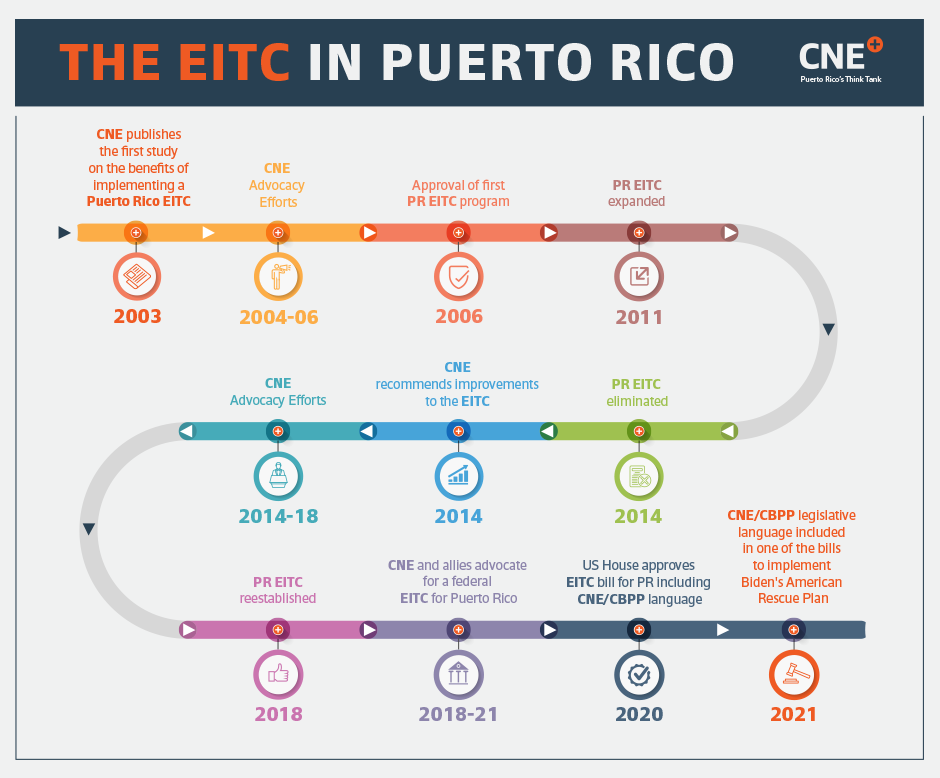

Brief History of the EITC in Puerto Rico

Click the image above to read more about the EITC’s history in Puerto Rico and CNE’s advocacy efforts since 2003.

Basic Economic Theory

The EITC is tied to income earned from work, therefore, if properly designed, it should encourage people to increase the amount of hours worked and reduce the amount of hours dedicated to leisure. Economists call this the “substitution effect”. Click the button below to learn more about this intuitive theoretical outcome and the challenge that its counterpart, the “income effect”, presents.

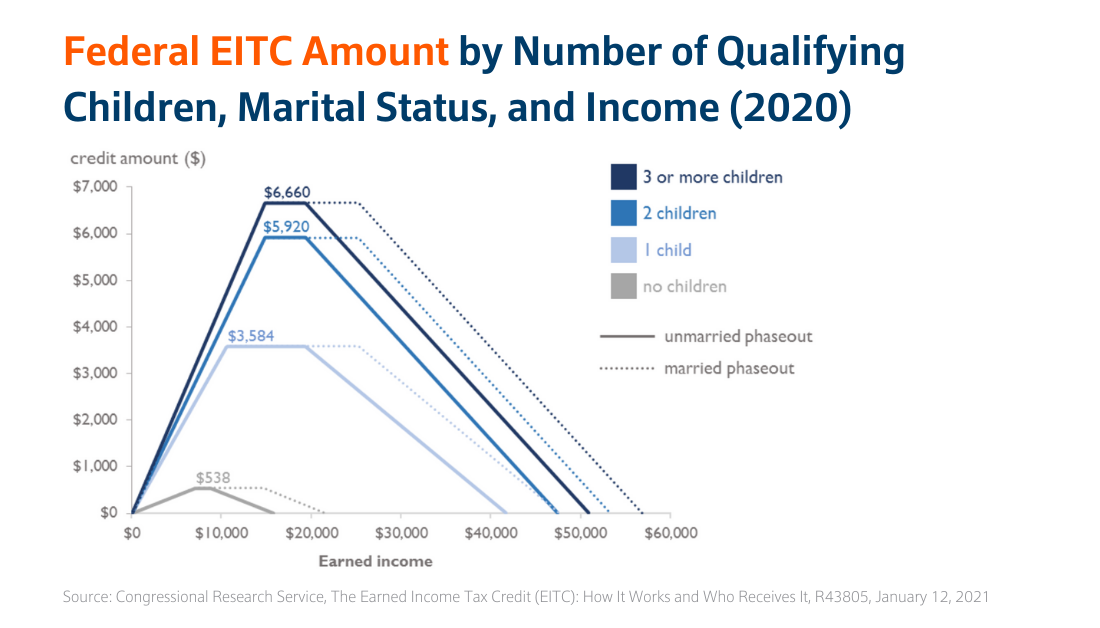

Policy Design

The challenge from a tax policy perspective is to design a program that will strengthen the substitution effect and weaken or overcome the income effect. The federal EITC has been designed with precisely these objectives in mind. As earned income increases, taxpayers qualify for an increasing EITC (known as the credit’s “phase-in” range) up to a maximum dollar amount. The maximum credit amount is available over a range of income (known as the “plateau” or “flat” range), after which the credit gradually phases down to zero (known as the credit’s “phase-out” range).

The figure above presents the phase-in, plateau, and phase-out ranges of the federal EITC for tax year 2020. Click the button below to learn why the EITC’s policy design is so effective.

CNExplains

Watch the video below for a brief overview of the EITC program (video in Spanish).