In his recently signed American Rescue Plan Act of 2021, President Biden included a proposal – designed by policy experts at the Center for a New Economy and the Center on Budget and Policy Priorities – to match Puerto Rico’s EITC spending on a 3 to 1 basis; a significant victory for Puerto Rico’s low- to moderate-income workers. But, what exactly is the EITC? How does it help families in overcoming poverty and how does it promote labor force participation? Keep reading to find out.

The Earned Income Tax Credit (EITC) is a refundable tax credit that promotes work. It does so by reducing the amount owed in taxes for low- to moderate-income individuals based on annual earnings. If the credit available to a tax filer turns out to be higher than the tax amount owed, individuals may be eligible to receive a one-time cash refund during the tax filing season. The credit was first established at the federal level in the 1970s with the goal of offsetting payroll taxes.

For the taxable year 2019, Puerto Rico enacted a local EITC that mirrors the program design of the federal EITC. The EITC structure is akin to a trapezoid, in that the credit rises as earned income increases up to an established ceiling amount (phase-in), it plateaus, and then steadily decreases as earned income continues to rise (phase-out).

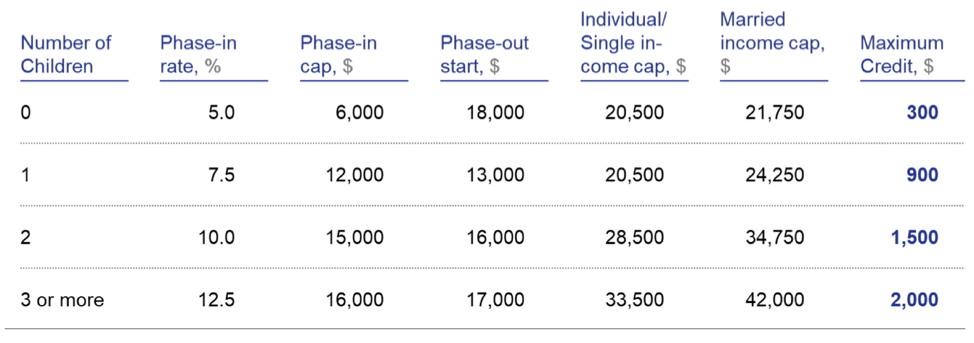

The approved Fiscal Plan for 2020 had established minimum credits at $300 and maximum credits at $2,000, all dependent on marital status and number of children. Given the federal incentive for the government of Puerto Rico to increase the size of the program, these figures will likely be revised. The credit amounts, income levels, family size, and composition for the expanded EITC will be determined in the near future by Hacienda (Puerto Rico’s Treasury Department) and must be approved by the local legislature.

Source: 2020 Certified Fiscal Plan for Puerto Rico, May 27, 2020, https://www.aafaf.pr.gov/wp-content/uploads/Fiscal-Plan-for-Commonwealth-of-Puerto-Rico_Certified-as-of-May-27-2020.pdf

Employers can really think of it quite simply: the EITC has the potential to boost the incomes of its employees without them having to spend a dime. The EITC, particularly the refundable aspect of it, effectively works as a wage subsidy for low- and moderate-income working families, thus attracting individuals into the formal workforce.

You are correct to remember this is not the first time Puerto Rico provides a work credit. Puerto Rico first enacted its own EITC in 2006 and expanded it in 2010. The take-up rate for the credit suggested the program could have a positive effect on millions of Puerto Rican families. In Fiscal Year 2013, for example, a little over half a million taxpayers, or 48 percent of all people who filed a tax return, claimed approximately $152 million in work credits. Unfortunately, the Puerto Rico EITC was eliminated due to the island’s deepening fiscal crisis. Years later, as part of Puerto Rico’s Tax Reform in 2018, Puerto Rico’s government reinstated the local credit, adjusting its design to account for marital status and the number of dependent children. Despite its redesign, Puerto Rico’s local EITC is still too modest to reap all the intended benefits. The new federal legislation will provide a federal reimbursement to Puerto Rico to serve as an incentive for the island to expand its local EITC.

First, it is important to clarify that the Federal EITC is NOT being extended to Puerto Rico. Instead, Puerto Rico is getting federal funding to expand its local EITC, which is estimated to cost about $200 million. The federal funding is being provided in a ratio of 3 to 1. If, for example, the local EITC has a cost of $800 million, the federal supplement would then provide a $600 million reimbursement to the local government.

To put $600 million in Puerto Rico’s EITC is still far less than it would cost the U.S. government if Puerto Rico were to receive the federal EITC. As a point of comparison, in 2017, low-wage workers in Mississippi (with similar population size as Puerto Rico) claimed $1.1 billion in federal EITC dollars.

Finally, a large share of individuals and families that would gain the most from the EITC in Puerto Rico wouldn’t pay federal income taxes anyway (just like in the U.S.) because their annual earnings are too low.

Before the Federal Treasury provides the additional funds, Puerto Rico’s legislative assembly must amend Section 1052.01 of Law No. 257-2018 to expand the local EITC. Following its enactment, Puerto Rico will provide the U.S. Treasury an estimated cost of its expanded EITC. The U.S. Treasury would then advance up to a maximum annual of $600 million to Puerto Rico. Therefore, if the Commonwealth expects the cost to its EITC to be $800 million, the federal government would provide a supplement of $600 million, and the Commonwealth would cover the other $200 million.

The government of Puerto Rico will soon be providing additional details on the changes to the program. Hacienda will design the expanded size and configuration of the EITC, and work along with the local legislature to amend the local tax law. After the policy is adequately determined and implemented into law, the Family Socio-Economic Development Administration (ADSEF), will disseminate information to tax filers.