Published on June 30, 2021 / Leer en español

In This Issue

Today marks the 5th anniversary of the enactment of PROMESA. CNE has published a policy brief that takes a look at how PROMESA has evolved, what has been overlooked, its costs to Puerto Rico, and its consequences.

The unavoidable conclusion is that the territorial bankruptcy regime set up by law has failed to achieve most of the goals set forth by its authors. Five years in, only 1/3 of the bonded debt has been restructured; no critical projects for economic development have been approved; audited financial statements are three years behind; the shift to budgeting on a modified accrual accounting basis is a work in progress; and the government’s budget is still not balanced.

Thus, as CNE stated in 2016, the economic, political, and social costs associated with the colonial PROMESA experiment have been extremely high and explicit, while any benefits Puerto Rico may have derived have been small and most remain quite uncertain and contingent.

Keep reading for a summary of our policy brief. Click here to access the full text.

Insights + Analysis from CNE

PROMESA: A Failed Colonial Experiment?

By Deepak Lamba-Nieves, Ph.D., Sergio M. Marxuach & Rosanna Torres

Image: REUTERS/Carlos Barria

The Enactment of PROMESA

On June 30, 2016, President Obama signed into law the Puerto Rico Oversight and Management Economic Stability Act (“PROMESA”). At that time, the Puerto Rican economy had stopped growing for approximately a decade; the central government had incurred in chronic budget deficits for years; the island’s total bonded debt of $72 billion exceeded its gross national product; the government’s pension system was insolvent, adding an extra $55 billion in unfunded liabilities to Puerto Rico’s long-term obligations; and the governor declared the island’s debt to be “unpayable” in 2015.

The U.S. Federal Bankruptcy Code preempted Puerto Rico to file for bankruptcy, as an amendment to the U.S. Bankruptcy Code in 1984 excluded the island from such recourse (click here to learn more). After fruitless attempts to allow Puerto Rico to file for bankruptcy under Chapter 9 of the U.S. Bankruptcy Code, Congress created a territorial bankruptcy regime that consists, broadly speaking, of two elements: (1) the establishment of an oversight board with ample powers to impose fiscal discipline on the territory, in this case, Puerto Rico, and (2) a court-supervised process for the orderly adjustment of the territory’s debts and obligations. This two-pronged approach to territorial bankruptcy is what the late Judge Torruella called the “PROMESA experiment”. A legal experiment inflicted on Puerto Rico that was only possible because of its colonial status.

Under PROMESA, the island’s fiscal policy would be exercised by an undemocratic, unelected Financial Oversight and Management Board (“FOMB”) appointed by the president of the United States from a list of candidates submitted by Congressional leadership. That was the deal offered by Congress to its colonial subjects: debt restructuring in exchange for the loss of political control over government spending, taxation, and indebtedness.

Five Years Later

After five years of PROMESA and the FOMB, time has proven, unfortunately, that our initial assessment was essentially correct. While a lot has happened since 2016, and though the FOMB may reasonably argue that some of the events that have transpired since June 2016 were beyond their control, their actions to date reinforce the argument made by CNE back then, that PROMESA would not provide the platform to achieve political, economic and social stability.

If PROMESA was drafted, as some government officials stated back in 2016, to chart a sustainable path forward, then the bottom line is that the current track is far from sustainable. Worse yet, a whole host of proposals made by the financial body in its most recent Fiscal Plan suggests that FOMB members themselves don’t quite understand how their widespread cuts across the government will continue to hinder any chances of success for the island.

To be fair, Puerto Rico has had a respite from bondholder claims and has been able to spend money that otherwise would have gone to debt service. However, the stay on litigation did not apply to other legal (nonpayment) claims while the debt restructuring process, although orderly, has been extremely slow and expensive. With respect to the longer-term goals of PROMESA, we are still a long way from regaining access to the capital markets and balancing our budgets. All the while an unelected “dictatorship for democracy” keeps making decisions crucial to Puerto Rico’s future.

The Troika Precedent

Multiple countries and jurisdictions have faced similar situations to Puerto Rico. In that context, the experience of Greece offers us an analytical scaffolding to evaluate PROMESA and the work of the FOMB.

What Has PROMESA Delivered? – A Tropical Troika

Operating under the presumption that an independent body would make the “hard” decisions necessary to put the “fiscal house in order”, the FOMB has essentially followed the Troika formula in a colonial context, pushing for big budget cuts, relatively small tax increases, “structural reforms” in key areas such as energy, education, and labor laws, while agreeing to debt restructuring transactions that many analysts consider to be unsustainable.

Since its inception, the Board has pursued an austerity agenda in Puerto Rico to no avail and has consistently ignored warning signs that its austerity-based measures are failing to deliver.

On the other hand, the FOMB has projected expenses for legal and financial advisor fees between fiscal years 2018-2026 to exceed $1.5 billion, well in excess of the Congressional Budget Office cost estimate of $370 million between fiscal years 2017-2026. As such, Puerto Rico is poised to become one of the most expensive municipal bankruptcies ever.

In addition, because a lot of the gaps left by cuts to government personnel are filled by outside consultants, what we have now is essentially a parallel government with a whole new set of wasteful expenses. Instead of employing local, in-house personnel as a way to build long-lasting technical expertise in Puerto Rico and nurture local talent, the FOMB has opted to spend on outside consultants, lobbyists and advisors, further eroding Puerto Rico’s ability to ever get rid of the financial control body and successfully implement a long-term recovery program.

Finally, the Title V process of identifying and implementing high-value “critical projects” appears to have been discarded by the FOMB.

Click here to read more on why the colonial context is important and what PROMESA has delivered.

The Long and Winding Road to Goodbye

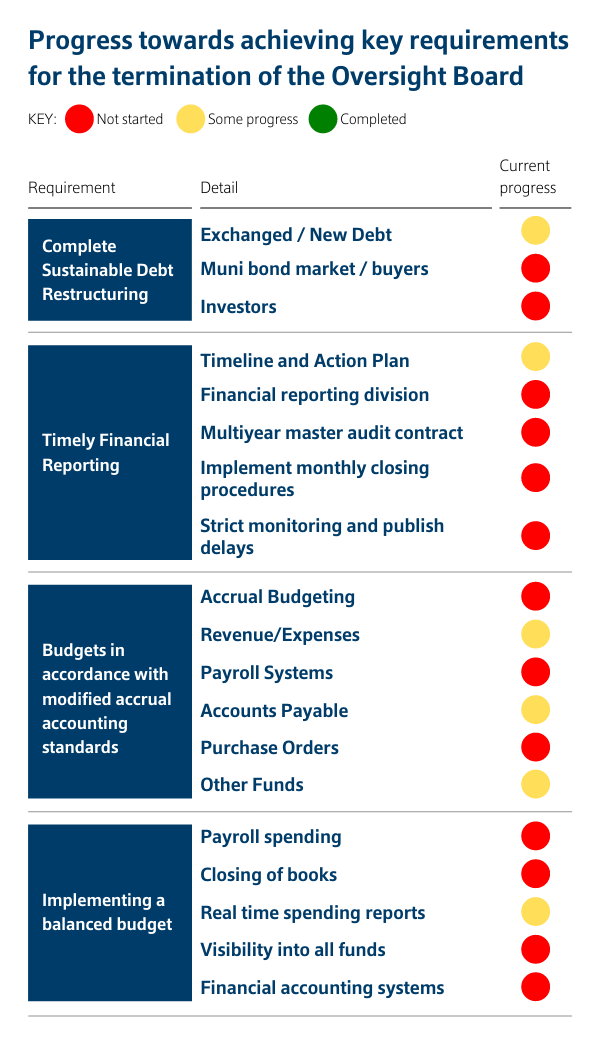

For the termination of the oversight board, PROMESA requires:

- adequate access to short-term & long-term credit markets at reasonable interest rates, and

- 4 consecutive fiscal years of balanced budgets following modified accrual accounting standards.

The FOMB has broken down these statutory requirements into several operational steps. None of these objectives have been achieved. See chart below:

Source: FOMB, Certified Fiscal Plan for the Commonwealth of Puerto Rico, April 23, 2021

According to the FOMB, “the Government has unfortunately not yet demonstrated meaningful progress in many of the key requirements for the termination of the Oversight Board.” We believe it is disingenuous, though, for the FOMB to blame the government of Puerto Rico for its lack of progress on this issue, when, at the same time, it is implementing policies that limit the same government’s capacity to satisfy this requirement.

Click here to read more on the progress made towards each requirement.

In Sum…

PROMESA has been, in the words of Judge Torruella, “Congress’s fourth try at cutting through the Puerto Rican Gordian knot in its interminable attempt to colonially rule Puerto Rico and its people” and, in our opinion, it has failed. Perhaps it is time for the United States “to accept that its relationship with its citizens who reside in Puerto Rico is an egregious violation of their civil rights. The democratic deficits inherent in this relationship cast doubt on its legitimacy, and require that it be frontally attacked and corrected ‘with all deliberate speed’”.

For its part, Puerto Rico needs to step forward and embark on overdue reforms to restore its credibility, improve its governance, effectively implement enhanced accountability and transparency measures, and promote increased civic engagement.

#WaybackWednesday

CNE Proposes Fiscal Rules as An Alternative to the FOMB

In February 2016, to improve Puerto Rico’s fiscal position and address credibility concerns, CNE proposed a fiscal rule for Puerto Rico as a sensible alternative to a control board. A robust and well-designed fiscal rule would establish a clear way to verify numerical objectives for public spending, considering the cyclical nature of government revenues, and provide for the long-term sustainability of the public debt. This alternative is critically needed, now more than ever. It is only by implementing sustainable and credible local structural reforms that Puerto Rico will have a chance of charting a prosperous path forward.

Play the video above to watch the forum “Is a Federal Fiscal Control Board the Only Option for Puerto Rico?” hosted by CNE in Washington D.C. on March 2, 2016. Click here for the event’s full proceedings.

On Our Radar...

![]() China – Intelligence analysts and scholars of international relations dedicate a significant amount of their time to determining the intentions of other countries and their capabilities to act on those intentions. Oftentimes, though, assessing the intentions of foreign actors is a lot more difficult than assessing their capabilities. A good assessment of a foreign government’s intentions requires a thorough knowledge of its history, politics, economics, social structure, and culture. This analysis is particularly complex in the case of China, a rising power with a long history, complicated politics, and a turbocharged economy. But what is China? As Professor Odd Arne Westad reminds us in this essay for Foreign Affairs “the answer is less obvious than it seems. Is the vast territory primarily a country, a civilization, or a political construct? Is it an empire or a nation-state? Is it a region with different languages and cultures or a (mostly) homogeneous people in which the great majority are closely connected by common traditions and ancestors?”

China – Intelligence analysts and scholars of international relations dedicate a significant amount of their time to determining the intentions of other countries and their capabilities to act on those intentions. Oftentimes, though, assessing the intentions of foreign actors is a lot more difficult than assessing their capabilities. A good assessment of a foreign government’s intentions requires a thorough knowledge of its history, politics, economics, social structure, and culture. This analysis is particularly complex in the case of China, a rising power with a long history, complicated politics, and a turbocharged economy. But what is China? As Professor Odd Arne Westad reminds us in this essay for Foreign Affairs “the answer is less obvious than it seems. Is the vast territory primarily a country, a civilization, or a political construct? Is it an empire or a nation-state? Is it a region with different languages and cultures or a (mostly) homogeneous people in which the great majority are closely connected by common traditions and ancestors?”

![]() Russia – In contrast with China, Russia is widely viewed as a declining power that refuses to go quietly into the night. But, is that view accurate? This report from Chatham House, The Royal Institute of International Affairs, “deconstructs 16 of the most prevalent myths and misconceptions that shape contemporary Western thinking on Russia. It explains their detrimental impact on the design and execution of policy, and in each case outlines how Western positions need critical re-examination to ensure more rational and effective responses to Russian actions.”

Russia – In contrast with China, Russia is widely viewed as a declining power that refuses to go quietly into the night. But, is that view accurate? This report from Chatham House, The Royal Institute of International Affairs, “deconstructs 16 of the most prevalent myths and misconceptions that shape contemporary Western thinking on Russia. It explains their detrimental impact on the design and execution of policy, and in each case outlines how Western positions need critical re-examination to ensure more rational and effective responses to Russian actions.”

![]() COVID Isn’t Over – Unfortunately, as the Wall Street Journal reports, “more people have died from Covid-19 already this year than in all of 2020, according to official counts, highlighting how the global pandemic is far from over even as vaccines beat back the virus in wealthy nations. It took less than six months for the globe to record more than 1.88 million Covid-19 deaths this year, according to a Wall Street Journal analysis of data collected by Johns Hopkins University. The university’s count for 2021 edged just ahead of the 2020 death toll…”

COVID Isn’t Over – Unfortunately, as the Wall Street Journal reports, “more people have died from Covid-19 already this year than in all of 2020, according to official counts, highlighting how the global pandemic is far from over even as vaccines beat back the virus in wealthy nations. It took less than six months for the globe to record more than 1.88 million Covid-19 deaths this year, according to a Wall Street Journal analysis of data collected by Johns Hopkins University. The university’s count for 2021 edged just ahead of the 2020 death toll…”