Published on September 16, 2021 / Leer en español

In This Issue

In this September issue of the CNE Review we seek to answer the following questions:

- What is the current situation of the economy of Puerto Rico?

- How do the three systemic shocks – the government bankruptcy, the hurricanes, and the pandemic – that have affected the island interact with each other?

- What are some of the main risks to Puerto Rico’s economic growth in the short term?

- What factors can stimulate or depress economic growth?

The agenda for Puerto Rico is full, to say the least. We hope the breakdown and brief analysis we provide in this CNE Review will be helpful to you in making sense of a complicated situation.

Keep reading for a summary of our policy brief. Click here to access the full text.

Insights + Analysis from CNE

The Threefold Challenge to the Puerto Rican Economy

By Sergio M. Marxuach, Policy Director

The Puerto Rican economy is simultaneously recovering from three systemic shocks:

![]() The COVID-19 pandemic, which has adversely affected economic activity since the spring of 2020, is still an ongoing, developing event.

The COVID-19 pandemic, which has adversely affected economic activity since the spring of 2020, is still an ongoing, developing event.

![]() Four years after Hurricanes Irma and Maria, Puerto Rico is still recovering from the considerable damage inflicted by these storms.

Four years after Hurricanes Irma and Maria, Puerto Rico is still recovering from the considerable damage inflicted by these storms.

![]() Finally, the government of Puerto Rico is entering a critical phase of its debt restructuring process as ballots will be sent soon to creditors so they can vote on the Plan of Adjustment (“POA”) negotiated by the Fiscal Oversight and Management Board (“FOMB”). If certified by the court, Puerto Rico’s bankruptcy will be officially over and the POA will govern Puerto Rico’s fiscal policy for the next 25 years.

Finally, the government of Puerto Rico is entering a critical phase of its debt restructuring process as ballots will be sent soon to creditors so they can vote on the Plan of Adjustment (“POA”) negotiated by the Fiscal Oversight and Management Board (“FOMB”). If certified by the court, Puerto Rico’s bankruptcy will be officially over and the POA will govern Puerto Rico’s fiscal policy for the next 25 years.

The COVID-19 Pandemic

In June 2020, the International Monetary Fund (“IMF”) described the COVID-19 pandemic as a “crisis like no other”. A year later, the direst predictions have not been realized, thanks in large part to unprecedented policy support from the public sector. It would be a mistake, though, to assume the crisis is over.

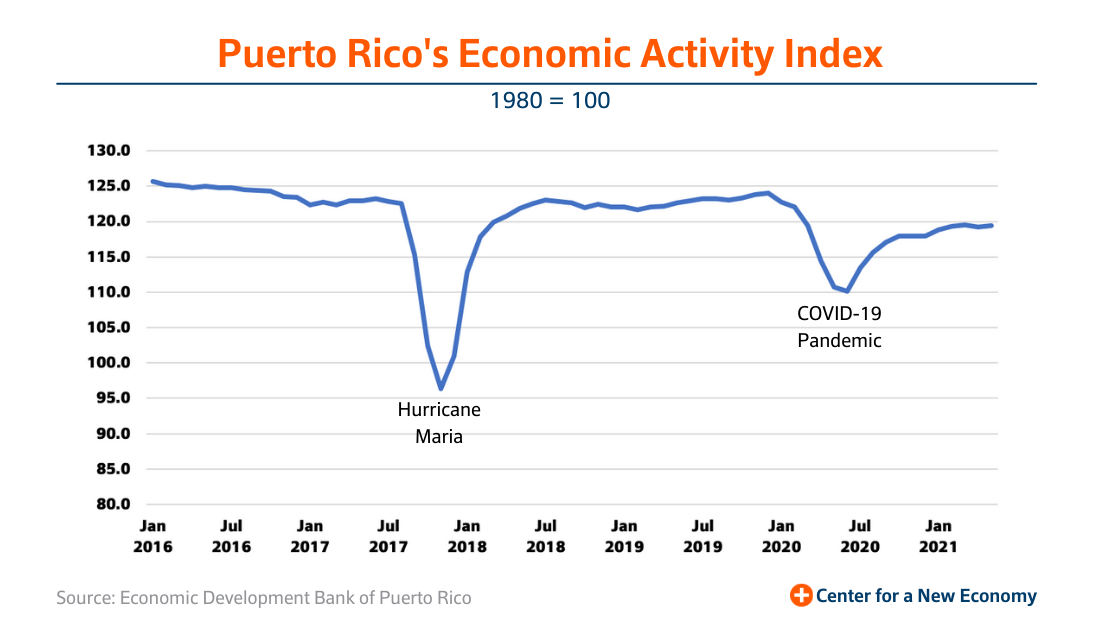

In Puerto Rico, just like in the rest of the world, the impact of the COVID-19 pandemic was swift and severe. According to data from the Puerto Rico Economic Development Bank, the Puerto Rico Economic Activity Index decreased from 122.1 in February of 2020 to 110.1 in June 2020, a decrease of 12 points or approximately 9.8%. As of June 2021, the index had a value of 118.9 points, which means we have made up for about two-thirds of the loss in economic activity. Keep in mind that this relatively rapid recovery is due largely to the positive effect of federal spending related to the COVID-19 pandemic.

Click here to read more about the effects of the pandemic on total employment in Puerto Rico and how federal pandemic funding may further impact recovery.

Hurricane Maria Reconstruction

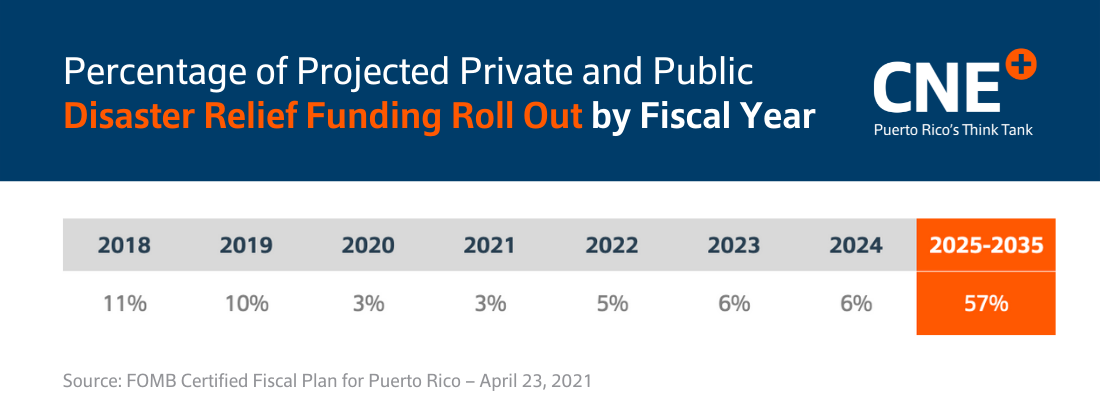

Four years after Hurricane Maria wreaked havoc on the island and generated some $90 billion in damages, the pace of reconstruction remains slow. While Congress has allocated $64 billion for disaster relief and recovery operations in the island, as of June 30, 2021, only $18.6 billion, or approximately 29%, has been spent. Furthermore, some of the most important work, such as refurbishing and modernizing the electric grid, has not yet begun.

According to the FOMB, the pace of federal disbursements, and hopefully the reconstruction work, should pick up during the next couple of years, as shown in the table below. We note, though, that the bulk of recovery funding, some $47.44 billion, or approximately 57% of total funding, is scheduled to be disbursed during the ten-year period between 2025 and 2035.

This delayed disbursement schedule presents several risks for Puerto Rico. However, the main risk could be the creation of a false sense of complacency as the economy begins to grow when the federal money starts to flow.

Click here to learn the two reasons why it would be a mistake to believe that our economic problems will be over once the disbursement of federal reconstruction funding begins in earnest.

The Fiscal Plan and the POA

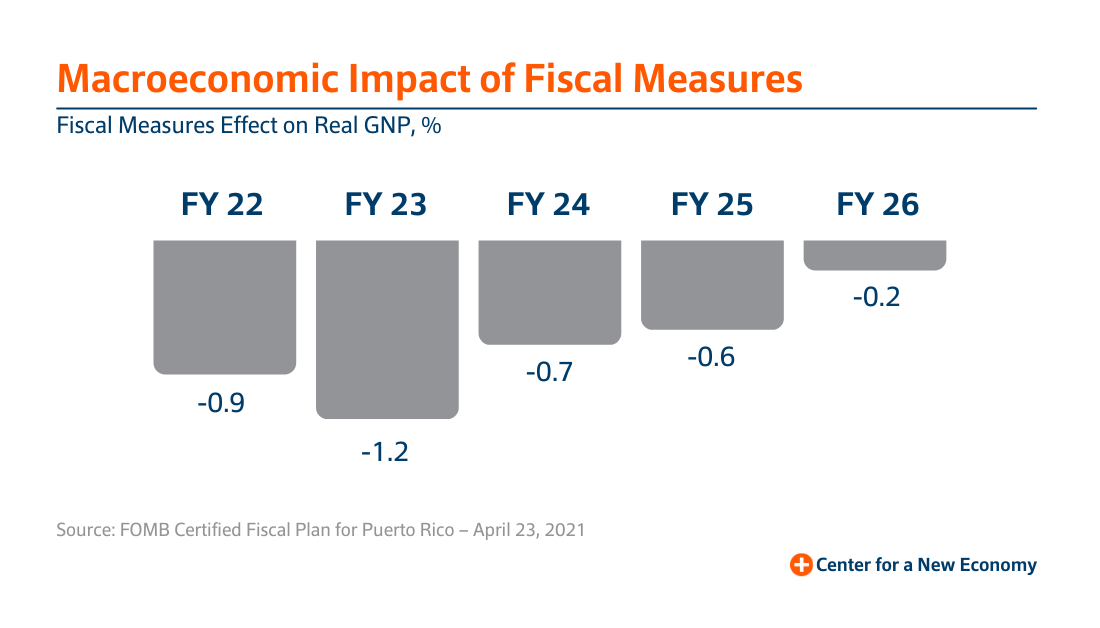

The Fiscal Plan certified by the FOMB for the central government sets in motion policies that have inconsistent effects on the real economy. First, the FOMB continues with the implementation of fiscal austerity measures, which it estimates will reduce GNP by 0.9%, 1.2%, and 0.7% during fiscal years 2022 (ongoing), 2023, and 2024, respectively. In their view, this fiscal consolidation is necessary to balance the budget in the short term. Note that the fiscal consolidation scheduled for FY2023 is particularly deep.

On the other side of the equation, the FOMB is promoting the implementation of “structural reforms” in the areas of social welfare, energy, and ease of doing business, which it estimates will have a cumulative positive impact equal to 0.75% of GNP by fiscal year 2026. Therefore, the net effect of the Fiscal Plan is a net drag on economic activity in the absence of other expansionary policy measures. The FOMB, however, believes that fiscal drag is reduced or eliminated completely when it factors in federal spending related to (1) the COVID-19 pandemic and (2) the reconstruction of the damage caused by Hurricane Maria. That bet, though, is not a sure thing. As we stated above, most of the COVID-19 funds have been spent already and the bulk of the reconstruction money is scheduled to be disbursed after FY 2025.

Because the Fiscal Plan is the master document upon which the long-term Plan of Adjustment is based, it is important to understand how this game of fiscal weights and counterweights plays out. Click here to learn more.

Conclusion

Puerto Rico’s short-term economic performance is overshadowed by a large cloud of uncertainty, as the island’s government concurrently addresses the impacts of three systemic shocks: the COVID-19 pandemic, Hurricane Maria, and the bankruptcy of the central government. Each of these processes generates its own set of risks, which oftentimes could interact among and between them in complex ways.

At a deeper level, however, it is worrisome that economic growth in the short term depends mostly on the receipt of federal transfers that we do not control. We worry that these expenditures will have a temporary positive impact on the economy that may set back efforts to develop a medium/long-term economic strategy or plan for Puerto Rico. Let’s avoid that trap and keep focused on addressing the structural factors that are the root cause of Puerto Rico’s long-term economic stagnation.

Welcome to a Brave New World

The CNE 2021 Growth Policy Summit will be held on December 3, 2021 and will bring together a dynamic mix of thought-leaders, policy-makers, and global innovators not only to spur thoughtful discussion and debate but more importantly, to provoke action and broad engagement.

Save the date, and join us in deciphering how to best leverage Puerto Rico’s resources and transform our economic model.

On Our Radar...

![]() Afghanistan – Twenty years after 9/11 and the beginning of the war in Afghanistan there has been a lot of pontificating about American hubris. But, while that critique may be applicable to the war in Iraq, it is inappropriate in the case of Afghanistan. As historian Robert Kagan reminds us, it was fear, not hubris that led the U.S. into Afghanistan. I know this to be true because I was living and working in Manhattan when the attacks took place. Today, though, “the feelings and perceptions of threat that led them to war in Afghanistan have faded, and all that is left are the consequences of that decision, the costs in lives and money, the inevitably mixed and uncertain results, and the unanswerable question: Was it all worth it?”

Afghanistan – Twenty years after 9/11 and the beginning of the war in Afghanistan there has been a lot of pontificating about American hubris. But, while that critique may be applicable to the war in Iraq, it is inappropriate in the case of Afghanistan. As historian Robert Kagan reminds us, it was fear, not hubris that led the U.S. into Afghanistan. I know this to be true because I was living and working in Manhattan when the attacks took place. Today, though, “the feelings and perceptions of threat that led them to war in Afghanistan have faded, and all that is left are the consequences of that decision, the costs in lives and money, the inevitably mixed and uncertain results, and the unanswerable question: Was it all worth it?”

![]() End of Pandemic Unemployment Benefits – According to a recent analysis by the Wall Street Journal, “states that ended enhanced federal unemployment benefits early have so far seen about the same job growth as states that continued offering the pandemic-related extra aid.” This means the causes holding back workers from jumping into the labor market lie elsewhere.

End of Pandemic Unemployment Benefits – According to a recent analysis by the Wall Street Journal, “states that ended enhanced federal unemployment benefits early have so far seen about the same job growth as states that continued offering the pandemic-related extra aid.” This means the causes holding back workers from jumping into the labor market lie elsewhere.

![]() The End of Reaganomics? – The $3.5 trillion spending package currently under consideration by Congress would be “the most significant expansion of the nation’s safety net since the war on poverty in the 1960s, devising legislation that would touch virtually every American’s life, from conception to aged infirmity”, according to this analysis by the New York Times. If enacted, it would also mark the end of 40 years of Thatcher/Reagan economic policies that led to increasing inequality, stagnating incomes for the middle class, and depleted government resources.

The End of Reaganomics? – The $3.5 trillion spending package currently under consideration by Congress would be “the most significant expansion of the nation’s safety net since the war on poverty in the 1960s, devising legislation that would touch virtually every American’s life, from conception to aged infirmity”, according to this analysis by the New York Times. If enacted, it would also mark the end of 40 years of Thatcher/Reagan economic policies that led to increasing inequality, stagnating incomes for the middle class, and depleted government resources.