Published on March 16, 2023 / Leer en español

SPECIAL EDITION

Puerto Rico’s Energy Transformation

and the Genera Agreement

In this edition of the CNE Review, we take a look at the ongoing transformation of Puerto Rico’s electricity sector. First, we present a summary of the following ongoing processes: the restructuring of PREPA’s debt, the reconstruction of Puerto Rico’s energy system, the transition to a new grid operator, and Project PR100. That update is followed by a policy brief that examines what has come to be known as “the Genera contract” or the Puerto Rico Thermal Generation Facilities Operation and Maintenance Agreement. Our Policy Director analyzed over 600 pages between the contract, Partnership Committee Report, and other complementary documents in detail to highlight the transaction’s most critical aspects for our readers.CNE has consistently delivered the most comprehensive analysis of PREPA’s transformation processes providing non-partisan research, insights, and recommendations to policymakers, media outlets, and the public. This valuable work is only possible thanks to our sponsors. Thank you for supporting our work.

Puerto Rico’s Energy Transformation: Where are we now?

By Sergio M. Marxuach, Policy Director

Access to affordable, clean, and reliable electricity is necessary for the long-term sustainable growth of the Puerto Rican economy. This transformation process began in earnest with the enactment of Act 57 of May 17, 2014, which created the Puerto Rico Energy Commission (now the Puerto Rico Energy Bureau) to regulate the generation, transmission, distribution, and sale of electricity in Puerto Rico. Since then, other laws and regulations have been enacted to establish Puerto Rico’s long-term energy policy; require the unbundling of the vertically integrated operations of the Puerto Rico Electric Power Authority (“PREPA”); and expand the installation of generation capacity using renewable energy sources. In fact, Puerto Rico has committed to meeting its electricity needs with 100% renewable energy by 2050, along with realizing interim goals of 40% by 2025, 60% by 2040, the phaseout of coal-fired generation by 2028, and a 30% improvement in energy efficiency by 2040. In addition to all that legislative and regulatory activity, the following processes are currently ongoing:

![]() Restructuring PREPA’s Debt – After years of mismanagement, PREPA (through the Fiscal Oversight and Management Board, “FOMB”) filed a petition to restructure its financial obligations through the bankruptcy-like procedure provided by Title III of the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”) in July 2017. After six years of tough negotiations, a majority of the creditors have not reached a consensual agreement with the FOMB. On February 9, 2023, the FOMB filed an amended proposed Plan of Adjustment to reduce PREPA’s obligation approximately by 50%. Given the lack of agreement among the parties, it is likely that some of the underlying legal issues will have to be litigated before any proposed plan of adjustment is confirmed by the Court. This litigation process, including any appeals, could take an additional 12 to 18 months.

Restructuring PREPA’s Debt – After years of mismanagement, PREPA (through the Fiscal Oversight and Management Board, “FOMB”) filed a petition to restructure its financial obligations through the bankruptcy-like procedure provided by Title III of the Puerto Rico Oversight, Management, and Economic Stability Act (“PROMESA”) in July 2017. After six years of tough negotiations, a majority of the creditors have not reached a consensual agreement with the FOMB. On February 9, 2023, the FOMB filed an amended proposed Plan of Adjustment to reduce PREPA’s obligation approximately by 50%. Given the lack of agreement among the parties, it is likely that some of the underlying legal issues will have to be litigated before any proposed plan of adjustment is confirmed by the Court. This litigation process, including any appeals, could take an additional 12 to 18 months.

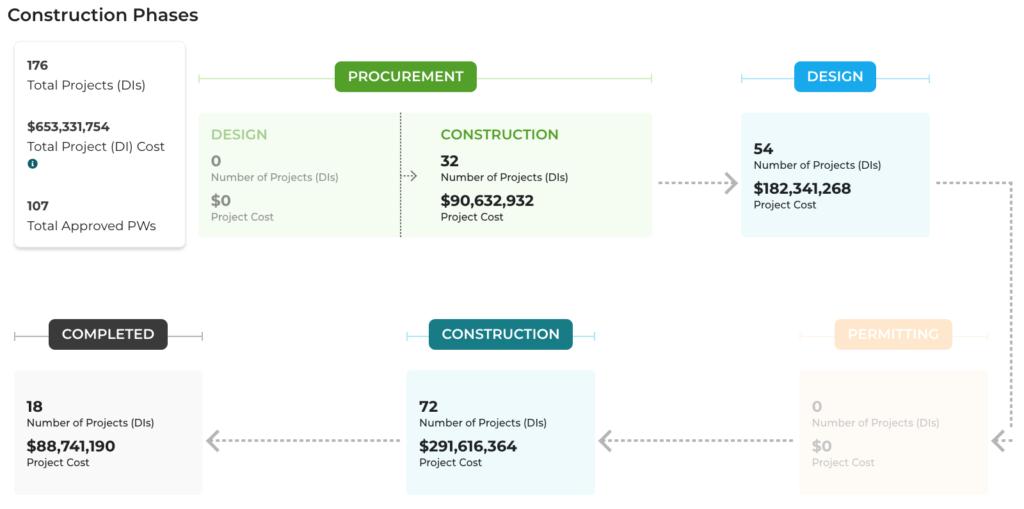

![]() Reconstruction of Puerto Rico’s Energy System – Hurricane Maria devastated Puerto Rico’s electric system in September 2017. The federal government, through FEMA and HUD, has allocated approximately $12 billion, mostly for the reconstruction of the electric grid. However, according to data from the Puerto Rico Central Office for Recovery, Reconstruction, and Resiliency, only 18 permanent work reconstruction projects in the energy sector, totaling $88,741,190, had been completed as of March 6, 2023 (see the chart below for more detail). At this pace, it would take over 100 years to complete the reconstruction of the Puerto Rico electric grid. To be fair, the delay in spending these funds has been partly due to the imposition of burdensome and sometimes unprecedented federal bureaucratic requirements on Puerto Rico. Nonetheless, more than five years after Hurricane Maria the amount of money spent on rebuilding the electric grid remains eye-watering small.

Reconstruction of Puerto Rico’s Energy System – Hurricane Maria devastated Puerto Rico’s electric system in September 2017. The federal government, through FEMA and HUD, has allocated approximately $12 billion, mostly for the reconstruction of the electric grid. However, according to data from the Puerto Rico Central Office for Recovery, Reconstruction, and Resiliency, only 18 permanent work reconstruction projects in the energy sector, totaling $88,741,190, had been completed as of March 6, 2023 (see the chart below for more detail). At this pace, it would take over 100 years to complete the reconstruction of the Puerto Rico electric grid. To be fair, the delay in spending these funds has been partly due to the imposition of burdensome and sometimes unprecedented federal bureaucratic requirements on Puerto Rico. Nonetheless, more than five years after Hurricane Maria the amount of money spent on rebuilding the electric grid remains eye-watering small.

Source: Puerto Rico Central Office for Recovery, Reconstruction and Resiliency![]() Transition to a New Grid Operator – On June 22, 2020, PREPA, the Puerto Rico Public-Private Partnerships Authority (the “P3 Authority”), LUMA Energy LLC, and LUMA Energy ServCo, LLC (“LUMA”), entered into a Transmission and Distribution Operation and Maintenance Agreement (the “T&D O&M Agreement”), pursuant to which LUMA will operate, maintain, and modernize PREPA’s transmission and distribution system, during a period of 15 years. The transition from PREPA to LUMA has been tempestuous, to say least, due partly to the inexperience of the government of Puerto Rico in managing these kinds of agreements and partly to LUMA’s arrogance and its misjudgment of the complexity and the difficulty of the tasks it was agreeing to undertake pursuant to the T&D O&M Agreement. However, the electric grid, which to be fair is in quite a poor condition, appears to have stabilized since the beginning of 2023.

Transition to a New Grid Operator – On June 22, 2020, PREPA, the Puerto Rico Public-Private Partnerships Authority (the “P3 Authority”), LUMA Energy LLC, and LUMA Energy ServCo, LLC (“LUMA”), entered into a Transmission and Distribution Operation and Maintenance Agreement (the “T&D O&M Agreement”), pursuant to which LUMA will operate, maintain, and modernize PREPA’s transmission and distribution system, during a period of 15 years. The transition from PREPA to LUMA has been tempestuous, to say least, due partly to the inexperience of the government of Puerto Rico in managing these kinds of agreements and partly to LUMA’s arrogance and its misjudgment of the complexity and the difficulty of the tasks it was agreeing to undertake pursuant to the T&D O&M Agreement. However, the electric grid, which to be fair is in quite a poor condition, appears to have stabilized since the beginning of 2023.![]() Project PR 100 – On February 2, 2022, the U.S. Department of Energy (“DOE”) launched the Puerto Rico Grid Resilience and Transitions to 100% Renewable Energy Study (“PR100”). This is a “2-year study by DOE’s Grid Deployment Office and six national laboratories to comprehensively analyze stakeholder-driven pathways to Puerto Rico’s clean energy future. PR100 entails five activities, with an emphasis on modeling and analyzing scenarios that meet Puerto Rico’s renewable energy targets and achieve short-term recovery goals and long-term energy resilience.” In January 2023, the DOE presented a one-year progress report. The final report and recommendations are expected to be made public by December 2023 or early 2024.

Project PR 100 – On February 2, 2022, the U.S. Department of Energy (“DOE”) launched the Puerto Rico Grid Resilience and Transitions to 100% Renewable Energy Study (“PR100”). This is a “2-year study by DOE’s Grid Deployment Office and six national laboratories to comprehensively analyze stakeholder-driven pathways to Puerto Rico’s clean energy future. PR100 entails five activities, with an emphasis on modeling and analyzing scenarios that meet Puerto Rico’s renewable energy targets and achieve short-term recovery goals and long-term energy resilience.” In January 2023, the DOE presented a one-year progress report. The final report and recommendations are expected to be made public by December 2023 or early 2024.

Insights + Analysis from CNE

Analysis of PREPA Legacy Assets Public-Private Partnership Agreement

By Sergio M. Marxuach, Policy Director

On January 24, 2023, the Puerto Rico Power Electric Authority (“PREPA” or the “Owner”), the Puerto Rico Public-Private Partnerships Authority (the “P3 Authority” or the “Administrator”), and Genera PR LLC (the “Operator” or “Genera”), executed the Puerto Rico Thermal Generation Facilities Operation and Maintenance Agreement (the “Agreement”) setting forth the terms and conditions pursuant to which the Operator will operate, maintain, and eventually decommission certain Legacy Generation Assets owned by PREPA. The execution of this Agreement is the most recent step in the long-term transformation of the Puerto Rico electricity market. In the Policy Brief, we present an analysis of the principal components of the Agreement, including the basic structure of the transaction; the compensation of the Operator (including any incentives and penalties provided for therein); the estimated savings to be generated as a result of hiring a private operator to operate and maintain the Legacy Generation Assets; the planned decommission of most of the existing facilities that currently use fossil fuels to generate electricity in Puerto Rico; and the resulting structure of Puerto Rico’s electricity market. Keep scrolling for some highlights.

The Structure of the Agreement

Energy costs in Puerto Rico are very high since we depend on old power plants that burn mostly fossil fuels, which represents 70% of operational costs. The Agreement lays out the blueprint for a transition to renewable energy generation (and/or natural gas and hydrogen) which could provide a significant reduction in the cost of energy in the long term, depending on how this difficult and complex process of decommissioning fossil fuel generation while simultaneously deploying large scale renewable generation is implemented. The 300+ page contract lays out the terms and conditions pursuant to which Genera will operate, maintain and eventually decommission certain power plants.Genera was hired to provide, directly or through subcontractors, four types of services: Mobilization Services, Operation and Maintenance Services, Decommissioning Services, and Demobilization Services. In exchange for providing these services, the Operator is entitled to receive certain compensation, subject to any applicable incentive payments or penalties.

The Expected Savings

The government of Puerto Rico has stated that it expects this Agreement to generate significant savings. Yet, in the short term, the savings estimated by Genera will be insufficient to provide any savings to consumers even if PREPA’s debt is cut approximately by 50% to $5 billion and pays 6% interest, which means consumers will need to pay $300 million annually to service the restructured debt. Genera estimates, as set forth in a report by FTI Consulting, that the “combined estimated savings from O&M and fuel range from $100 million to $200 million annually (including fuel conversion savings if approved by PREB).” Under the terms of the Agreement, those “savings would be shared 50%/50% between Genera and the consumers of Puerto Rico. That would result in $50 million to $100 million per year to Puerto Rico electric system customers.” The methodology used by Genera to calculate those expected savings is not provided in the FTI report, so it cannot be properly evaluated. Genera insists on pointing to potential savings to be extracted from the conversion of oil-burning plants to facilities that burn natural gas. Such conversions would generate approximately 50% of total expected savings from the agreement. Given that Genera is a wholly-owned subsidiary of New Fortress Energy, a company that produces and delivers natural gas a clear conflict of interest arises. The Agreement, however, includes a fully-developed policy to address organizational conflicts of interest. It remains to be seen how thoroughly will that policy be enforced and implemented. In addition, the Agreement does not identify who would pay for the capital expenditures necessary for such conversions nor does it explain how expected savings will be affected once the cost of capital is taken into account.

Pros and Cons

Several elements of the new agreement are clearly superior to the LUMA Agreement. Among these we can mention:

- a well-developed system of incentives and penalties to motivate the Operator;

- the inclusion of clear benchmarks to measure Genera’s performance;

- stronger filters to analyze transactions with affiliates and related parties, including a fully fleshed-out policy to address organizational conflicts of interest;

- the requirement to engage in good faith negotiations with current PREPA employees so as to minimize the learning curve of the new operator; and

- setting a cap on the fees that the Operator can earn during the Mobilization Period.

All point to the conclusion that this is an agreement that offers better protections to the people of Puerto Rico from some of the foreseeable risks associated with this transaction. Other aspects of the agreement are not as good. For example:

- most of the services will be provided by subcontractors (wouldn’t it be more efficient just to contract directly with them?);

- the analysis of the expected savings is clearly deficient and we would like to see a more rigorous examination of those professed savings; and

- it is not clear to us that the resultant market structure will lead to lower prices, generate allocative efficiencies, and/or produce significant increases in consumer welfare.

Of Note: Buy Local Provisions

A novel feature of the Agreement is that it requires Genera to use “commercially reasonable” efforts to ensure that local companies, or foreign companies with a significant presence in Puerto Rico, are included in the procurement process for materials and services under the agreement. In addition, it requires Genera to use “commercially reasonable” efforts to select companies established under the Commonwealth of Puerto Rico or companies that have “a significant presence in the Commonwealth of Puerto Rico” as material subcontractors. These provisions, if implemented, have the potential to generate local economic activity and allow local firms and workers to obtain valuable experience working on a complex multi-year project.

So, relative to the status quo, is the post-Genera electricity market in better shape in Puerto Rico?

Probably yes, but that is an awfully low bar. Everybody who has objectively analyzed PREPA’s performance over the last 30 or 40 years has concluded that it is a mess, the financial and operational equivalent of a long-smoldering dumpster fire. By that standard, trying anything new, no matter how outlandish it may seem, would probably constitute progress. However, if we set a higher bar, if we ask whether this transaction will really help Puerto Rico achieve its long-standing goals of generating affordable, cleaner, and reliable electricity, then the answer is not quite as clear, for the good is indeed mingled with the ill. The fact is that there is a lot uncertainty surrounding this transaction and it is hard to avoid the unsettling feeling we are being presented with a fait-accompli on a take it or leave it basis. Maintaining the status quo, though, is not an option. The real question is whether there is a better alternative to a negotiated agreement in this instance. The answer, when taking into account the totality of the circumstances, appears to be no. The available alternatives seem to be (1) worse, for example, resuscitating PREPA; (2) unrealistic, entailing, for instance, the creation of a new Tennessee Valley Authority-like entity to provide electricity in Puerto Rico; or (3) downright utopian, involving extremist schemes reminiscent of Mao’s Great Leap Forward.After assessing the risks and benefits of the Generation O&M Agreement we face a dilemma in the classical sense of making a decision with no good options. But in a situation with no objectively good options, taking a calculated risk may, perhaps, be the best option.

On Our Radar…

![]() Interest Rates – Jay Powell, Chair of the Board of Governors of the Federal Reserve System, recently testified before the Committee on Banking, Housing, and Urban Affairs of the U.S. Senate. In his statement, Mr. Powell reiterated the Federal Reserve’s commitment to keeping inflation at 2% over the long run. However, “with inflation well above our longer-run goal of 2 percent and with the labor market remaining extremely tight, the FOMC has continued to tighten the stance of monetary policy, raising interest rates by 4-1/2 percentage points over the past year. We continue to anticipate that ongoing increases in the target range for the federal funds rate will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” In plain English, this means the Federal Reserve will keep increasing interest rates until inflation decreases to its policy target of 2%. The real question is whether the Fed will be able to accomplish this without triggering a recession. Only time will tell.

Interest Rates – Jay Powell, Chair of the Board of Governors of the Federal Reserve System, recently testified before the Committee on Banking, Housing, and Urban Affairs of the U.S. Senate. In his statement, Mr. Powell reiterated the Federal Reserve’s commitment to keeping inflation at 2% over the long run. However, “with inflation well above our longer-run goal of 2 percent and with the labor market remaining extremely tight, the FOMC has continued to tighten the stance of monetary policy, raising interest rates by 4-1/2 percentage points over the past year. We continue to anticipate that ongoing increases in the target range for the federal funds rate will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” In plain English, this means the Federal Reserve will keep increasing interest rates until inflation decreases to its policy target of 2%. The real question is whether the Fed will be able to accomplish this without triggering a recession. Only time will tell.

![]() The Debt Limit – On January 19, 2023, the United States reached its statutory debt limit of $31.4 trillion “and the Treasury announced a ‘debt issuance suspension period’ during which, under current law, it can take well-established ‘extraordinary measures’ to borrow additional funds without breaching the debt ceiling.” The Congressional Budget Office estimates that “if the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will be exhausted between July and September 2023—that is, in the fourth quarter of the current fiscal year. The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections.” House Republicans have stated they will not vote to increase the debt limit unless the Biden administration agrees to broad-based spending cuts (which may or may not include defense spending depending on who you ask on the Republican side). The White House, for its part, has stated it will not negotiate anything other than a “clean” debt limit bill. That is, a bill increasing the debt limit without any spending cuts attached. So far, both parties are holding fast to their initial positions. A recent report from Moody’s Analytics concludes that the failure to increase or suspend the debt limit would have dire consequences on the U.S. and global economy.

The Debt Limit – On January 19, 2023, the United States reached its statutory debt limit of $31.4 trillion “and the Treasury announced a ‘debt issuance suspension period’ during which, under current law, it can take well-established ‘extraordinary measures’ to borrow additional funds without breaching the debt ceiling.” The Congressional Budget Office estimates that “if the debt limit remains unchanged, the government’s ability to borrow using extraordinary measures will be exhausted between July and September 2023—that is, in the fourth quarter of the current fiscal year. The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections.” House Republicans have stated they will not vote to increase the debt limit unless the Biden administration agrees to broad-based spending cuts (which may or may not include defense spending depending on who you ask on the Republican side). The White House, for its part, has stated it will not negotiate anything other than a “clean” debt limit bill. That is, a bill increasing the debt limit without any spending cuts attached. So far, both parties are holding fast to their initial positions. A recent report from Moody’s Analytics concludes that the failure to increase or suspend the debt limit would have dire consequences on the U.S. and global economy.

![]() Medicare Solvency – The Biden Administration has announced a proposal to extend the solvency of the Medicare program by at least 25 years by (1) increasing the Medicare tax rate on income over $400,000; (2) closing loopholes in existing Medicare taxes; and (3) crediting savings from prescription drug reforms to the Medicare Hospital Insurance Trust Fund. So far, the Republicans in Congress appear to be uninterested in pursuing this path.

Medicare Solvency – The Biden Administration has announced a proposal to extend the solvency of the Medicare program by at least 25 years by (1) increasing the Medicare tax rate on income over $400,000; (2) closing loopholes in existing Medicare taxes; and (3) crediting savings from prescription drug reforms to the Medicare Hospital Insurance Trust Fund. So far, the Republicans in Congress appear to be uninterested in pursuing this path.