Published on September 12, 2023 / Leer en español

In This Issue

Decades of corruption, mismanagement, politically influenced business decisions, and postponing critical maintenance and required capital expenditures resulted in the bankruptcy of the Puerto Rico Electric Power Authority (“PREPA”) in the summer of 2017. The hurricanes of September 2017 and the earthquakes of 2020 further weakened PREPA’s already fragile infrastructure.

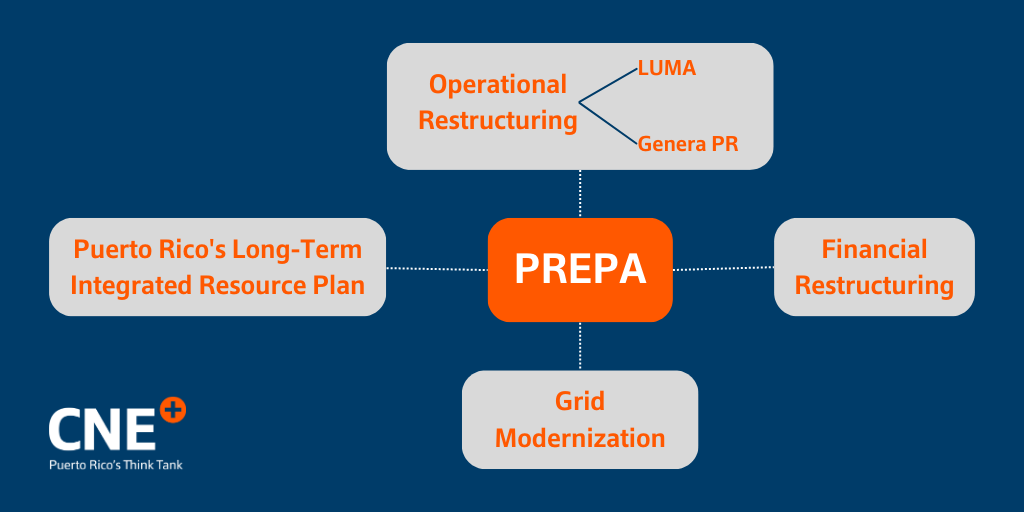

Now in 2023, the reconstruction and transformation of Puerto Rico’s electric power system is entering a critical stage, as several important processes—PREPA’s operational and financial restructuring; the commencement of large-scale projects to rebuild the grid; and the elaboration of a new Integrated Resource Plan—converge at a key point in time.

However, existing policy disagreements regarding the extent of the use of natural gas during the transition to 100% renewable generation and the ongoing debate about the advantages and limitations of installing distributed generation capacity (mostly rooftop solar systems with batteries) instead of utility-scale projects have generated delays in the rollout of new renewable generation capacity and pose a serious risk to Puerto Rico’s ability to meet its renewable energy objectives.

–Sergio M. Marxuach, Editor-in-Chief

Insights + Analysis from CNE

Puerto Rico Electric Power Authority Update

By Sergio M. Marxuach, Policy Director

Privatization: Operational Restructuring

The restructuring of PREPA’s operations is at a fairly advanced stage after the execution of two agreements to outsource the operation and management of PREPA’s (1) transmission and distribution (“T&D”) grid and (2) legacy generation assets (“LGA”).

LUMA, a Canadian/American consortium, has been in charge of energy dispatch operations and maintaining the stability of the T&D system since July 2021. The transfer to LUMA of the T&D assets was bumpy and the company faced severe problems during its first year of operations. Recently, however, the T&D system has appeared to gain some stability although rolling blackouts and unplanned outage rates are still significantly above average compared to similar utilities in the mainland.

Early this year the government of Puerto Rico selected Genera PR, a subsidiary of New Fortress Energy (a natural gas company), to manage and operate PREPA’s aging fleet of LGAs. As part of the agreement, Genera is required to make some short-term capital expenditures (funded by FEMA) to stabilize the system, generate savings from renegotiating fuel contracts, and eventually commence decommissioning the LGAs.

Click here to read more about how these two agreements are being put into practice.

Plan of Adjustment: Financial Restructuring

PREPA has been in negotiations with its creditors since July 2017. However, six years of tough on-and-off negotiations have not yet yielded a comprehensive plan of adjustment of PREPA’s liabilities. PREPA currently owes about $9 billion in outstanding bonds, has an unfunded pension liability of $3.8 billion, owes an additional $700 million to fuel line lenders, and several million more to other unsecured creditors.

Without PREPA restructuring its debt and other liabilities, the average residential customer who consumes 425 kWh per month would see its bill increase by approximately 26%. Clearly, that is an unsustainable scenario given Puerto Rico’s stagnant economy and high poverty rates.

On August 25, 2023, the Financial Oversight and Management Board for Puerto Rico (“FOMB”) announced that it had “filed the third amended Plan of Adjustment to reduce more than $10 billion of total asserted claims by various creditors against the Puerto Rico Electric Power Authority (PREPA) by almost 80%, to the equivalent of $2.5 billion, excluding pension liabilities.” (FOMB Press Release, August 25, 2023)

Click here for details on the FOMB’s latest filing.

Puerto Rico’s Long-Term Energy Plan: New Integrated Resource Plan

In April 2022, the Puerto Rico Energy Bureau (the “PREB”) extended the deadline for the next Integrated Resource Plan (“IRP”) filing, resolving that LUMA shall file the next IRP by no later than March 1, 2024.

The IRP is a key document since, pursuant to Puerto Rico law, it sets forth the timetable and sequence for achieving the objective of 100% renewable generation by 2050. Unfortunately, the intermediate objectives set in the IRP currently in effect (approved in 2020) have not been met.

Click here to read more on the status of the IRP’s objectives.

Grid Modernization: Reconstruction of the T&D System

In terms of funding for the rebuilding of the grid, only 19% of FEMA funding has been “approved” to be spent. In terms of the number of permanent work projects to rebuild the grid, 134 grid improvement projects had been “approved” by FEMA; and 60 grid improvements had “broken ground”. Regardless of the metric we use, the conclusion appears to be that the grid reconstruction process has proceeded at a relatively slow pace.

Click here to read more on the possible causes of this delay.

On Our Radar…

![]() The U.S. Federal Budget – Back in May of this year, Congress and the White House agreed to a two-year spending plan as part of a deal to raise the U.S. debt limit and avoid a default by the United States. The Republicans who control the House agreed with the Biden administration to set limits on annual defense and nondefense discretionary expenditures for fiscal years 2023 and 2024. In order to avoid a government shutdown each chamber, the House and the Senate, has to enact 12 appropriation measures and submit them to the President on or before September 30. However, a recent analysis from the Center for American Progress, states that “the 12 bills that House Republican appropriators have written and reported violate the negotiated terms in three key ways”: (1) the bills provide $58 billion less for nondefense discretionary programs than the level agreed to in the debt limit deal; (2) the bills rescind $115 billion of funding outside the jurisdiction of the House Appropriations Committee, significantly beyond the cuts agreed to in the debt limit deal; and (3) the bills include several controversial policy riders regarding funding for the border wall, eliminating environmental programs, and hindering the ability of the IRS to operate, among dozens of other controversial items. Thus, it appears that Washington is headed for a shutdown come September 30, unless the parties can agree to a short-term continuing resolution to gain time to resolve these vexing issues.

The U.S. Federal Budget – Back in May of this year, Congress and the White House agreed to a two-year spending plan as part of a deal to raise the U.S. debt limit and avoid a default by the United States. The Republicans who control the House agreed with the Biden administration to set limits on annual defense and nondefense discretionary expenditures for fiscal years 2023 and 2024. In order to avoid a government shutdown each chamber, the House and the Senate, has to enact 12 appropriation measures and submit them to the President on or before September 30. However, a recent analysis from the Center for American Progress, states that “the 12 bills that House Republican appropriators have written and reported violate the negotiated terms in three key ways”: (1) the bills provide $58 billion less for nondefense discretionary programs than the level agreed to in the debt limit deal; (2) the bills rescind $115 billion of funding outside the jurisdiction of the House Appropriations Committee, significantly beyond the cuts agreed to in the debt limit deal; and (3) the bills include several controversial policy riders regarding funding for the border wall, eliminating environmental programs, and hindering the ability of the IRS to operate, among dozens of other controversial items. Thus, it appears that Washington is headed for a shutdown come September 30, unless the parties can agree to a short-term continuing resolution to gain time to resolve these vexing issues.

![]() Farm Bill – According to the Congressional Research Service, “the farm bill is an omnibus, multiyear law that governs an array of agricultural and food programs. It provides an opportunity for policymakers to comprehensively and periodically address agricultural and food issues.” The Farm Bill usually comes up for review and reapproval every five years. The version currently in effect elapses on September 30. Given the current situation regarding the budget for FY24 (see above), it is highly unlikely Congress will enact a new Farm Bill prior to the deadline. The most probable scenario is for Congress to enact a short-term extension, probably until December 31, to gain time to address several open issues regarding nutritional assistance, conservation programs, and support for major commodity crops, among others. This year’s Farm Bill is particularly important for Puerto Rico because there is a good chance that it will include language authorizing the phase-out of the current Nutritional Assistance Program that helps thousands of low-income households on the archipelago and provides for Puerto Rico’s inclusion in the Supplemental Nutrition Assistance Program (“SNAP”). The transition to SNAP would increase the number of households that qualify for the program, increase the average benefits available for nutritional assistance, and end decades of unfair discriminatory treatment against the residents of Puerto Rico who otherwise qualify for this program. The government of Puerto Rico and many NGOs, both in Puerto Rico and the mainland, are currently advocating for including language allowing this transition in the new Farm Bill. As of this writing, it is difficult to assess the probabilities of success, but this is the best opportunity we have had in years to achieve this major policy change.

Farm Bill – According to the Congressional Research Service, “the farm bill is an omnibus, multiyear law that governs an array of agricultural and food programs. It provides an opportunity for policymakers to comprehensively and periodically address agricultural and food issues.” The Farm Bill usually comes up for review and reapproval every five years. The version currently in effect elapses on September 30. Given the current situation regarding the budget for FY24 (see above), it is highly unlikely Congress will enact a new Farm Bill prior to the deadline. The most probable scenario is for Congress to enact a short-term extension, probably until December 31, to gain time to address several open issues regarding nutritional assistance, conservation programs, and support for major commodity crops, among others. This year’s Farm Bill is particularly important for Puerto Rico because there is a good chance that it will include language authorizing the phase-out of the current Nutritional Assistance Program that helps thousands of low-income households on the archipelago and provides for Puerto Rico’s inclusion in the Supplemental Nutrition Assistance Program (“SNAP”). The transition to SNAP would increase the number of households that qualify for the program, increase the average benefits available for nutritional assistance, and end decades of unfair discriminatory treatment against the residents of Puerto Rico who otherwise qualify for this program. The government of Puerto Rico and many NGOs, both in Puerto Rico and the mainland, are currently advocating for including language allowing this transition in the new Farm Bill. As of this writing, it is difficult to assess the probabilities of success, but this is the best opportunity we have had in years to achieve this major policy change.

![]() The Inflation Reduction Act and Green Energy – Scholars at the Brookings Institution take a look at the economic implications of the green energy provisions of the Inflation Reduction Act (“IRA”), which provides approximately $392 billion in green energy incentives over ten years. According to Brookings, “most models suggest the law puts the United States on track to achieve reductions in greenhouse gas emissions from 2005 levels in the range of 32-42% by 2030, which is 6-11 percentage points lower than without the IRA. The IRA lowers the costs of adopting clean technologies and accelerates the deployment of clean electricity generation, electric vehicles, and several emerging technologies, including carbon capture and hydrogen. That would narrow the gap between current emissions and the goal set for the United States under the Paris Climate Agreement.” Puerto Rico can benefit from these incentives but it has to move fast as most of the funding will be allocated on a first-come, first-served basis.

The Inflation Reduction Act and Green Energy – Scholars at the Brookings Institution take a look at the economic implications of the green energy provisions of the Inflation Reduction Act (“IRA”), which provides approximately $392 billion in green energy incentives over ten years. According to Brookings, “most models suggest the law puts the United States on track to achieve reductions in greenhouse gas emissions from 2005 levels in the range of 32-42% by 2030, which is 6-11 percentage points lower than without the IRA. The IRA lowers the costs of adopting clean technologies and accelerates the deployment of clean electricity generation, electric vehicles, and several emerging technologies, including carbon capture and hydrogen. That would narrow the gap between current emissions and the goal set for the United States under the Paris Climate Agreement.” Puerto Rico can benefit from these incentives but it has to move fast as most of the funding will be allocated on a first-come, first-served basis.