Published on March 18, 2021 / Leer en español

Dear Readers:

The signing into law of the American Rescue Plan Act of 2021 (“ARPA”) by President Biden last week is already being hailed by some analysts as a turning point in American politics, away from the Reagan-era agenda of small government (except in “law and order” issues), low-taxes, high military spending, deregulation, and containment of the welfare state, towards a more assertive fiscal policy stance in favor of government intervention in the economy. Yet, while the $1.9 trillion economic relief package is probably the broadest piece of social legislation enacted since Lyndon B. Johnson’s Great Society, we think it may be premature to announce the demise of what has been the mainstream Republican economic policy since 1980.

Several long-term trends do seem to be coalescing around claims for a more activist government. Decades of wage stagnation have led to increased income and wealth inequality and higher poverty rates, in both urban and rural areas. This growing sense of economic insecurity, in turn, has fueled the rise of populist political movements from both the left and the right. During the last two decades, new research has found robust evidence of the long-term adverse effects of inequality and poverty. And there is a feeling that “Covid exposed the fissures of systemic racism and systemic poverty that already existed…It forced a deeper conversation about poverty and wages in this country”, in the words of Rev. William J. Barber II of the Poor People’s Campaign.

Nevertheless, even with its large scale and scope, the ARPA is, in essence, an emergency measure in response to a once-in-a-century pandemic. Most of its innovative policies, such as the expanded Child Tax Credit, are temporary. Also, the ARPA is funded solely with debt, not new taxes, which would be necessary to make these programs permanent. Furthermore, American distrust of government runs deep, and while a provisional increase in social spending has proven extremely popular in the midst of the COVID-19 crisis, it remains an open question whether permanent economic policy changes, such as an increase in the minimum wage, stronger regulation, higher taxes and an expansion of the social safety net can garner broad political support in the post-Trump era.

—Sergio M. Marxuach, Editor-in-Chief

Insights + Analysis from CNE

The PREPA-LUMA Agreement

By Sergio M. Marxuach, Policy Director

Back in August 2020, CNE published a report that analyzed important aspects of the agreement between the Puerto Rico Electric Power Authority (“PREPA”) and LUMA Energy and offered specific recommendations to improve it. Given the recent public debate regarding this transaction, we are republishing a summary of our findings in this Weekly Review.

On June 22, 2020, the Puerto Rico Electric Power Authority (“PREPA”) and the Puerto Rico Public-Private Partnerships Authority (the “P3A” or “Administrator”) entered into an agreement for the Operation and Maintenance (“O&M” Agreement) of PREPA’s Transmission and Distribution System (“T&D System”) with LUMA Energy, LLC, (“ManagementCo”) and LUMA Energy Servco, LLC (“ServCo”, and together with ManagementCo, the “Operator”).

The Operator, in turn, is a consortium formed by ATCO Ltd., a Canadian operator of electric systems, and Quanta Services, Inc., a Texas-based provider of “infrastructure solutions” for the electric power industry.

EITC Q&A

By Rosanna Torres – Director, Washington, D.C. Office

In his recently signed American Rescue Plan Act of 2021, President Biden included a proposal – designed by policy experts at the Center for a New Economy and the Center on Budget and Policy Priorities – to match Puerto Rico’s EITC spending on a 3 to 1 basis; a significant victory for Puerto Rico’s low- to moderate-income workers. But, what exactly is the EITC? How does it help families in overcoming poverty and how does it promote labor force participation? Keep reading to find out.

What is the EITC?

The Earned Income Tax Credit (EITC) is a refundable tax credit that promotes work. It does so by reducing the amount owed in taxes for low- to moderate-income individuals based on annual earnings. If the credit available to a tax filer turns out to be higher than the tax amount owed, individuals may be eligible to receive a one-time cash refund during the tax filing season. The credit was first established at the federal level in the 1970s with the goal of offsetting payroll taxes.

Click the button below to read the answers to the following questions:

- How does it work?

- How does this affect employers?

- Is this the same credit that was into effect years ago?

- Puerto Rico doesn’t pay income taxes. Why should it get the Federal EITC?

- Does this policy enter in effect immediately?

- Where can I get more information?

Throwback Thursday

A Bit of EITC History

The path for converting a policy idea into law is often a long and winding road. On the Earned Income Tax Credit, CNE is proud to have been present since the beginning.

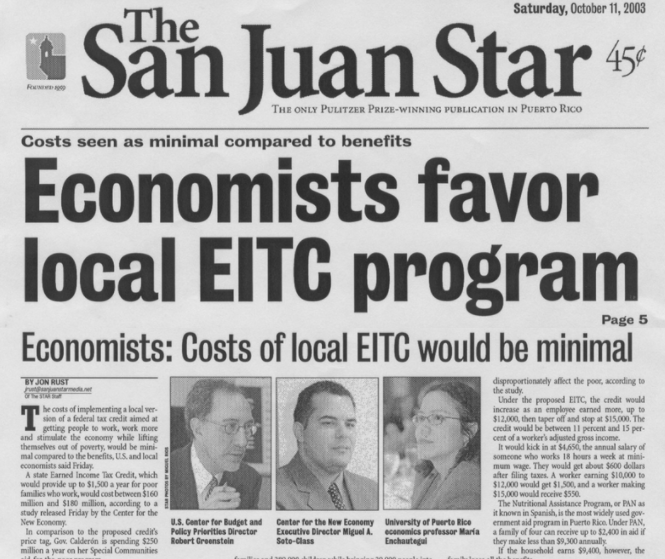

The image above is a clipping of the front page and the leading story of The San Juan Star for October 11, 2003, published the day after CNE hosted a public forum to present its proposal to develop and implement a Puerto Rico EITC. The paper was presented by Miguel A. Soto-Class, CNE Founder & President; Maria Enchautegui, Ph.D., economics professor at the University of Puerto Rico; and Bob Greenstein, Director of the Center on Budget and Policy Priorities, in Washington, D.C.

Fifteen years after its enactment, its subsequent elimination and reinstatement, the American Rescue Plan Act of 2021 signed into law last week by President Biden will provide a 3 to 1 match for Puerto Rico’s EITC, thus increasing the total amount of the tax credit that families may claim. A refundable tax credit, which functions as a wage supplement, the EITC should help lift millions of families out of poverty and increase labor force participation rates.

Learn more about Puerto Rico’s EITC and CNE’s role in its enactment and expansion.

On Our Radar...

![]() The Legal Legacy of Racism – Congresswoman Stacey Plaskett, delegate of the U.S. Virgin Islands to the U.S. Congress, writes in The Atlantic about the racist legacy of the Insular Cases, “a series of highly fractured and controversial decisions” in which “the Supreme Court invented an unprecedented new category of ‘unincorporated’ territories, which were not on a path to statehood and whose residents could be denied even basic constitutional rights. Which territories the Court determined were ‘unincorporated’ turned largely on the justices’ view of the people who lived there—people they labeled ‘half-civilized,’ ‘savage,’ ‘alien races,’ and ‘ignorant and lawless’.” And those cases are still the law of the land.

The Legal Legacy of Racism – Congresswoman Stacey Plaskett, delegate of the U.S. Virgin Islands to the U.S. Congress, writes in The Atlantic about the racist legacy of the Insular Cases, “a series of highly fractured and controversial decisions” in which “the Supreme Court invented an unprecedented new category of ‘unincorporated’ territories, which were not on a path to statehood and whose residents could be denied even basic constitutional rights. Which territories the Court determined were ‘unincorporated’ turned largely on the justices’ view of the people who lived there—people they labeled ‘half-civilized,’ ‘savage,’ ‘alien races,’ and ‘ignorant and lawless’.” And those cases are still the law of the land.

![]() Global Vaccination – “Only a year after the new coronavirus emerged, the first vaccines to protect against it are being administered. But production challenges, vaccine nationalism, and new virus strains are all presenting hurdles.” Here is a backgrounder from the Council on Foreign Relations about Global COVID-19 Vaccine Efforts.

Global Vaccination – “Only a year after the new coronavirus emerged, the first vaccines to protect against it are being administered. But production challenges, vaccine nationalism, and new virus strains are all presenting hurdles.” Here is a backgrounder from the Council on Foreign Relations about Global COVID-19 Vaccine Efforts.

![]() Tourists Behaving Badly – Tourism is an unusual industry in that it does not own the assets it monetizes — a mountain view, a beautiful beach, an ancient cathedral — which usually belong to governments, religious and other not-for-profit institutions, or the public at large. It also generates significant negative externalities, that is, it imposes costs — fragile natural areas are spoiled, historic buildings are trashed, pristine beaches are ruined — on the rest of society, which in the absence of adequate regulation are not compensated either by the providers or the users of tourist services. Recently, Puerto Rico has seen an increase in incidents between tourists and residents, as reported by Coral Murphy Marcos in The Guardian.

Tourists Behaving Badly – Tourism is an unusual industry in that it does not own the assets it monetizes — a mountain view, a beautiful beach, an ancient cathedral — which usually belong to governments, religious and other not-for-profit institutions, or the public at large. It also generates significant negative externalities, that is, it imposes costs — fragile natural areas are spoiled, historic buildings are trashed, pristine beaches are ruined — on the rest of society, which in the absence of adequate regulation are not compensated either by the providers or the users of tourist services. Recently, Puerto Rico has seen an increase in incidents between tourists and residents, as reported by Coral Murphy Marcos in The Guardian.